Summary

- Empire Resources Ltd. Reported significant results during 2020 at its Yuinmery Project, beginning with Highly anomalous copper and gold results in January 2020.

- In March 2020, ERL reported the discovery of strong copper-gold mineralisation within the newly identified copper/gold horizon at the Yuinmery Project.

- In due course, ERL reported significant results across its project portfolio through impressive discoveries and mineralisation grades.

- Recently, ERL raised also A$1.3 million through the issue of 108 million new shares via a placement at an issue price of A$0.012 per share.

Empire Resources Ltd. (ASX:ERL) is a copper and gold driven exploration and development company which completely owns two extremely prolific projects, namely, Yuinmery Copper-Gold Project and Penny’s Gold Project, which consist of several targets for exploration with tremendous prospectivity.

ERL has been working against the clock towards the advancement of its Yuinmery project and seeks to extract value from direct exploration in its current projects while identifying value adding investment opportunities.

Detailed Discussion at: Empire Resources Cracking Crust at Yuinmery Project With Excellent Exploration Results, Secures Funding Through Placement

ERL Obtains Highly Anomalous Copper-Gold Results

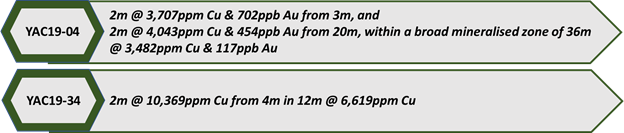

ERL head started the year 2020 with strongly anomalous copper and gold results across several prospects at its Yuinmery Project through reconnaissance aircore drilling, including the following

Data Source: ASX Announcement 11 March 2020

In addition to this, the results identified a new prolific horizon close to the Just Desserts deposit and highlighted the potential to hold numerous Cu-Au deposits at the project.

Furthermore, broad arsenic anomalism bordering distinct gold mineralisation was discovered while drilling added several prospective targets to the Company’s portfolio.

Interesting Read: Empire Resources Limited Calls the Tune in Its Significant Landholdings, A Walk Through Its Project Portfolio

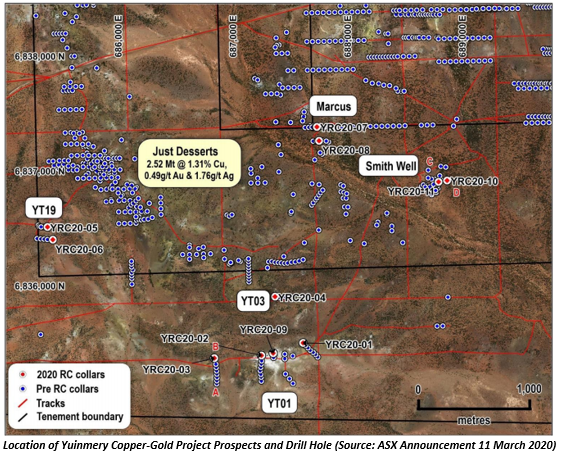

New Copper-Gold & Copper-Nickel Prospects Confirmed At Yuinmery

Further, in March 2020, ERL identified strong copper-gold mineralisation within the newly identified copper/gold horizon at the Yuinmery Project, including the following at the prospect YT01:

- 28m @ 0.60% Cu & 0.20g/t Au from 32m; containing 8m @ 1.09% Cu & 0.37g/t Au from 44m (YRC20-03)

- 24m @ 0.54% Cu & 0.08g/t Au from 56m; including 4m @ 0.89% Cu & 0.12g/t Au from 56m (YRC20-02)

Moreover, continuity of mineralisation first identified in late 2019 by Empire from aircore drilling was confirmed through the RC drilling while exhibiting the prospects for discovery of numerous copper-gold deposits within this horizon.

Furthermore, at Smiths Well, a broad down hole intercept was returned through drilling in sulphide mineralisation of 68m @ 0.37% Cu & 0.13% Ni from 50m (YRC20-10), including:

- 1m @ 1.26% Cu from 60m

- 1m @ 1.03% Cu & 0.23% Ni from 67m

- 2m @ 1.22% Cu from 91m

In addition to this, significant potential for further sulphide copper-nickel discoveries was demonstrated within the Yuinmery Project.

Did you read: Empire Resource’s Investment in NTM Gold Proves Lucrative, Grows From $0.0325 to ~$0.09 Within a Year

Continues Excellent Copper-Gold & Copper-Nickel Results At Yuinmery

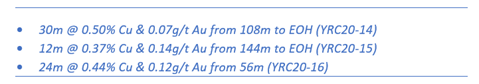

Over the due course, RC drilling continued to return excellent results at Yuinmery validating ERL’s perception about the highly prospective nature of the Yuinmery Project to host several copper-gold and copper-nickel deposits.

At YT01, RC drilling demonstrated broad copper-gold sulphide mineralisation and resulted from 4m composite sampling included:

Data Source: ASX Announcement 24 April 2020

Moreover, excellent drilling results at YT01 prospect highlighted the potential for discovery of fresh copper-gold deposits within the new southern horizon while the Smith Well progressively demonstrated prospects through further broad zones of sulphide mineralisation returned from the prospect.

Related: Empire Resources Reports Significant Results from Drilling Campaigns, Stock Zooms by ~7%

ERL Concludes Capital Raising Worth A$1.3 million

In early August 2020, ERL successfully concluded a capital raising worth A$1.3 million before costs through an issue of 108 million new shares at a price of A$0.012 per share via a placement.

The proceeds were planned to be utilised towards exploration drilling across ERL’s project portfolio, comprising Yuinmery Project, Penny’s Gold Project as well as for working capital requirements.

Interesting Read: Empire Resources to Raise A$1.3 Million For Exploration Drilling Across Portfolio; Finalises Strongly Supported Placement

ERL believes that there lies significant opportunity as the recent highly encouraging Cu-Ni-PGM results are delivered at Yuinmery Project along with highly prolific gold targets at Penny’s Gold Project in an environment dominated by all-time high gold prices.

Related: Empire Resources Unveils Encouraging DHEM Responses & Broad Sulphide Mineralisation at Yuinmery

ERL share price ended the trading session at $0.013 on 04 September 2020, with a market capitalisation of $12.72 million. Empire stock has delivered 75% returns to its shareholders in the last six months till 03 September 2020.