Summary

- Empire Resources Limited has reported excellent exploration results for the Yuinmery Project as well as Smith Well prospect during the quarter ended 30 June 2020.

- Additional RC drilling programs and a Downhole Electromagnetic (DHEM) survey were undertaken at Yuinmery Project.

- Anomalous nickel has been recently identified at the Smith Well prospect, which is interpreted to host two steeply dipping, parallel mineralised horizons.

- Empire remains in dispute with Eastern Goldfield Milling Services Pty Ltd, and the matter has been referred to Arbitration.

Mineral exploration and resource investment company, Empire Resources Limited (ASX:ERL) focuses on the exploration of gold and copper owns 100% of two highly prospective projects, The Yuinmery Copper-Gold Project and Penny’s Gold Project.

ERL has reported its developments during the quarter ended 30 June 2020 at its YT01 Prospect as well as Smith Well Prospect, which lie under the Yuinmery Copper-Gold Project.

During the quarter, ERL has continued to deliver excellent exploration results for the Yuinmery Project with another two RC drill programs and completed a downhole geophysics survey.

Following the announcement, ERL stock was up by 7.143% on 15 July 2020 at a price of $0.015 with a market capitalisation of $11.2 million. Moreover, ERL has delivered 75% returns to its shareholders in the past three months till 14 July 2020.

Let us discuss in detail the developments across the Company during the quarter.

Yuinmery Copper-Gold Project

Located 470km North East of Perth in the base metal-rich Youanmi greenstone belt, Yuinmery Copper-Gold Project witnessed the commencement and completion of two RC programs and a Downhole Electromagnetic (DHEM) survey during the June 2020 quarter.

Prior to these programs and survey, the Company had successfully conducted two reverse circulation (RC) drilling programs during the March 2020 quarter. Final assay results for the January and March 2020 RC drill programs were received in April 2020 whereas RC drill program of three holes and one re-entry for 462m drilled at the Yuinmery Copper-Gold Project was concluded in May 2020.

June 2020 saw Empire completing seven RC drill holes at Yuinmery for 1,001m drilled and testing the May 2020 and historical DHEM modelled conductors at Smith Well with four holes testing the North-East extension and two holes testing the South-East extension.

All samples for the June 2020 RC program have been submitted to the laboratory and results remain pending as of now.

YT01 prospect

Encouraging assay results were received from the January and March RC drilling programs. In March, copper oxide minerals above the base of oxidation were intercepted at YT01 prospect through RC drilling. Moreover, holes YRC20-14, YRC20-15, YRC20-16, and YRC20-17 intercepted trace and disseminated sulphides consisting of chalcopyrite, pyrrhotite and pyrite at the base of the oxidation interface.

The results include:

- 44m @ 0.47% Cu & 0.07g/t Au from 88m (YRC20-14), including:

- 1m @ 1.00% Cu & 0.18g/t Au from 93m

- 2m @ 1.05% Cu & 0.22g/t Au from 95m

- 1m @ 1.40% Cu & 0.13g/t Au from 101m

- 12m @ 1.02% Cu from 44m (YRC20-03), including:

- 1m @ 2.56% Cu from 44m

- 3m @ 1.31% Cu from 48m

- 3m @ 1.01% Cu from 57m and 1m @ 1.03% Cu from 79m (YRC20-02).

During the May RC drilling program, Hole YRC20-14 was extended by 24m based on the end of hole copper anomalism.

YT01 Prospect Cross Section 687,250mE (Source: Company's Report)

Later in June 2020, one RC hole was drilled under YRC20-14 to test for extensions of copper-gold mineralisation below the base of the oxidation, all samples from which have been submitted to the laboratory and results are pending.

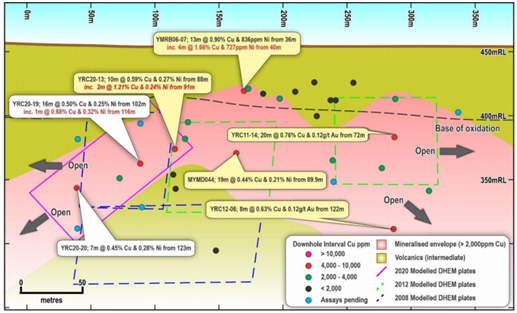

Smith Well prospect

A historic copper-gold prospect with recently identified anomalous nickel in drilling, Smith Well prospect is interpreted to host two steeply dipping, parallel mineralised horizons, which are as follows:

- The first being copper intercepts of >1% Cu associated with elevated nickel (>0.2% Ni), low-level gold and cobalt values have been identified to occur in the upper horizon

- The second lower horizon is characterised by copper intercepts of >1% Cu associated with elevated gold >0.1g/t Au and low nickel values

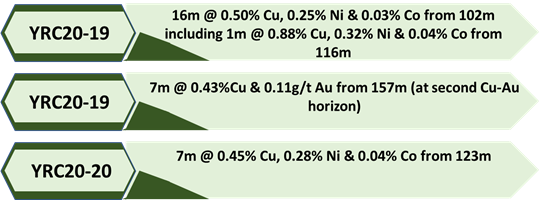

So far sulphides, including chalcopyrite, pyrrhotite and pyrite in varying concentrations have been intercepted through drilling during 2020 and assay results from the drilling program indicate the potential of the prospect to host substantial copper mineralisation with selected results including:

- 12m @ 0.49% Cu, 0.28% Ni & 0.03% Co from 86m (YRC20-13), including:

- 4m @ 0.61% Cu, 0.32% Ni & 0.04% Co from 94m.

- 12m @ 0.38% Cu & 0.01% Ni from 60m (YRC20-12)

Subsequent to receiving these encouraging results, three RC holes were drilled in May to check the additional DHEM data as compared to 2008 anomaly, which returned the following results:

A further six RC holes were completed by ERL in June 2020 at Smiths Well, of which two holes were drilled in the South-Western limb testing upper Cu-Ni as well as lower Cu-Au horizons and remaining four holes were drilled in the North-Eastern limb to test the extents of the modelled May DHEM plate in the upper Cu-Ni horizon.

Smith Well Long Section Looking South-East (Source: Company's Report)

Importantly, Smith Well is interpreted to lie within a broad stratigraphic horizon, which includes multiple prospects such as C-Zone and Claudius, where promising historical Cu-Au mineralisation has been identified. Moreover, unique elevated nickel content of Smith Well is interpreted to be the result of fluids from a mafic intrusion interacting with the original copper-gold mineralisation within the volcanics.

Empire is of the view that additional exploration is needed for a definitive assessment at the Smith Well Prospect.

Investment in NTM and Cash Position

The Company held a significant holding of 6.76% or 45,888,708 shares in NTM Gold Limited (ASX:NTM) at the close of the quarter. Moreover, the value of the holdings at the end of the quarter was at $3,671,097 from $1,499,875 originally invested in July 2019.

Net cash used in operating activities for ERL during the quarter was approximately $302,000 with cash on hand at quarter-end of $598,000.

Dispute with Eastern Goldfield Referred to Arbitrator

ERL’s is still in disagreement with Eastern Goldfield Milling Services Pty Ltd (EGMS) regarding gold unaccounted for following a toll treatment milling campaign conducted by the later at its Burbanks Gold Processing facility in late 2017.

In this event, Empire Seeks to recover gold valued more than $1 million.

The matter has been referred to Arbitration for which, Empire had submitted documents to the Arbitrator during the quarter, and the next arbitration hearing is scheduled to be heard in early September 2020 quarter.

ERL is committed to building a sustainable and lucrative mineral business and seeks to obtain value from direct exploration in its current projects as well as identifying value accretive investment prospects that supplement its development objectives.