Summary

- Empire Resources Limited has witnessed high returns through investments over its journey as gold and copper focussed exploration and development company.

- Empire Resources Limited’s investment in NTM Gold Limited has grown multi-folds over the period of one year.

- ERL invested $1.5 million for 46.15 million shares in NTM Gold Limited at a per-share price of $0.0325, a year ago in July 2019, which has now grown to be valued at $3,671,097.

- ERL looks forward to making a substantial boost to the resource base through aggressively testing a large number of prospective targets identified previously.

Gold and copper focussed exploration and development company Empire Resources Limited (ASX:ERL) owns 100% of a highly prospective project, Yuinmery Copper-Gold Project.

Over the year, ERL has made significant progress at its Yuinmery project located in the Mid-West region of Western Australia. The project consists of five granted tenements for a total area of 84.5 km2, of which two are for mining and three for exploration.

Latest Quarterly Update: Empire Resources Reports Significant Results from Drilling Campaigns, Stock Zooms by ~7%

Eighteen new target areas were identified within the project limits that are prospective for precious and base metal mineralisation through the integration of the geochemical and geophysical datasets. Various prospects identified at the Yuinmery project include the following:

- Just Desserts Deposit

- A Zone Prospect

- Smith Well Prospect

- YT01 Prospect

- Constantine Prospect

ERL has something more than its project portfolio to boast about. Let’s get to know what it is:

ERL’s Investment in NTM Gold Limited

One of the most major improvements amongst its numerous developments that have added significant value during this time frame is ERL’s investment in NTM Gold Limited (ASX:NTM). NTM is an emerging gold exploration company that is actively engaged in exploring the Eastern Goldfields of Western Australia.

Approximately a year ago, ERL participated in the placement of fully paid ordinary shares to institutional and sophisticated investors in NTM Gold Limited. Empire invested $1.5 million for 46.15 million shares at a per-share price of $0.0325.

Related: Empire Resources Unveils Encouraging DHEM Responses & Broad Sulphide Mineralisation at Yuinmery

As a result of the investment, ERL held 8.70% of NTM’s expanded capital. At the end of the June 2020 quarter, ERL held 45,888,708 shares in NTM Gold Limited representing a 6.76% interest. The interest that was acquired at $0.0325 per share in July 2019 was valued at $3,671,097 by the end of June 2020 quarter (at the closing price of $0.080 per NTM share).

More recently, NTM shares were noted trading at a price of $0.097 on 27 July 2020. Moreover, NTM was up by 7.792% on 13 August 2020 at AEST 02:12 PM. Interestingly, NTM recorded its 52-weeks high price of $0.099 on 21 May 2020.

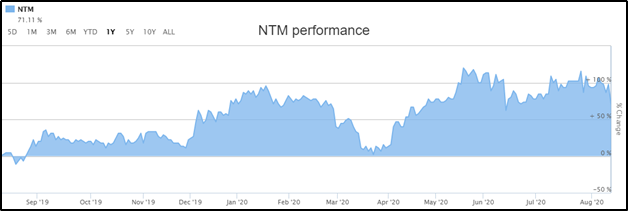

Looking at the ASX chart, NTM stock has increased by 71.11% in the last one year till 12 August 2020.

Source: ASX

ERL’s investment in NTM has grown significantly over the year, and ERL has been optimistic about the job that team at NTM had done so far to identify, delineate and define numerous potentially economic gold prospects.

While ERL’s investment interests continue to mature generating potential for substantial, non-dilutive revenue into 2020, ERL has been actively continuing to add value to its projects. Moreover, ERL had plans to make a significant improvement to its resource base through aggressively testing the large number of prospective targets identified earlier.

Stock Information

On 13 August 2020, ERL stock remained unchanged at $0.013 with a market capitalisation of $11.81 million. The stock traded its 52-weeks high price of $0.020 on 10 July 2020 and has generated 62.50% returns for its shareholders from 1 January 2020 to 12 August 2020.