Summary

- MRG Metals has been unlocking enormous exploration potential in its Mozambique-based Corridor tenements.

- Nhacutse target has delivered exceptional valuable heavy mineral (VHM) assemblage results, whereas Zulene target too returned high quality mineral assemblage.

- Nhacutse and Zulene demonstrate the existence of substantially higher value mineralogy than previously reported within the Corridor Tenements, highlighting the importance of upcoming drilling programs.

- Meanwhile, Viaria is emerging as another high priority drill target.

MRG Metals Limited (ASX:MRQ) is exploring for economic deposits of Heavy Mineral Sands (HMS) in the southern part of Mozambique. The Company has been fast tracking the development of Corridor Central (6620L) and Corridor South (6621L) tenements, which continue to unlock enormous exploration potential.

On 31 August 2020, MRG Metals notified about further significant results for mineral assemblage characterisation by Qemscan analysis of 12 chosen composite samples from 6621L tenement.

Exceptional VHM mineral assemblage results have been delivered at Nhacutse. Consequently, the Company has set a further goal to discover sands of high insitu value. This improvised goal is above the one that was notified post recent metallurgy work at Koko Massava- producing a near 50% TiO2 concentrate, with a low-cost capital requirement.

Besides, Zulene and Viaria target have been progressing as both returned high quality mineral assemblage.

ALSO READ: MRG Metals Unveils Further Outstanding Exploration Results from Saia, Viaria & Zulene

Duplicate Sample Results From Nhacutse

Duplicate sample results returned from the significant eastern Nhacutse sample, CSNH03, affirmed formerly reported exceptional results of 68.82% VHM (compared to the previous primary sample with VHM of 73.37%). These include 63.84% ilmenite+leucoxene, 2.92% zircon and 2.06% rutile. The result demonstrates the robust and quality nature of the VHM assemblage and opens up significant exploration opportunity in the Corridor tenements.

Besides, new data from central Nhacutse area returned ilmenite+leucoxene up to 45.45% and 1.77% zircon.

Moving onto additional new mineral assemblage results for the central portion of the target-

- Majority of samples have VHM >42%, with a peak of 48.05% in sample CSNH08.

- Best mineral assemblage result for the new Nhacutse data is from sample CSNH08, related to auger hole 20CSHA363 (6.31% THM).

- The sample contains 45.45% ilmenite+leucoxene, 1.77% zircon and 0.83% rutile

- Sample CSNH06 relates to auger hole 20CSHA288 with 5.98% THM, and is important in terms of the assemblage with 40.16% ilmenite+leucoxene plus 0.75% rutile and 1.62% zircon

- Half of the mineral assemblage samples show ilmenite+leucoxene of >40% within the THM, with a peak of 68.29% for the eastern sample CSNH03.

New Results From Zulene, Viaria, And Saia

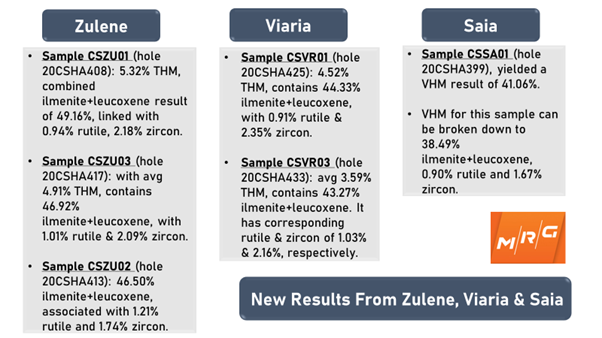

The Company advises that at Zulene, the good ilmenite+leucoxene content >46%, particularly for sample CSZU01 (49.16%), across a broad area of at least 4.5km at Zulene target is very encouraging. Mineral assemblage data for the Viaria seem very positive, with all samples yielding >41% ilmenite+leucoxene. Besides, the good mineral assemblage at Viaria extends over a very broad area at least 3.8km from the northwest end to beyond the southeast end of the interpreted target limit.

Kalkine Image (Source: MRG Metals ASX Update, 31 Aug 2020)

Significance of New Mineral Assemblage Results

The new mineral assemblage results demonstrate that a better value mineral assemblage occurs to the east side and the south end of the Corridor South tenement further from the Limpopo River valley. This observation, a prioritisation filter in exploration targeting, is likely to drive the selection of additional mineral assemblage samples for the third batch. Besides, it may be instrumental in prioritising aircore drilling that is scheduled to commence in late August.

Mineral Assemblage Details

The composite samples were arranged from a micro-split fraction of each primary heavy mineral concentrate from each individual sample interval in chosen auger holes. They relate to a single auger hole.

- Samples were submitted to CSIRO Minerals Research Centre for Qemscan particle analysis.

- Each sample was screened at -45µm to remove slime material, +1mm to remove oversize sand.

- The composite sample was systematically analysed for mineral identification of a statistically meaningful particle population providing bulk mineralogy, particle maps, particle liberation and particle size.

- Auger drill holes used for the creation of composite samples were selected based on a range of average THM grade from 3-5% and >5% and geographic distribution across the Zulene, Nhacutse, Viaria, and Saia targets.

- Combined ilmenite+leucoxene in the samples from all targets ranges from 37.56%–63.84%, with an average of 44.74%.

- The rutile content ranges 0.75%–2.06%, with an average 1.01%; and zircon content ranges 1.42–2.92%, with an average 1.96%.

- The titanomagnetite content overall ranges 0.07%–21.75%, with an average of 16.49%.

Way Forward

The Company further notified that samples have been selected for Qemscan analysis from the deep aircore drillholes completed at Poiombo target in March 2020. These analyses will help determine relative mineral assemblage value of the very high grade THM intersections.

MRQ quoted $ 0.007 on 31 August 2020. The stock has delivered returns of 16.67% in the past three-months.