Summary

- Medium grade manganese market is the fastest growing section of the manganese market.

- Element 25’s goal is to produce clean, low cost, ethical manganese products for world markets.

- Located in the Tier 1 jurisdiction of WA, E25’s Butcherbird Manganese Project is a world class manganese resource with current JORC resources in excess of 263 Mt of manganese ore.

- A Pre-Feasibility Study recently concluded hinting that outstanding economics, the low capital hurdle of less than $15 Mn are likely to enable E25 to develop the Project in a relatively short timeframe.

Demand for manganese is growing though supply has constraints. Tapping this lucrative opportunity while firmly transitioning from an explorer to a miner, Element 25 Limited (ASX:E25) is currently developing a resilient project- Butcherbird Manganese Project.

On 20 July 2020, E25 released its progress report for the quarter ending 30 June 2020 proclaiming that it made “excellent progress” in the reporting period. The release of this update seemed instrumental in driving E25 high on the ASX. The stock was closed at $ 0.445, up by 4.706%, on 20 July 2020, YTD returns stand at 150 %.

Pre-Feasibility Study and Maiden Reserve

In the quarter ending 30 June 2020, the publication of a Pre-Feasibility Study (PFS) was concluded, looking at the potential for a low capital cost, early cashflow operation exporting manganese concentrate from the Project. The PFS returned outstanding economics. Consequently, E25 is working to deliver the Project as soon as practicable.

PFS highlights include-

- Maiden Proved and Probable Ore Reserve of 50.55Mt at 10.3% Mn containing 5.22Mt Mn (4.28Mt Recoverable Mn)

- PFS returns a pre-tax Net Present Value8 of Nominal $441M (Real $283M) and IRR of Nominal 255%, (Real 223%)

- Low capital requirement of $14.5M along with $9.2M working capital

- Average annual operating cashflow of $32.1M for years 1-5

- Simple payback period 6 months from the start of operations

- 42-year mine life based on Measured and Indicated Resources

- Full beneficial production scheduled for next financial year

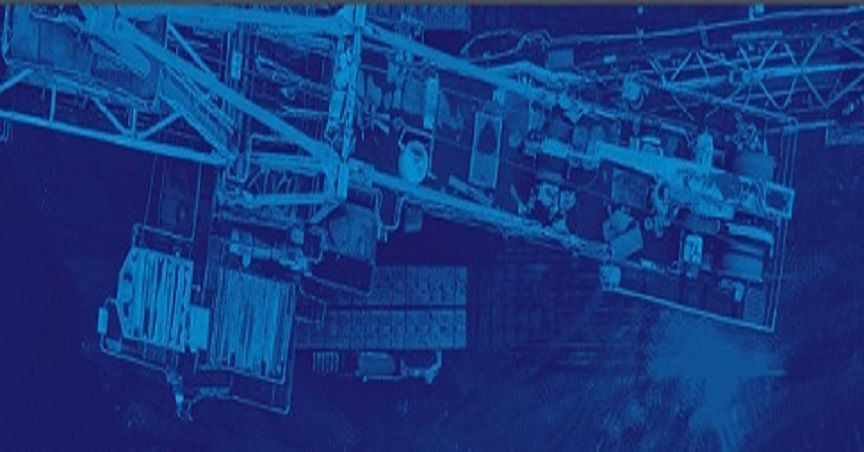

Process Plant Design

In accordance with standard industry practice, beneficiation process plant and other infrastructure have been designed. Unit operations included in the flowsheet are well established within the resources and other industries. Design philosophy predominantly used mobile or semi-mobile equipment for operating installation to maintain a degree of flexibility for management of the advancing mining face, while reducing civils, structure, and set-up investment costs.

Potential process to further upgrade concentrate- Ore Sorting

Ore sorting was found to be a potential process to upgrade the concentrate further.. Subsequently, sorting tests were conducted by Steinert Australia using a full-scale 1m wide multiple sensor Steinert KSS sorter, on the two size fractions generated from the scrubbing/screening process-

- This affirmed ability of industrial scale ore sorter to upgrade manganese concentrate on a repeatable basis to a commercially marketable specification (range 30-35% Mn)

- Ore sorter delivered a 33% Mn grade product which was the result of an upgrade of ~6 %, maintaining manganese recovery of 94%

- E25 opines that combined size fraction concentrate has grade, composition and size distribution traits of commercial concentrates presently used in the steel industry

- Moreover, impurity levels across the main elements of concern seem acceptable. Certain key impurities may even offer marketing opportunities which will be further explored.

Logistics and Ore Transport Progresses

The Company is likely to produce between 270k and 370k tonnes of Mn Ore per annum. Manganese lump product will be trucked from the Project mine site to the Utah Point at Port Hedland where it will be loaded on to ships for export.

- E25 has begun negotiations with Pilbara Ports for the access to the Utah Point stockpile and port facilities at Port Hedland. The product will reportedly be in lumpy form, apt for existing handling infrastructure located at Utah Point.

- Besides this, E25 has engaged with Qube Logistics that has extensive experience in loading manganese ores. Qube indicated that E25’s product could be handled and loaded efficiently with the current infrastructure.

E25 notified that proposed concentrate handling method is fully compliant with Class 9 transport requirements and no special bulk shipping restrictions currently apply for UN 3077 mineral concentrates. Moreover, the ore is not classified as dangerous or hazardous good in transit and is not affected by typical atmospheric conditions.

Butcherbird Progresses Post PFS

A water bore drilling programme commenced at the Project to follow up on previously announced water exploration drilling in the March 2020 Quarter. This programme is likely to conclude two production bores for conducting pump tests to confirm the potential of the selected area to provide sufficient process water for the beneficiation plant.

To read more, PLEASE READ: Element 25 Launches Drilling Programme to Affirm Process Water Supply at Butcherbird

Besides this, the final Access Agreement was signed during the quarter between the Company and the owner of the Bulloo Downs Pastoral Lease, Ms Chandra Ridley. The agreement was integral to granting of mining lease application M52/1074 for Butcherbird. The mining lease has now been granted for a period of 21 years.

For more insight, PLEASE READ: Element 25 Formally Granted 21-Year Term Mining Lease for Butcherbird, Stock in Green

A third progress activity was marked when sub-sampling of diamond core from BBDD016 drilled into the Coodamudgi manganese resource returned high grade manganese values of up to 42.3%Mn from the surface with low impurity levels. Though work completed in this programme is preliminary and needs to follow up, sampling reported was strongly suggestive that material has the potential to deliver a high-grade concentrate.

To know more, PLEASE READ: Element 25 Continues Butcherbird Progress, Identifies Potential High-Grade Manganese Concentrate

Corporate Progresses

The royalty sale agreement with Vox Royalty Corp. was completed during the quarter. Besides this, E25 is utilised the Controlled Placement Agreement with Acuity Capital to raise $555k (inclusive of costs) by agreeing to issue 1.53 million shares to Acuity Capital at $0.363 (issue price).

After the quarter, E25 received firm commitments from sophisticated, professional, and institutional investors to raise up to a total of $ 3.5 million (before costs) via placement of up to 8.75 million fully paid ordinary shares at an issue price of $0.40 per share.

Reportedly, E25 is also conducting a Share Purchase Plan to existing eligible shareholders to raise up to $ 1.5 million at $0.40 per share.

The below demonstrates the Project development timeline-

With Butcherbird closer to end users than many other Projects and developments advancing well, E25 seems to be on the right trajectory to become a globally significant manganese producer.

(Note: All currency in AUD unless otherwise specified)