Summary

- Element 25 aims to produce clean, low cost, ethical manganese products for world markets and become a globally significant manganese producer

- It is currently building a globally significant, low cost, high purity manganese project- 100% owned Butcherbird Manganese Project that is turbocharged by early cashflow from a low capex concentrate export opportunity.

- The newly launched Placement and SPP seeks to offer Element 25 with additional funds to accelerate the development of Butcherbird

Securities of Element 25 Limited (ASX:E25), manganese focussed Company transitioning from an explorer to a miner, was placed on a trading halt pending the release of an announcement as updated on 2 July 2020. Naturally, market and investors were keen on understanding what would be next in the development spree period for the Company post recent commencement of drilling programme, inking of an Access Agreement and a non-binding MoU, formal grant of Mining Lease M52/1074 and significant discovery from a sub-sampling exercise at Coodamudgi at its 100% owned Butcherbird Manganese Project.

Finally, the Company notified on 6 July 2020 that it has received firm commitments from sophisticated, professional and institutional investors to raise up to a total of $ 3.5 million (before costs) via a placement and its intention to conduct a Share Purchase Plan (SPP) to existing eligible shareholders to raise up to additional $ 1.5 million.

Element 25 Placement

The Company received firm assurances to raise up to a total of $ 3.5 million (before costs) via a placement of up to 8.75 fully paid ordinary shares at an issue price of $ 0.40 per share. Euroz enacted Lead Manager and Sole Bookrunner to the Placement.

The Placement is not subject to shareholder approval. It will conclude pursuant to Element 25’s existing capacity under ASX Listing Rules 7.1 and 7.1A with 1,076,773 shares and 7,673,227 shares to be issued under those capacities, respectively.

Element 25’s SPP

At the same issue price of $ 0.40 per share, the Company will also conduct a SPP with existing eligible shareholders and raise up to $ 1.5 million. Interestingly, the SPP will enable existing shareholders to take part in the capital raising without incurring any brokerage fees or other transaction costs. However, participation in this offer is optional.

Eligible shareholders, i.e. the ones who have an address in Australia, Germany, Hong Kong, China and New Zealand will have the chance to apply for up to $ 30k worth of fully paid ordinary shares in Element 25. Moreover, in case an eligible shareholder holds shares as a 'custodian', the offer under the SPP will be made to the 'custodian' who will have the discretion to extend it to relevant beneficiaries (subject to several conditions).

The SPP also offers an opportunity for those shareholders holding less than a marketable parcel of share (holding where the current value is less than $500) to raise their shareholding to a marketable parcel- without incurring brokerage fees.

In the event of the SPP not being fully subscribed, Element 25 will pursue placing any shortfall shares, at its discretion.

Placement & SPP Representation – Use of proceeds

The issue price for the Placement and the SPP represents an 11.10 per cent discount to the volume weighted average price of shares traded on the ASX during the 5 trading days on which sales in the shares were recorded immediately.

Funds raised are expected to-

- Facilitate Element 25 to accelerate the development of the Butcherbird Manganese Project

- Allow deposits for long lead time items to be placed

- Progress detailed engineering design

- Contribute towards other activities associates with the development of the Project

Placement & SPP Timeline

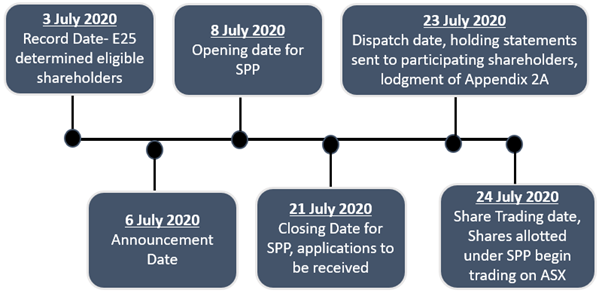

The Company has provided with the below indicative timetable of the Placement & SPP, which may be altered at its discretion-

E25 Stock Performance

New shares issued under the SPP will rank equally with all fully paid ordinary shares on issue. On 6 July 2020, E25 ended the day at $ 0.44 on the ASX. The stock has delivered impressive returns of 223.33 per cent in the last three months.

(Note: Please regard all currency in AUD unless specified otherwise)