Summary

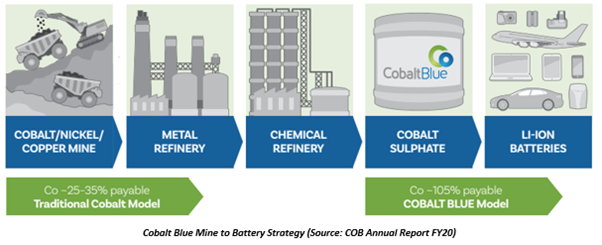

- Cobalt Blue, the sole owner of the largest greenfield cobalt project outside Africa, highlighted significant developments concerning Broken Hill Cobalt Project and COB Processing Technology in FY20 annual report.

- During the year, the Company executed partnerships, received government grants, and advanced test work towards producing commercially acceptable products.

- Cobalt Blue completed a major project optimisation study, delivering better project economics with long life and potential for low-cost battery ready cobalt products.

- Test work highlighted that BHCP cobalt products are amenable to global standards, with high cobalt content and low impurities.

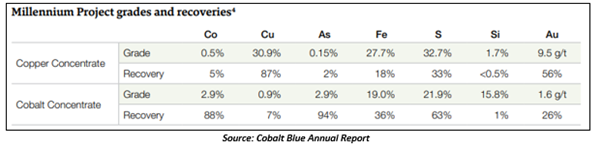

- Proprietary technology offered high metallurgical recovery for GEMC’s Millennium Project producing separate cobalt and coper concentrates.

- EIS to be started during 2020 and lodged in 2H of 2021, with feasibility study planned to be completed in 2022.

Australia-based pure play cobalt-focused company, Cobalt Blue Holdings Limited (ASX:COB) has released its annual report for FY20 ended 30 June 2020. The report highlighted relentless efforts towards development of the largest greenfield cobalt project outside Africa, the Broken Hill Cobalt Project (BHCP). The Company’s wholly owned project is looming towards the feasibility study, which is expected in 2022.

Cobalt Blue is focused on the development and commercialisation of the project, which extends over 5 granted tenements on ~93 square kilometres. BHCP has been identified for hosting large tonnage cobalt-bearing pyrite deposits. A strategic metal, cobalt is gaining strong traction for new generation batteries, primarily for clean energy system applications.

Last year in December, COB announced entering a binding Heads of Agreement to acquire the remaining 30% stake in BHCP (including all tenements) from American Rare Earths Limited (AREL) to move to 100 per cent ownership.

Project Review Enhancing Economics of the Next Major Cobalt Source

Results from a major project update study were released in July 2020, unveiling significant project enhancements via optimisation studies following the prefeasibility study of 2018.

- Large Scale & Innovative Battery Ready Product - The Broken Hill Cobalt Project is expected to have average production capacity of 3,500-3,600 tonnes a year of battery ready cobalt sulphate product. Additionally, 300,000 tonnes of elemental sulphur are anticipated.

- Mining & Processing Infrastructure - Integrated process plant with waste disposal of process plant tailings and mine waste rock.

- Lower Capital Cost: Initial pre-production capital of $560 million with contingencies of $70 million for developing the cobalt mining and processing operation with an annual capacity of up to 6.3 million tonnes. The capital costs are around a third of other proposed greenfield cobalt projects.

- Low Operating Cost: Average life of mine C1 cash cost and All-in Sustaining Costs of US$9.34/lb and US$12.13/lb of cobalt inclusive of nickel and sulphur credits, respectively.

- Increased Ore Reserve: Mineral reserves of 71.8 million tonnes with a 710 ppm cobalt grade and a 7.6% sulphur grade.

- Longer Operating Life: Life of mine stands at ~14 years, which includes 13 years of cobalt production and targets an operating life of 17 years.

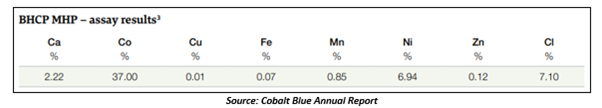

Cobalt Blue also completed a value engineering study to assess the potential contribution of nickel at BHCP. Previously concluded drilling programs indicate the presence of nickel in mineralised zones. The study further concluded that a mixed hydroxide product (MHP) contains 7% nickel from the RC chip samples from mineral deposits.

The Company realises that further work is required to estimate quantities of nickel and other minor metals such as copper and zinc, in the mineral reserve and resource estimates.

BHCP Products Amenable to Industrial Benchmark

Cobalt Blue initiated laboratory-scale test work at ALS Metallurgy. A 7.7 tonne of concentrate sample has been produced from a 45-tonne sample procured during 2019. The mixed hydroxide product was produced and tested, which reflected in a 37% cobalt grade.

Presently, approximately 75% of total global cobalt trade is conducted as hydroxide intermediates. Fastmarkets, which publishes the prices for cobalt products, quotes prices for hydroxide with 30% minimum cobalt content. COB’s hydroxide stands strong with high cobalt content and lower amount of impurities.

A commercially saleable intermediate product will be optimised to suit the varying market conditions and produce a superior product accordingly.

BHCP is anticipated to produce-

- A commercial intermediate MHP nominally containing 37% Co and 7% Ni. The high content of nickel is likely to enhance the sale price.

- A cobalt sulphate product will be produced from refining of the MHP with >20.5% Co content sulphate crystal suitable for battery cathode applications.

Must Read: Major Breakthrough: Cobalt Blue Announces BHCP Testwork Achieving Battery Grade Cobalt Product

Sample Program Targeting High-Quality Cobalt and Sulphur products

Cobalt Blue launched a cobalt product sample program during the year to provide mixed hydroxide and cobalt sulphate samples for technical and market assessments to battery manufacturers and cobalt trading firms.

The Company entered an agreement with Mitsubishi Corporation for marketing trials for elemental sulphur, which may further be converted into an offtake contract, contingent on success of the current trials and further negotiations.

Good Read: Cobalt Blue Supported by Industry Majors: LG and Mitsubishi, Many More to Follow

Proprietary Technology Suggests Feasible Solution at World-Class Mining Operations

Cobalt Blue has developed a proprietary processing technology for the treatment of pyrite ores to produce elemental sulphur and high-quality cobalt products. The Company has developed a flotation scheme for GEMC’s Millennium Project to produce pure copper and cobalt concentrates.

Overall flotation recovery of metal to concentrates was recorded as 93% cobalt, 90% copper and 80% gold. Cobalt concentrates were further leached while the residue was used to recover additional free gold. The metallurgical recovery of gold from the cobalt concentrate stood at 90% with 80% in the cyanide leach and 10% in the chloride leach.

The Company is also working with Oz Minerals Limited (ASX:OZL) to test the amenability of the Carrapateena copper-gold project with initial test work anticipated to be completed in Q3 of 2020.

Government Grant & R&D Incentive

Cobalt Blue secured a $2.4 million funding under the Cooperative Research Centre (CRC) – Project for applied research & development in beneficiation of cobalt-pyrite ore to produce battery ready cobalt sulphate product.

To know more on government partnership with Cobalt Blue, Read Here

The Company received refunds worth $837,000, an increase of ~140% against 2019, under the Research and Development Tax Incentive Scheme (R&D). Cobalt Blue held cash reserves of $2,057,000 with net assets of $19,316,000, as on 30 June 2020.

Cobalt Blue is progressing on the development of a pilot plant and anticipates commencing the supply of product samples under the sampling program from Q1, 2021. The Company plans to commence relevant technical studies to support the Environmental Impact Statement in 2020 and lodge with DPIE for exhibition and assessment in 2H, 2021.

COB traded at $0.094 on 11 September 2020 with a market capitalisation of $22.56 million.

(All financial information pertains to Australian currency unless stated otherwise.)

.jpg)