Summary

- Cobalt Blue is developing a globally significant cobalt project holding Australia’s largest cobalt sulphide deposit and a patented minerals processing technology.

- Preparing for future, COB has entered commercial partnerships with industry majors, while sending products to multiple sampling partners for evaluation.

- Low-cost, long-life mining operations complemented by the proprietary technology for the battery grade cobalt product hold the key to ethical cobalt supply.

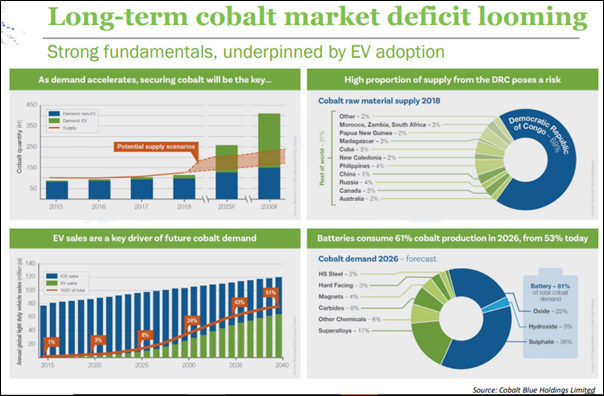

With absence of primary cobalt mining operations, cobalt supply has been heavily dependent on the performance of other co-existing commodities such as copper and nickel. The quantum of dependence can be realised from the fact that roughly 55% of the global cobalt production comes from nickel mining operations. Despite abundance of cobalt, only few primary cobalt mining operations exist today, with the most prominent one being Managem’s Bou Azzer in Morocco.

World Bank has also predicted a surge of 460% in demand for cobalt against 2018 levels by 2050. Democratic Republic of Congo, which faces child labour and safety issues at its cobalt mining grounds, presently caters to more than 65% of the global cobalt supply, which is estimated to surpass 73% by 2023.

Development of primary cobalt mining operations immensely de-risk the cobalt value chain against copper and nickel price fluctuations and is critical for a sustainable ethical cobalt supply.

Cobalt Blue Holdings: The Future Supplier of Large-Scale Low-Cost Battery-Grade Ethical Cobalt: Must Read

Broken Hill, the Largest Primary Cobalt Project Outside Africa

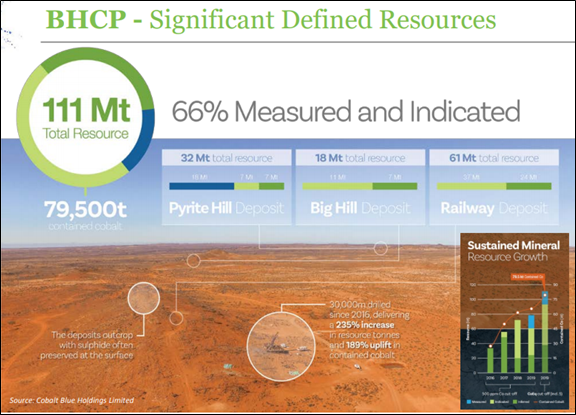

Cobalt Blue Holdings Limited (ASX: COB), a New South Wales based pure play cobalt company, owns and advances on the Thackaringa Cobalt Project, the largest primary cobalt project outside Africa.

Thackaringa Cobalt Project is located in the neighbourhood of Broken Hill, and is popularly referred as “Broken Hill Cobalt Project” or BHCP, enjoying the presence of existing electricity, water, rail and road infrastructure in the geopolitical stable, tier 1 mining jurisdiction of New South Wales.

BHCP holds large-scale superficial mineralisation amenable to open pit mining methods. The project holds mineral resources of over 111 million tonnes of ores with grades of 715 grams of cobalt a tonne and 7.8% sulphur. The large-scale of mineralisation, shallow presence and high grades make BHCP a low-cost source for cobalt.

BHCP has been placed in the lowest quartile of cash cost curve, owing to anticipated annual average production of 3,500 tonnes of cobalt and 300,000 tons of elemental sulphur at a low C1 cash cost between US$10 and US$11 per pound of cobalt. The feasibility study and final investment decision for the project development are anticipated in 2022. Another 1.5-2 years of construction places the tentative commencement of the project around late 2024 or 2025.

Cobalt Blue Backed by Industry Majors

Cobalt Blue understands that the battery industry is undergoing a revolutionary transition with constant improvement in energy density and battery ranges, which require a higher quality cobalt product. In order to serve to the forecast levels in upcoming years, the Company aims to ensure that its product meets the most stringent cobalt specifications.

COB has teamed up with several market leaders to test the commercial acceptance and optimisation of its product and proprietary technology for the battery sector.

To know more about COB’s proprietary technology, read Cobalt Blue Holdings Advances on Battery Road with Broken Hill Project and Proprietary Technology

LG International - The strategic first mover partnership with LG International in 2018 to produce a high purity battery grade cobalt sulphate product covers assistance in terms of capital and technology to Cobalt Blue. The agreement was an important event for the Company and its shareholders, while demonstrating BHCP as one of the most advanced cobalt projects of its type in the world.

LG International remains an active equity strategic partner of Cobalt Blue. It is the resources investment arm of LG Corporation and operates in close cooperation with LG Chem, which is one of the largest lithium-ion battery manufacturers in the world.

Mitsubishi Corporation - Later, in 2019, Cobalt Blue signed an agreement with Mitsubishi Corporation, an active global sulphur and sulphuric acid market trader, to evaluate the commercial potential of elemental sulphur, a coproduct of BHCP. COB aims to produce over 300 kilo tonnes of sulphur a year for over 15 years, eyeing to be a long-term supplier of elemental sulphur. Since the project is located in Australia, supply would be targeted towards close end-user markets across South-East Asia.

It is to be noted that Australia imports over 1 Mtpa of elemental sulphur, for which strong demand is expected from metallurgical and fertilizer applications. Cobalt Blue seeks to serve the local demand through its annual capacity of ~300 kilo tonnes of elemental sulphur.

Sojitz Corporation - Cobalt Blue formed a corporate partnership with Japanese giant Sojitz Corporation for sample testing. Consequently, samples from the Broken Hill Project were tested at the Sojitz facilities in April 2020, affirming premium high-quality nature of cobalt hydroxide product with ~37% cobalt and 7% nickel content with low presence of impurities.

Cobalt Blue seeks to form multiple sample partnerships to optimise and achieve the target of high quality, high purity, battery grade cobalt products. The Company plans to substantially de-risk the project and prequalify its final cobalt and sulphur products through corporate partnerships, prior to the completion of feasibility study and investment decision into BHCP.

COB closed at $0.115 a share on 11 June 2020, with a market capitalisation of $19.19 million. The last three-month return of the stock was noted at 14.29%.

All financial figures have been expressed in AUD, unless stated otherwise

Must Read: Meet Cobalt Blue’s Management Team Driving Significant Global Cobalt Resource, BHCP