Growing awareness regarding cleaner mobility solutions and energy generation has accelerated battery sector growth, which on the “S Curve” is now approaching the inflection point, the point following which an exponential rise is expected in electric vehicle and energy storage segments.

With major supply concerns looming around cobalt, one of the critical battery components, due to sparse cobalt presence across the globe and a situation of civil unrest in the Democratic Republic of the Congo, which accounts for more than 60% of the global production, there is an opportunity for the mineral-rich Australia to uncover challenges burdened by the industry.

Pure play cobalt company based in New South Wales, Cobalt Blue Holdings Limited (ASX:COB) is focused on development of the Broken Hill Cobalt Project (BHCP) and commercialisation of the cobalt technology.

BHCP, also known as Thackaringa Cobalt Project, is the largest greenfield cobalt project outside Africa and is located in the vicinity of Broken Hill, New South Wales. The Company wholly owns the project after acquiring the remaining 30% stake from Broken Hill Prospecting Ltd (ASX:BPL), for a cash consideration of A$6 million, later last year. The project covers an area of 63km2 in the mining friendly region of Broken Hill with access to existing power, water, road and rail infrastructure.

Progress So Far: PFS and Mega Corporate Partnerships

In the past 3 years or so, Cobalt Blue has aggressively progressed on the Broken Hill Cobalt Project with completion of the scoping and pre-feasibility study by 2018 and entering critical partnerships with industry leaders including LG International and Mitsubishi Corporation. The Company has also developed a proprietary cobalt extraction technology from pyrite at the Broken Hill that is currently under evaluation.

The first mover partnership with LG International in 2018 includes capital and technical assistance from the world’s largest Li-ion battery manufacturer (LG Chem) to produce a high purity battery grade cobalt sulphate product. Later, in 2019, Cobalt Blue signed an agreement with Mitsubishi Corporation to evaluate the commercial potential for elemental sulphur. Cobalt Blue aims to produce over 300,000 tonnes of sulphur a year for over 15 years.

CRC Funding for Cobalt Processing

In early 2020, Cobalt Blue secured a A$2.4 million grant from the Cooperative Research Centre as per the Round 8 funding from the Australian Government. The funding program is designed to promote research & development of processing technologies for cobalt-pyrite ore to extract battery-grade cobalt sulphate products over the next 3 years. As part of the funding, the Company would obtain over A$1.57 million for a demonstration pilot plant construction and operation project, with the remaining fund to be utilised by the Australian Nuclear Science and Technology Organisation (ANSTO) and the University of New South Wales.

Cobalt Blue also participates in the Future Battery Industries CRC and secured a government grant of A$25 million, a significant milestone for the Company. The Future Battery Industries Cooperative Research Centre is a six-year plan with objectives to fill gaps across the value chain right from mining to recycling of battery metals.

Pilot Plant to Demonstrate Commercial Possibilities for Broken Hill

COB plans to build a demonstrable pilot plant at the Broken Hill project and has already received some of the equipment; however, delivery of the remaining equipment slowed down due to supply chain disruption amidst the coronavirus outbreak. Initially, the pilot plant would have a production capacity of over 100-300 kilograms of cobalt sulphate, which would later be scaled to over 1,000-2,000 kilograms of cobalt sulphate from over 2,000 tonnes of ores.

Results from the pilot plant would be beneficial during the feasibility study and later in engineering, procurement, and construction phases of the full-scale processing plant. Specification of cobalt sulphate and hydroxide products would be utilised to evaluate the commercial potential. The plant is anticipated to commence operations in Q4 2020.

Largest Greenfield Cobalt Mine Outside Africa With Long-Life and Low-Cost Operations

Broken Hill Cobalt Project is currently under the feasibility study, which is expected to be completed by Q1 of 2022. The Company is advancing aggressively with mineral reserves estimation, with completion antiicpated by Q2 of 2020.

The project holds mineral resources of over 111 Mt containing 79,500 t Co & 8.7 Mt sulphur at a cut-off grade of 400 ppm Coeq with a life of mine in excess of 20 years.

An average of 3,500 tonnes of cobalt and 300,000 tonnes of elemental sulphur would be produced with a C1 cash cost anticipated around US$10-11 per pound of cobalt, which places the project in the lowest quartile of the cash cost curve.

Proprietary Process Successful Results, One Step Closer to Commercialisation

With the proprietary technology already in place, Cobalt Blue has advanced to test the technology at additional project locations. Two metallurgical test work programs are already in place, at-

- Global Energy Metals Corporation’s Millennium Project in Northern Queensland

- OZ Minerals Ltd (OZL) owned Carrapateena mine

Cobalt Blue received ore samples of over 70 kilograms from Millennium and processed the ore to produce two separate cobalt and copper concentrates with overall metallurgical flotation recovery of 93% cobalt, 93% copper and 80% gold.

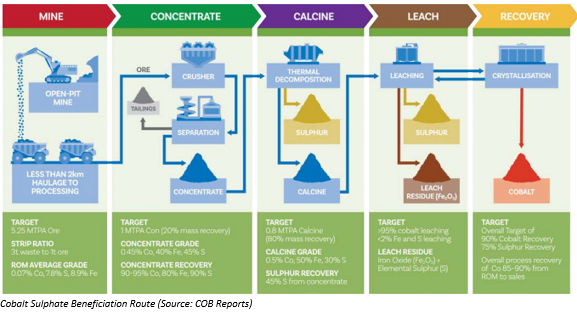

The cobalt concentrate was subject to the proprietary Cobalt Blue’s processing technology, which involved thermal decomposition and leaching steps to extract cobalt and copper. The process successfully resulted in leaching extractions of 90% of cobalt and 95% of copper. In addition, 10% of gold was also leached into rich solution from gold chloride complexes. Leached tailings were used to recover coarse gold volumes with final recovery of over 90% gold.

The high recovery for all three co-existing commodities immensely validates the processing technique. The increase recovery would improve the payable content of concentrate products immensely not just for cobalt, but for other commodities like copper and gold.

For OZL’s Carrapateena Mine, the metallurgical test program is expected to be completed in May.

Cobalt Blue plans to go for a strategic and phased roll out of the beneficiation process and plans to further evaluate the technology efficiency on varied ores and tailings of varied mineralisation, collecting consulting fees and eventually switching to an equity or profit sharing in the projects and jointly marketing the refined cobalt products.

Commercialisation of the proprietary technology and development of the Broken Hill Cobalt Project is expected to place Cobalt Blue Holdings amongst the market leaders in upcoming period.

COB last traded at $ 0.115 on 13 May 2020. The last one-month return of the stock stood at 9.52%.