Rare earths is a cornerstone of global governmentsâ macro-initiatives aimed at improving energy efficiency, increasing renewable power generation capacity, and reducing greenhouse gas emissions.

With the aim to tap the lucrative rare earths opportunity, Australia-based Greenland Minerals Limited (ASX: GGG) is focussed on the Kvanefjeld Rare Earth project in south west Greenland. When developed, the project would be a large-scale, low-cost, long term supplier of products- at the centre of the unfolding revolution in the efficient use of energy.

In late June 2019, the Company had lodged with the Government of Greenlandâs (GoG) Mineral License and Safety Authority (MLSA) an application for an exploitation (mining) license for the Project, including an Environmental Impact Assessment (EIA), along with a Social Impact Assessment (SIA) and a Navigational Safety Investigation study (MSS).

The updated EIA was the culmination of a programme of work which began with stakeholder consultations and workshops with government agencies in 2013.

The supporting documents were prepared by independent expert consultants and lodged in Greenlandic, Danish and English.

What followed is a milestone for GGG and the Project:

An update from the GoGâs Environmental Agency For Mineral Resources Activities (EAMRA) and EAMRAâs principal external advisers, the Danish Centre for the Environment (DCE) depicts significant progress towards finalising the thorough and detailed process of the EIA, providing confidence to Greenland stakeholders and regulators.

Positive Developments Regarding the EIA Review

On 22 October 2019, GGG received structured comments on the EIA from EAMRA, which it believes outline an approach to finalising the EIA and thereby moving to the next phase of the licensing process, which would be formal public consultations.

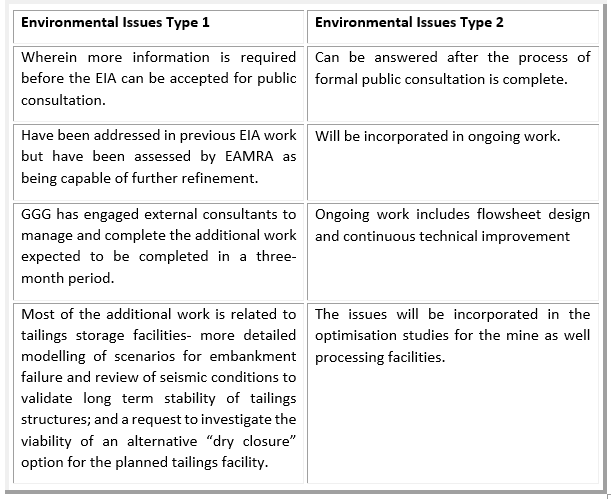

EAMRA has separated outstanding environmental issues into two categories, Type 1 and Type 2, to bring the EIA approval process closer to permitting practices in other countries where issues relating to final design, engineering and construction are not salient to significant environmental risk, and are dealt with in the final approvals process:

Global Tailings Review

In June 2019, the International Council on Mining and Metals, the Principles for Responsible Investment and the United Nations Environment Programme co?convened a global tailings review to establish best global practices on tailings storage facilities. This review is expected to be completed by the end of 2019.

GGG considers it best for its plans for tailings to be tested against the highest standards and acknowledging the same, has begun a review of the design and operations of tailings management at Kvanefjeld to ensure compliance with updated standards.

Moreover, meetings are planned with EAMRA and the DCE in order to finalise the EIA in a timely manner, as the Company looks forward to providing updates as the additional studies conclude and a schedule is formed for a public consultation.

Stock Price Information

The GGG stock ended the dayâs trading session at $0.100 on 22 October 2019 with a market capitalisation of $119.1 million and approximately 1.19 billion shares outstanding. In the past six months, the stock has delivered a return of 40.85%.

As stated by Dr Mair, after several years of working closely with the Greenland regulators and their advisers, the range of outstanding issues has been significantly narrowed with clear guidance provided to close out the outstanding items.

While the market awaits the upcoming progress for Greenland Minerals, we encourage you to read more about the Kvanefjeld rare earth project developments HERE.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.