On 24 May 2019, Millennium Minerals Limited (ASX:MOY) released its AGM presentation where the key highlights were companyâs two significant expansion projects currently underway, the rising gold production along with high leverage to A$ gold price.

Also, the company is concentrating on its wholly owned Nullagine Gold Project which is situated in the East Pilbara region of Western Australia.

In its AGM presentation, the company reported a strong gold production in the East Pilbara region. The strategy for growth includes as follows:

- Growth initiatives with the focus on increasing head grade and recovery efficiency.

- At present, the first underground mine at Bartons is ramping up.

- Commissioning of low CAPEX/OPEX upgrade to the processing plant is under process in order to enable significant sulphide Resource base processing.

- The mine plan for the CY2019 was re-optimized to reflect a delay in completing the forecast production in the first half CY2019 of 34,000-36,000oz was increased to 46,000-54,000oz in the second half of CY2019 along with annual guidance of 80-90koz at AISC of A$1,370-1,450/oz.

The new mining strategy includes the mining of larger scale, longer life open pit deposits with the aim to increase head grade through additional underground development. The development of the Golden Gate mining centre is targeted to start in the later parts of 2019.

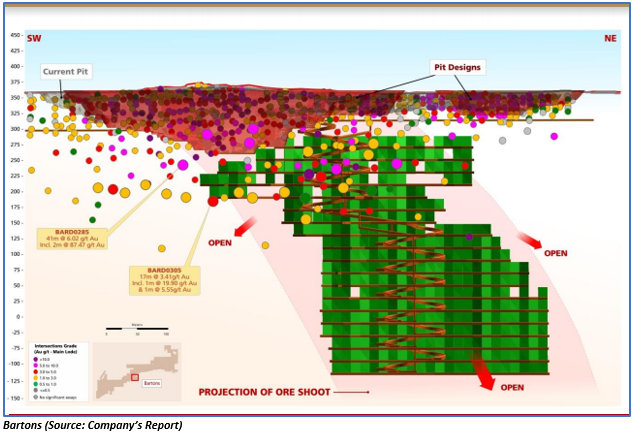

About Bartons:

Bartons is the first underground mine at Nullagine with resources of 750,000t @ 4.1g/t Au for 99,400oz. At the site, all the deeper holes came across the main ore zone, and they continue to define extensions. The 1st phase of the underground drilling has completed targeting deeper extension. The planning of the 2nd phase depth and strike extension is under process.

Sulphide Resources Project Update:

Sulphide Resources Project Update:

The concentrator spirals are commissioned, and the production of gold concentrate is ramping up. The Ultra-fine Grind Mills are in place and is final commissioning is expected by the end of June 2019 which will enable the production of gold doré.

The metallurgical test work confirmed more than 80% gold from pyrite-dominant ore and around 70% gold from arsenopyrite-dominant ore.

Golden Gate:

Golden Gate is one of the highest-grade open pit ore sources that was mined at Nullagine. At the site, the major drilling program completed in order to extend the high-grade open pit as well as underground mining potential. The new high-grade drill result was outstanding, and it confirmed the potential for next underground mine which includes Condor Northwest, D Reef and initial underground Ore Reserve of 220,600t @ 3.8g/t Au for 27,100oz.

Further, the company provided an update on funding and CY2019 guidance which are as follows:

Companyâs Production Guidance:

As a result of production and the ramp-up delays, the production for 1H CY2019 will be in the range of 34,000oz to 36,000oz. The production in the 2H CY2019 is expected to be in the range of 46,000oz and 54,000 oz. Thus, the company has revised its production guidance for CY2019 to be in the range of 80,000-90,000oz at an AISC range of $1,370 - $1,450 per ounce.

Funding Support:

The company has reached an in-principle agreement with IMC Group, the major shareholder of MOY to provide a term loan facility of A$20 million for a period of eighteen months to provide interim working capital. This term loan facility of $20 million along with existing Investec Facility and cash-flow from operations will be used to complete the ramp-up at Bartons as well as bring the Stage 1 sulphide plant fully on stream.

By the end of the trading session, on 24 May 2019, the price of the MOY shares were at A$0.105, down by 12.5% as compared to its previous closing price.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.