Summary

- Primary objective of Calima Energy is to bring its Montney Formation asset, Calima Lands into production phase within the next few months.

- The Company appears to have successfully executed its overarching strategy so far, as reflected by the acquisition of Tommy Lakes Infrastructure, which has elevated the Montney asset to be a development ready project.

- Holding a regulatory approval for a service pipeline’s construction and operation, the Company plans to connect Calima wells (current and potential) to the West 2 compressor facilities in Tommy Lakes Field.

- CE1 has anticipated an estimated $1.9 million in working capital on 31 March 2021.

Walking through a spectacular journey since the acquisition of Montney Formation Asset, oil & gas entity Calima Energy Limited (ASX:CE1) has established a material spot in the tier 1 petroleum province of Canada. The Company’s remarkable progress is reflected through its ownership of two core assets – Tommy Lakes Facilities and the Calima Lands.

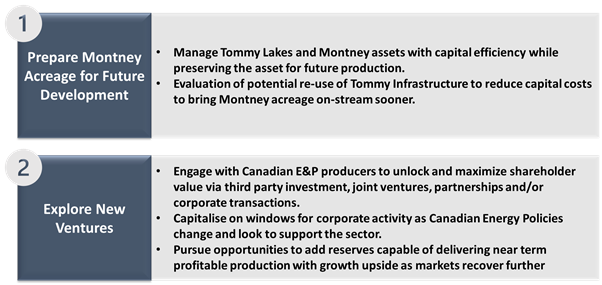

While the Company intends to prepare the Montney acreage for future development and explore new ventures in 2020, its primary objective is to bring development ready Calima Lands into production phase within the next few months. Needless to say, Calima’s highly proficient leadership team would play a crucial role in the realisation of its 2020 operational objectives.

That being said, let us discuss Calima’s key achievements till date, which are likely to pave the way for the Company’s future growth trajectory:

- Executed Strategy

While an improvement in the Canadian gas market situation has been offering a considerable uplift to O&G players like Calima, the Company’s noteworthy progress at Calima Lands, in accordance with its overarching strategy, deserves real credit.

Calima’s strategy is focused on generating value for shareholders through:

The Company appears to have successfully executed its strategy so far, as reflected by the acquisition of Tommy Lakes Infrastructure in Q1 2020, which has elevated the Montney asset to be a development ready project. The acquisition has provided Calima with a cost-effective access to processing facilities and NorthRiver pipeline and from there to significant pipeline networks like Alliance, NGTL and T-North.

- Well Quality Exceeded Expectations

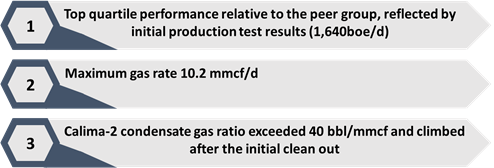

In 2019, the Company successfully concluded a three-well drilling campaign, covering 9,353m, which produced significant results surpassing its expectations. The drilling campaign was undertaken on one vertical (Calima-1) and two horizontal wells (Calima-2 and Calima-3), with the Calima-2 well delivering above-average performance.

Below are the key drilling results from the well drilling campaign:

On the back of drilling results, consultants projected the Calima-2 well to meet or beat the performance of nearby wells, in terms of both overall production performance and liquid yield. Besides, they mentioned that the aggregate gas test rate from the Calima-2 well compares positively to other liquids-rich wells.

The success of the drilling campaign enabled the Company to convert its ~60 per cent of primary acreage to ten-year production leases, encompassing 33,643 acres.

- Maiden Contingent Resources

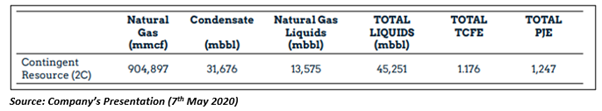

Leading Canadian reserves auditor, McDaniel finalised the evaluation of independent resources upgrade in July last year, estimating a maiden contingent resource of 196.1 Mmboe for Calima Lands. Besides, the auditor’s resource report assessed ultimate recovery (EUR) as 8.4 Bcf per well.

McDaniel’s Best Estimates of total un-risked contingent within the Calima Lands are summarised in the below table:

- Secured Egress

Calima also holds a regulatory approval to build and operate a service pipeline (19.5 km steel 8-inch), connecting Calima wells (current and potential) to the West 2 compressor facilities in Tommy Lakes Field. The approval was secured in December 2019, as part of the Company’s permitting and approval process connected with bringing Calima Lands into production in an economical manner.

The pipeline that would operate through the core of the Calima Lands would possess the capacity to transfer up to 50 million cubic feet of wet gas per day and 1,500 barrels of well-head condensate per day.

- Prudent Management of Capital

Calima notified in its March 2020 quarterly report that it had a strong current working capital position of ~$3.6 million as at 30 April 2020. The Company believes it is sufficiently funded post the acquisition of Tommy Lakes Facilities, with its capital position having 1.5-2 years of running room.

The Company has also anticipated an estimated $1.9 million in working capital on 31 March 2021.

Way Ahead

On 9 July 2020, CE1 stock closed the day’s trade at $0.004.