Summary

- Canadian gas market situation has considerably improved over the recent years, backed by robust government support.

- In comparison to 2018/19, when there was an excessive downtime in NGTL system due to maintenance, along with limited gas storage in summer due to line maintenance; the situation is a lot better now with two major pipelines under construction.

- Improving Canadian gas market situation provides enhanced momentum for future gas projects in British Columbia.

- Calima aims to manage Tommy Lakes and Montney assets with capital efficiency while preserving the asset for future production.

- CE1 intends to bring Calima Lands into production within next 6-9 months, under stable market conditions.

Pace at which the Canadian gas market situation has improved over recent years is truly commendable. Formerly pipeline-constrained, oil & gas pricing in the country has stabilised with additional egress out of the western Canada impending near-term.

Continued momentum in gas pricing is offering a significant uplift to oil & gas players such as Calima Energy Limited (ASX:CE1), which has established a material position in a Tier 1 petroleum province that competes favourably with the best of the US resource plays.

Calima owns and operates 100 per cent stake in over 63,000 acres of Montney drilling rights in British Columbia and holds two core assets - Calima Lands and recently acquired Tommy Lakes facilities.

For Calima Lands, a development ready project located within a liquids-rich sweet-spot of the Montney Formation in NE British Columbia (BC), McDaniel has estimated maiden contingent resource of 1.176 TCFE/ 1,247 Pje. Moreover, three wells in 2019 allowed CE1 to convert 60% of its core acreage to 10-year production leases, and initial production test results ranked in the top quartile of peer group Montney wells (1,640 boe/d). The Company intends to bring its Montney asset into production within next 6-9 months, under stable market conditions.

Acquisition of Tommy Lakes Facilities has provided the Company with an access to 50 mmcf/d of gas processing and transport capacity. The infrastructure provides CE1 with pipeline access to regional, national and US markets via NGTL, Alliance, T-North and other major pipeline networks.

Additionally, CE1, in late-2019, secured regulatory permit to construct and operate a service pipeline, which will connect the Calima well-pad (existing and future) with regional pipeline and processing infrastructure.

Also Read: Walk through Calima’s Impressive Journey Since Acquisition of Montney Formation Asset

An improvement in the Canadian gas market situation over recent years is further boosting Calima’s growth prospects in the period ahead. Given this backdrop, let us discuss some key factors testifying upswing in the gas market:

Egress/Pipelines

While T-South pipeline was operating below maximum operating pressure in 2018-19, it returned back to maximum operating pressure in December 2019. In addition, the Trans Mountain pipeline that was earlier held up into court cleared significant legal hurdles and is now under construction following purchase by the Federal Government for C$4.5 billion, with planned spending for expansion being targeted at C$3.6 billion.

The period 2018/19 saw excessive downtime in NGTL system due to maintenance, along with limited gas storage in summer due to line maintenance. However, the situation is a lot better now with two major pipelines under construction.

The Alberta Government has funded US$1.1 billion and provided assistance with US$4.2 billion financing for the construction of the Keystone XL pipeline operated by TC Energy, that will carry an additional 830,000 bbl/d from Canada. The construction of this pipeline has already commenced.

Moreover, Coastal Gas Link Pipeline construction is continuing post agreements with the Provincial and Federal governments reached with Hereditary Chiefs.

LNG Export, West Coast Canada

Back in 2018/19, regulatory hurdles existed for facilities and pipelines, together with lack of final investment decisions by any operator. Consequently, no construction started during that time.

However, with LNG Canada attaining Final Investment Decision (FID), construction is progressing for 14 million tonne p.a. project despite coronavirus. The project is targeted to be delivered by 2024. Notably, the governments, at both federal and provincial level, are supporting LNG and providing incentives.

Clear Government Direction on Resource Project Approval

From continued court battles and lack of the Federal Government support in 2018/19, Canadian gas market is now receiving the Federal level support for key projects, including Coastal Gas Link and TMX.

Besides, there is now clear government direction on approvals for resource projects. For instance, the Federal Court of Appeals rejected appeals by First Nations with regards to adequate consultation for the Trans Mountain Pipeline, reflecting a change in tone concerning major infrastructure projects in Canada.

Canadian Supply Pressure

In comparison to oversupply of gas with producers hitting maximum condensate volumes previously, the Canadian oil & gas upstream budgets fell by 31 per cent over April 2020 for a cumulative reduction of US$5.6 billion.

North American Competition & Associated Gas

Though the Permian Basin enjoyed peak production levels with a volume increase in associated gas during 2018/19, production is now declining and consequently strengthening the North American gas pricing. Permian is observing a decline in gas rates due to reduced oil drilling. Moreover, US natural gas production experienced a fall for the five straight months recently.

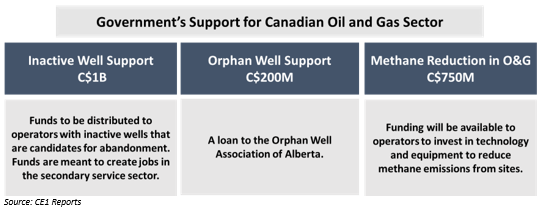

In a nutshell, improvement in these key factors provides enhanced momentum for future gas projects in British Columbia, expected to improve Calima Energy’s growth prospects. Additionally, Calima is well positioned to tap lucrative opportunities emerging in the Canadian O&G sector, backed by robust management team, its core assets, and solid government support for the energy industry.

CE1 closed the trading session at $0.005 on 4th June 2020.