Six to nine months down the line, production from the Calima Lands could become a reality under stable market conditions. Towards this end, oil & gas player Calima Energy Limited (ASX:CE1) has finalised the acquisition of Tommy Lakes Infrastructure (Facilities).

Post the key update, CE1 surged by more than 33 per cent on the ASX, closing the trading session at $0.004 on 20th April 2020.

It’s a remarkable achievement for Calima Energy, which has got access to all the major growth markets in a very cost-efficient manner via Tommy Lakes’ existing connections to NGTL/AECO, Alliance and T-North/Station 2. Additionally, the Tommy Lakes acquisition has completed the building blocks required for a pilot production project, capable of producing up to 50 million cubic feet per day and 1,500-2,000 barrels per day, subject to funding and further drilling.

Also Read British Columbia Pipeline Network Vis-à-Vis Calima Lands in Montney Formation

Tommy Lakes Acquisition Completed Under Budget

Calima Energy has completed the acquisition of Tommy Lakes Infrastructure under budget with the expenditure to complete the acquisition and shut-in estimated at ~$750,000. The Company previously estimated the principal consideration to be paid in the range of $825,000, comprising the payment of a refundable performance bond to British Columbia’s Oil & Gas Commission (OGC) and the cost of shutting down the facilities.

Moreover, the Company estimated the cost of maintaining the Facilities in a shutdown state at ~$420,000 per annum.

The replacement cost of Tommy Lakes has been estimated at ~$85 million, with Facilities being in excellent condition. With the $85 million replacement value, re-utilisation of Tommy Lakes considerably lowers the capital cost and saves the time involved in constructing and permitting new facilities.

Main Components of Acquired Facilities

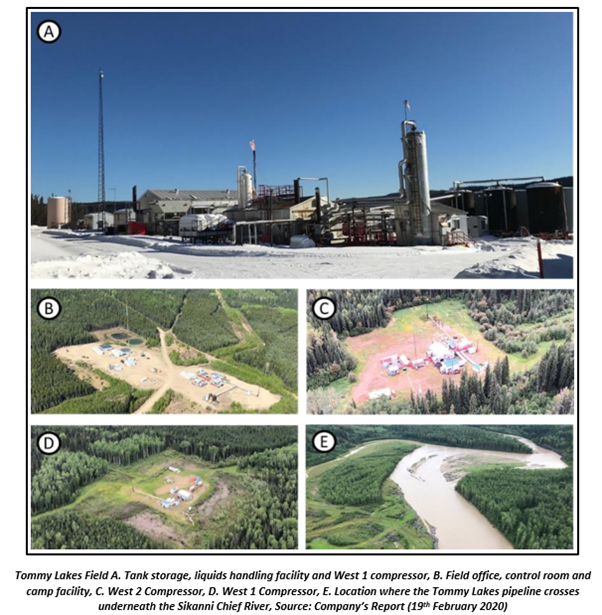

The main components of the Facilities acquired as part of Tommy Lakes acquisition include:

- Processing, Compression and associated pipelines that can transport 1,500-2,000 barrels per day of well-head condensate and up to 50 million cubic feet per day of gas to NorthRiver’s Jedney processing facility.

- Off-loading and condensate storage facilities year-round.

- Field office, together with a control room and camp facilities (flexible), appropriate for carrying out drilling activities.

It is worth mentioning that Tommy Lakes Infrastructure is situated immediately north of the Calima Lands, the Company’s primary asset in the Montney Formation, and gives access to the most cost-effective, closest tie-in to pipeline networks (regional) and processing facilities. The Company has already secured the approval for constructing the pipeline connecting the Tommy Lakes Facilities to its suspended wells on Pad A in December last year.

Facilities Preserved for Future Recommissioning

Calima Energy notified that the facilities are fully permitted and have been preserved for future recommissioning, pending production commencement. Currently, the Facilities are engaged in gas and condensate processing from Enerplus Corporation-owned and operated Tommy Lakes Field.

The Tommy Lakes Field has been in production for over twenty years using traditional completion methods from the Dog/Halfway Formation, situated immediately over the Montney. It is imperative to note that the Facilities have been maintained in line with an integrity management program that is of high standard.

Moreover, due diligence by the third party has validated that pipelines and other assets acquired are fully compliant with all OGC requirements, in good working order and can operate safely and efficiently.

With the acquisition of the Facilities, Calima is now directly connected to NorthRiver Jedney processing facility and from there to major pipeline networks like NGTL, Alliance and T-North. Additionally, the Company has the option to acquire 11 producing wells that could provide fuel gas for the start-up phase of production.

Being a critical component of the Field Development Plan (FDP), the completion of Tommy Lakes acquisition has elevated the Calima Lands to become a ready-for-development project. Calima Energy is well on track to take a Final Investment Decision, which is subject to securing funding via either introduction of a joint venture (JV) partner and/or project financing facilities.

Must Read Management Shift to Canada - Calima Energy's Strategic Forward Plan towards Commercialisation