Investing in stock market is speculative, which means high risk is accompanied with higher returns. However, if an investor looks for some safety of his capital, he should remain invested in such stocks which have the capability to weather market disruptions. These assets could be identified as Blue-chip stocks. Investing in Blue-chip companies can provide more security as compared to mid and small cap stocks which are prone to the vagaries of the market. At the time of market correction or speculation, blue chip stocks do not correct as vigorously as mid and small caps. In the article below, we will be focusing on a few blue-chip companies with their recent updates:

Treasury Wine Estates Limited

Treasury Wine Estates Limited (ASX:TWE) is involved in sourcing and growing grapes, production of wine as well as marketing, sales and distribution of wine.

Issue of Securities

- The company recently through a release announced that it has issued 200,844 fully paid ordinary shares at the consideration of $18.5632 per share on 4th October 2019.

- TWE has issued shares under its dividend reinvestment plan, i.e. final dividend.

Strategies for upcoming years

The company has recently published a presentation, wherein it communicated about its performance in the past as well as strategies for future:

- TWE is planning to drive premiumization via a focused portfolio strategy and deliver scalable innovation.

- The companyâs priorities are to pursue opportunities throughout multiple COOs as well as adjacent categories.

- It is also in the planning to enhance marketing spend efficiency and effectiveness.

In the past five years, it has made substantial changes for strengthening its business models in order to create a significant competitive advantage. The following picture depicts overview of CAGR growth in EBITS:

The stock of TWE closed at $18.300, up 1.61% as on 15th October 2019. The stock has generated return of 14.71% and 13.77% during the last three months and six months, respectively.

Oil Search Limited

Oil Search Limited (ASX: OSH) is into exploration of oil and gas fields. It is also involved in the development and production from such fields. Recently, the company has published a presentation, wherein OSH primarily stated about its 2019 highlights as well as production outlook for 2019:

- It outlined that Papua LNG Gas agreement has been inked in April 2019, and endorsed in September 2019. It added that other key commercial agreements are ready to be implemented after the finalization of P'nyang gas agreement.

- The inaugural Pikka Unit drilling programme in Alaska has provided robust results.

- OSH possesses decent liquidity position in order to support growth opportunities in Alaska as well as PNG.

- The company further added that because of issues with loading system as well as limited storage available in liquids export system it has reduced rates in the middle of August 2019.

The stock of OSH closed at $7.120, flat against the previous close, on 15th October 2019. The stock has generated return of -3.00% and -11.88% during the last three months and six months, respectively.

Sydney Airport

Sydney Airport (ASX: SYD) is into operations of Sydney Airport with a market capitalization of A$18.5 billion as on 15th October 2019.

Changes to the Board and Compliance Committee

The company through a release dated 27th September 2019 announced that The Trust Company (Sydney Airport) Limited as the responsible entity of Sydney Airport Trust 1 has updated the market with changes to the Board and Compliance Committee of The Trust Company (Sydney Airport) Limited.

- It added that Eleanor Padman put a resignation from the designation of director of the responsible entity.

- It was mentioned in the release that Chris Green also resigned as an Alternate Director for Eleanor Padman for The Trust Company (Sydney Airport) Limited.

- The company appointed Simone Mosse as a member of the Compliance Committee

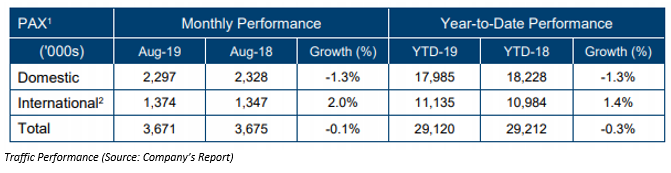

The following picture depicts an idea of traffic performance for the month of August 2019:

The stock of SYD closed at $8.370, up 2.198% as on 15th October 2019. The stock has generated return of 4.33% and 10.98% during the last three months and six months, respectively.

TPG Telecom Limited

TPG Telecom Limited (ASX: TPM) provides wholesale and corporate telecommunications services. In addition it serves retail consumers also.

A Look back at Financial Year 2019:

The company has recently updated the market participants with the financial results for the full year ended 31st July 2019:

- TPM stated that its FY19 reported results have been largely affected by its decision to stop the launch of its Australian mobile network in January 2019, which gave rise to an impairment expense amounting to $236.8 million as well as a significant rise in amortization and interest expense relating to the TPMâs Australian spectrum licences.

- The companyâs underlying EBITDA amounted to $ 818.4 million in FY19 as compared to $ 826.7 million of FY18.

- The net operating cashflows before tax of the group were strong, surpassing the EBITDA at $836.3 million.

- For FY20, the group expects to have the greatest financial impact from customer migration to NBN, with combined headwinds originating from residential DSL and home phone customers moving to NBN estimated to be approximately at $85 million.

The stock of TPM closed at $6.850, down 0.146% as on 15th October 2019. The stock has generated return of 4.89% and -1.44% during the last three months and six months, respectively.

Woodside Petroleum Ltd

Woodside Petroleum Ltd (ASX: WPL) is primarily into the management and operation of hydrocarbon. The market capitalization of the company stood at A$30.15 Bn as on 15th October 2019:

Issue of Shares

- On 20th September 2019, the company has issued 6,135,351 fully paid ordinary shares at the consideration of A$31.3447 per share.

- The shares have been issued under in line with its dividend reinvestment plan for the 2019 interim dividend, which was paid on 20th September 2019.

For the half-year ended June 2019, the company reported net profit after tax amounting to $419 million. It added that the production for the first half stood at 39.0 MMboe and operating revenue came with a figure of $2,260 million. In the period, the Board of directors of the company have declared interim dividend amounting to 36 US cents per share.

The stock of WPL closed at $31.680, down 1% as on 15th October 2019. The stock has generated return of -10.69% and -10.71% during the last three months and six months, respectively.

Westpac Banking Corporation

Westpac Banking Corporation (ASX: WBC) is a banking corporation, which provides banking financial and related services.

Discussion paper by the Australian Prudential Regulatory Authority

WBC has noted the release of a discussion paper by the Australian Prudential Regulatory Authority, wherein the revisions to APS 111 Capital Adequacy: Measurement of Capital was mentioned:

- It was stated in the release that APRA outlined that the proposed changes target to ensure Australian deposit holders continue to be protected if the major banks hold various investments in subsidiaries.

- APRA proposed that the equity investments in subsidiaries would be risk weighted at 250%, up to a limit of 10% of Level 1 Common Equity Tier 1 (CET1) capital.

- It was also mentioned that equity investments more than 10% would be fully deducted from Level 1 CET1 capital for determining Level 1 capital ratios.

- WBC further stated that as of 30th June 2019, the Level 1 CET1 capital ratio stood at 10.5%. However, on a proforma basis, WBC expects a deduction of around 40 basis points in its Level 1 CET1 capital ratio by applying APRAâs proposed approach.

The stock of WBC closed at $28.940, up 0.138% as on 15th October 2019. The stock has generated return of 3.92% and 10.90% during the last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.