At times when the stock market is in a tailspin, investors are often lured towards investing in consumer staple stocks that typically refer to companies engaged in food, beverage, household goods, and feminine hygiene products, alcohol and tobacco. These are usually non-cyclical products and are considered as safe haven for investors in recessionary times. Market participants find it lucrative to invest in stocks that depict low beta.

Let us look at one such consumer staple stock under investorsâ radar - Treasury Wine Estates (ASX:TWE).

Treasury Wine Estates (ASX:TWE) is the leading wine company engaged in three principal activities including grape growing and sourcing, production, marketing and sales of wine with a portfolio of wine brands and prized viticultural assets, depicting the companyâs commitment and passion to craft, market and sell quality wine to its customers. They are focused on four major regions across the world: Australia and New Zealand, America, Europe and Asia.

FY19 Financial Performance (as at 30 June 2019)

- EBIT went up by 25% to $662.7m from $530.2m in FY18, delivering a 30% five-year CAGR while EBIT margin took a rise by 1.6% points to 23.4%.

- Luxury and Masstige brands grew by 27%, resulting in 69% of total net sales revenue in FY19 from 43% five years ago.

- There was a reduction in net borrowings by $51.8m to $750.5m due to increased EBITDA and movement in the working capital.

- Lease adjusted debt/EBITDAs was reduced by 0.2x to 1.7x in FY19.

- Maintenance and replacement spend amounted to $132m of $160m of total capital expenditure. The remaining $28m is the growth Capex represented by the investment in the vineyard acquisitions.

- The cash conversion exceeded to 75.8% from the guidance of 60-70%, which shows the improvement in sales profile in the US and market changes and efficient inventory management in the Australian vintage.

- The company is following the sustainable approach to manage the capital base by increasing the EPS by 18% to 4 cents and ROC by 2.3% to 14.9%.

- The net revenue went up by 16.6% to $2831.6m in FY19.

- There was an increase in finance costs which was primarily driven by higher average borrowings, commitment fees on bilateral debt facilities and the share buy-back in FY18.

- The increased earnings in Australia and Asia reflected a higher tax expense in FY19.

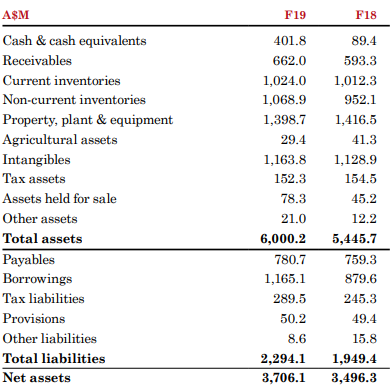

- There was a rise in inventory by $128.5m to $2,092.9m in FY19 due to the impact of forex translation on the US inventory and high quality, high volume vintages in Australia and California which further resulted in the higher working capital in comparison to 30 June 2018.

Financial Summary (Source: Annual report)

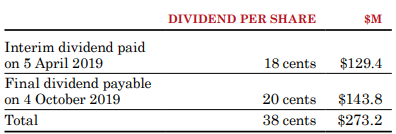

Dividend

The company declared a fully franked final dividend of 20 cents per share resulting the total dividend of 38 cents per share for FY19, which is 19% higher than the prior year and reflecting the pay-out ratio of 62.9%.

Financial Summary (Source: Annual Report)

Cash flows

A higher operating net cash flow of $415.6m was recorded in the FY19 than $295 in FY18.

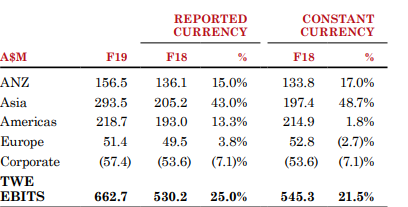

Division wise EBIT growth & EBIT margin

- Asia reported the highest EBIT growth of 43% to $293.5m followed by Australia and New Zealand by 15%, America by 13.3% and Europe by 3.8%.

- America reported EBIT margin of 19.3% leading to market changes and investment in the US.

- Leading demand of portfolio of TWE and availability of luxury wine resulted in the EBIT margin of 39.2% in Asia.

- Growth across the Masstige and lower Luxury portfolios, reduction in costs and improvement in performance led to the EBIT margin of 26% in Australia and New Zealand.

- Europe reported the EBIT margin of 14.9% driven by investment in top priority brands.

Financial Summary (Source: Company Presentation)

Region wise business performance

There was progress made throughout the year on number of initiatives.

America:

- In America, New route-to-market model led to a growth of 9.4% in NSR and a higher volume of 2.7% showing a positive momentum in first financial year. Although higher COGS were observed due to portfolio mix, logistics costs and high-quality vintages but delivered growth despite the period of significant operational change.

Asia:

- Route to market was continuously optimised and outstanding growth was observed in China, which was led by competitively advanced business model.

- NSR went up by 35.6% due to increased availability of luxury and Masstige wine, Price realisation across the region, key partnerships within the region and a more balance sales profile for Rawsonâs Retreat.

Australia and New Zealand:

- EBIT growth went up by 15% to $156.5m. EBIT margin of 26% was observed. This was led by the improving performance in the on-premise channels, Growth across the Masstige and lower Luxury portfolios and an ongoing focus on managing costs. Positive performance in Australia was led by positive collaboration with key retail partners and gains in the on-premise channel leading to increased NSR by 3.1% whereas transitional impacts in distributor channel resulted in decline of NSR in New Zealand.

- An increase in 1.2% of NSR IN Australia was due to strong growth and improved portfolio.

Europe:

- Europe reported 3.8% EBITS growth to $51.4 million and an EBITS margin of 14.9%. This was driven by targeted investment behind priority brands in focus markets throughout the region. There was an increase in volume and NSR by 2.9% and 4.4% respectively. Unfavourable COGS were observed which shows the pricing pressure in Australian and US commercial wine.

Business Achievements

- People: TWE grew their capability through the campaigns to build business acumen which was attended by more than 500 employees in Australia and over 400 employees in the America. It also launched the LinkedIn learning and TWE way of marketing which strengthened the functional capability.

- Brands and markets: The company grew priority brands and expanded into new countries through virtual brands. The company also grew its share in Asia, US and Australia via number of ways including portfolio expansion, RTM optimisation and category leadership.

Outlook

- Future operational and financial prospects include ongoing focus on premiumising TWEâs portfolio, investments in French production and vineyard assets. It is also expected to continue to launch new wine brands from new countries of origin.

- The company is also focusing on new revenue streams and pursuing potential opportunities for some brands e.g Penfolds spirited wine, Squealing Pig Gin.

- They are also seeking global expertise to invest in sales and market capability in key regions like North Asia and the US and leveraging the new route to drive greater brand availability, strategic retail and EBIT margin and growth in the US.

- The company is expected to deliver approx. 15-20% EBIT growth in the year 2020.

- The companyâs strategy the FY20 is focused on three pillars which includes Diverse workforce, inclusive workplace and employer of choice in workplace.

- In the F20 LTIP, the weighting of the two metrics remains unchanged from the F19 LTIP with ROCE weighted at 75% of the plan and Relative Total Shareholder Return weighted at 25%.

Stock Performance

The stock is currently trading at A$18.280 (AEST- 1:25 PM, 26 September 2019) which is very close to the 52-week high of A$19.470. The market cap is $12.97 bn with an annual dividend yield of 2.11% (as per ASX). The PE ratio for the stock is 31.230 and the stock position has gone up by 19.58% in past 6 months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.