The Australian benchmark index S&P/ASX200 was trading at 6741, up by 23.5 basis points and 0.3 percent (as on 20 September 2019, AEST 3:13 PM). In this article, we would discuss the four diversified stocks wherein, Cedar Woods Properties Limited is from real estate sector, Steadfast Group Ltd is from financials sector, while Elders Ltd and Tassal Group Limited are from consumer staples sector.

Let us now get acquainted with the four diversified stocks as follows:

Cedar Woods Properties Limited

Acquisition of 12.4 hectors of residential site in north-eastern growth corridor of Perth:

Cedar Woods Properties Limited (ASX: CWP) is an Australian company that is into the development of the properties.

The company, on 19 September 2019, notified that it inked a conditional contract for the acquisition of 179 Erindale Road, located in Hamersley, Western Australia from Broadcast Australia. This contract reflects the acquisition of 12.4 hectors of residential site, which is situated 14kms from the Perth CBD within the north-eastern growth corridor of Perth. The acquisition is for the total consideration of $21.2m, plus GST. However, the acquisition is on the condition that the company has to obtain all the approval related with town planning and environment. If CWP is able to acquire this site, then this will prove to be the third acquisition of the company in the past one-year period.

The company is making the acquisitions according to its strategy to diversify itself by geography, product type and price point of view. Further, the company intends to acquire properties in WA, Victoria and Queensland. Moreover, with the acquisition in Perthâs north-east growth corridor, the company will increase its presence, where it already has Ariella Estate, which has been performing strongly on the back of strong demand and limited supply. The property group also reflects that the project has infill opportunity, and the site can be readily accessed to the city, train stations, the airport and shops.

On the other hand, for fiscal 2020, the company is expecting comparatively lower earnings than FY 19 on the back of challenging environment.

FY 19 Financial Performance (Source: Companyâs Report)

On 20 September 2019, CWPâs stock was trading at $7.07, up by 2.762 percent (at AEST 2:16 PM). The company has a market cap of $551.63 million, with ~80.18 million shares outstanding. For the last 3 months period, the stock has delivered a return of 17.41 percent.

Steadfast Group Ltd

Raised Fund:

Steadfast Group Ltd (ASX: SDF) from financials sector, updated the market on 19 September 2019 that it raised approximately $19m through Share Purchase Plan (now completed) at an issue price of $3.38 per share. Prior to this, the company had raised $100 million through the institutional placement of the shares, which was oversubscribed and was at premium of 10 cent per share to the underwritten floor price of $3.28 per share.

Moreover, for FY 19 period closed 30 June this year, the company has delivered 21.4% growth in the underlying revenue to $688.3 m, 17.8% increase in underlying EBITA to $193.3m, 19% rise in Underlying NPAT to $89.2m, and 36.9% increase in the Statutory NPAT to $103.8m.

Additionally, for fiscal 2020, the company expects Underlying EBITA to be in the range of $215-$225 million, underlying NPAT to be in the range of 100-$110 million and underlying diluted EPS growth in the tune of 5% to 10%.

On 20 September 2019, SDFâs stock was trading at $3.58, down by 1.648 percent (at AEST 2:33 PM). The company has a market cap of $2.99 billion, with ~2.99 billion shares outstanding. For the last 3 months period, the stock has delivered a return of 6.74 percent.

Elders Ltd

Received the approval by the Federal Court of Australia for dispatch of the Explanatory Booklet:

Elders Ltd (ASX: ELD) from consumer staples sector, on 19 September 2019 notified the market, on the proposed acquisition of AIRR Holdings Limited. ELD mentioned that it had received the approval by the Federal Court of Australia has approved the dispatch of the Explanatory Booklet to AIRR shareholders. This is for the Scheme of Arrangement by which it will be acquired, for holding the Scheme meeting and annual general meeting of AIRR shareholders scheduled to be held on 25 October 2019.

This Explanatory Booklet was prepared by Leadenhall Corporate Advisory Pty Ltd, which tells that the proposed acquisition is not fair, however it is for the good interests of AIRR shareholders. The company expects to settle the acquisition of AIRR by 1 December 2019 and will include the earnings of 10 months in FY20. This acquisition reflects the multiple of 8.8x FY19 EV / EBIT its pre-synergies or 6.4x FY19 EV / EBIT post synergies.

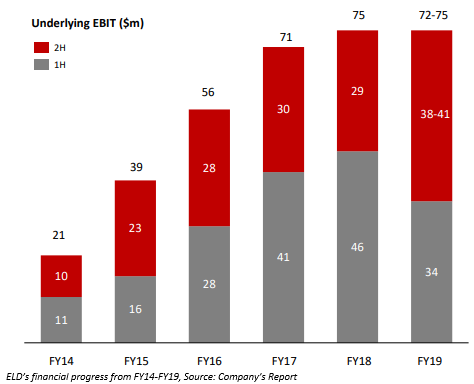

On the other hand, on 20 May 2019, ELD declared half-year report closed 31 March 2019. On the outlook front, for the FY 19 period, the company mentioned that it expects the Underlying EBIT to be in the range of $72 to $75 million and Underlying NPAT to be in the range of $61 to $64 million.

On 20 September 2019, ELDâs stock was trading at $6.49, down by 0.916 percent (at AEST 2:57 PM). The company has a market cap of $927.81 million, with ~141.65 million shares outstanding. For the last 3 months period, the stock has delivered a return of 4.60 percent.

Tassal Group Limited

Closed raising of funds through Share Purchase Plan:

Tassal Group Limited (ASX: TGR) from consumer staples sector notified the market on 19 September 2019 that it had closed raising of funds through Share Purchase Plan (SPP). The company has raised approximately $17.4 million through SPP. The company as per the plan will now issue approximately 4.18 million of new common shares at a price of $4.16 per share. The company will allot these new shares on 23 September 2019, which has been planned to start trading on 24 September 2019.

These new shares will be less than $4.31 as the shareholders of these shares will not receive the FY19 final dividend of 9 cents per share.

Moreover, the company has earlier raised circa $108 million through institutional placement of shares. The company has been raising funds for funding its accelerated prawn growth strategy. According to which, TGR intends to expand at Proserpine, new capacity for hatchery and domestication program, increase the facility for processing and implementing Smart Farm initiatives for all farms. Through this expansion, the company will be able to produce prawn of circa 6,000 tonnes per annum by FY22. Further, it will help in acquiring Exmoor Station in North Queensland, which will help to produce prawn of circa 20,000 tonnes per annum in the long term.

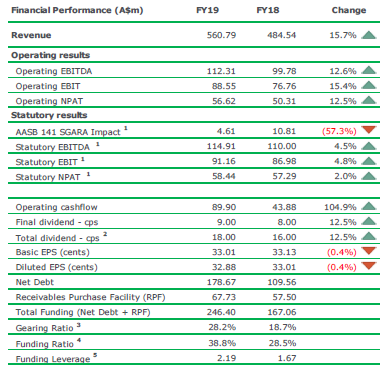

FY 19 Financial Performance (Source: Companyâs Report)

On 20 September 2019, TGRâs stock was trading at $4.22, down by 0.706 percent (at AEST 3:10 PM). The company has a market cap of $863.54 million, with ~203.19 million shares outstanding. For the last 3 months period, the stock has delivered a negative return of 15.67 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.