AUSTRAC, the financial intelligence agency of Australia, has raised alarms for money remitters, pubs, clubs and fintech companies to increase the security in their technology systems with the intention of helping them in protecting organised crime.

Last week AUSTRAC ordered PayPal to investigate issues with its international transaction reporting. Nicole Rose, the chief executive of AUSTRAC, has cautioned the companies involved in gambling and other money-handling industries to prevent money laundering, as they could be targeted if they evade from their responsibilities.

Letâs have a look at three fintech companies in Australia that have delivered good returns in the last one year.

Zip Co Limited

About the Company: Zip Co Limited (ASX: Z1P) is one of the top players in the payment industry and digital retail finance. It offers point-of-sale credit and digital payment services. The market capitalisation of the company stood at $1.69 billion as on 2 October 2019.

Extraordinary General Meeting: The company announced that an Extraordinary General Meeting would be held on 30 October 2019, wherein shareholders would be asked to consider the following Ordinary Resolutions:

- Resolution 1- Approval to issue shares to the PartPay shareholders under the PartPay acquisition;

- Resolution 2- Ratification of the prior issue of shares under the placement;

- Resolution 3- Ratification of the prior issue of shares to Westpac Banking Corporation Limited in connection with the placement.

Acquisition of New Zealand and Australian Businesses: Z1P recently announced that it has entered into an agreement to obtain the New Zealand and Australian businesses (Spotcap ANZ) of global SME lending provider Spotcap Global, which will provide its important capability in the SME credit space.

By acquiring Spotcap ANZ, Zip would have a proven and market-leading underwriting capability with 4 years of credit portfolio performance data and deep learnings that will be extracted from commercial bankâs transactional data.

Zip completes debt funding deal: Zip has priced its first issuance from the Zip Master Trust. The deal, which was arranged by NAB, was oversubscribed and was closed at $500 million (earlier mandate being $400 million)

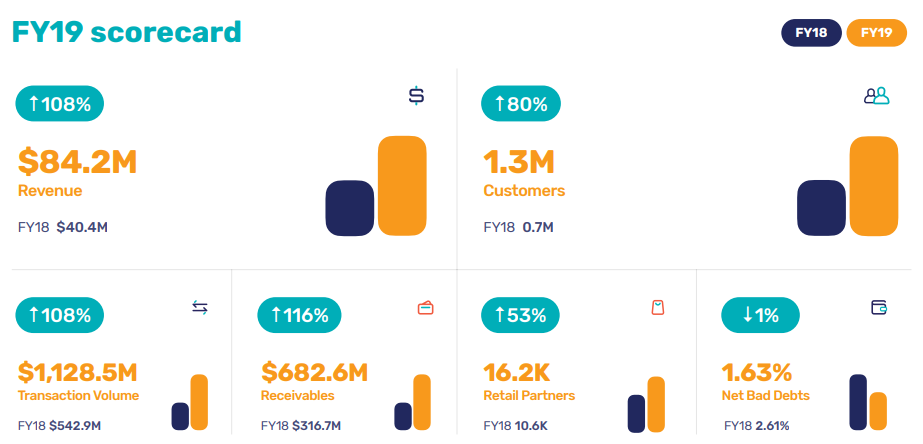

FY19 Financial Highlights: The company reported a revenue of $84.2 million, up by 138% from FY18, reflecting growth across all important segments. Transaction volumes increased by 108% to $1,128.5 million. During FY19, the company saw significant growth in all the segments as compared to the previous year:

- Customer number increased to 1.3 million, up by 80%;

- Partner number increased to over 16,000, up by 54%;

- Transaction volumes increased to $1,128.5 million, up by 108%;

- The number of transactions processed increased to 4.8 million, up by 154%.

Stock Performance: On 2 October 2019 (AEST 12:36 PM), the Z1P stock was trading at $4.720, down by 1.871% from the prior close. In the last one year, the stock has generated a total return of 284.50%.

EML Payments Limited

About the Company: EML Payments Limited (ASX: EML) provides ground-breaking financial technology, which delivers solutions for incentives and rewards, gifts, pay-outs, and supplier payments. It also issues virtual, mobile, and physical card solutions to some of the largest corporate brands across the globe. The market capitalisation of the company stood at $1.1 billion as on 2 October 2019.

Summary of FY19 Results:

- The company reported an underlying EBITDA of $29.1 million, up by 40%, which included the acquisition costs of $0.6 million;

- Results were above the expectations on both the revenue and EBITDA front, with revenue growth across all the segments;

- Underlying cash conversion to EBITDA ratio stood at 75.6%, which included one-time cash inflow of $7.1 million;

- The company successfully acquired and integrated PerfectCard DAC, transitioning to self-issuance in Europe utilising Irish e-money licence;

- The company also acquired Flex-e-Card group, thus making it a global leader in the shopping mall segment servicing over 900 malls.

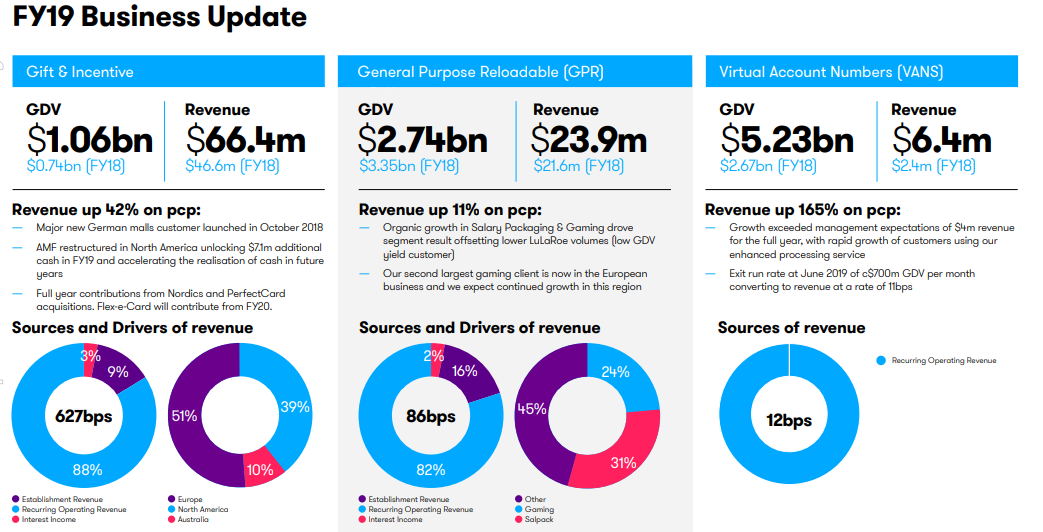

Segmental Performance of the Company:

- Gift and Incentives: The Gift & Incentives segment reported a Gross Debit Volume (GDV) growth of 42% to $1.06 billion, driven by stable trading conditions in North American malls, rapid growth in Europe from newly launched malls and the acquisitions of Nordics and Irish businesses;

- General Purpose Reloadable: The General Purpose Reloadable segment reported a Gross Debit Volume (GDV) decline of 18% to $2.74 billion due to a decline in volumes from a single program in North America;

- Virtual Account Numbers (VANS): The VANS segment reported a Gross Debit Volume (GDV) growth of 96% to $5.23 billion, driven by a combination of organic growth in existing customers and the launch of programs that were previously announced but not yet in the market.

Stock Performance: On 2 October 2019 (AEST 12:39 PM), the EML stock was trading at $4.285, down 0.117% from its previous close, and in the last one year, the stock has generated a return of 164.81%.

Afterpay Touch Group Limited

About the Company: Afterpay Touch Group Limited (ASX:APT) is a tech-driven payment company with global customers. Afterpay has over 35,300 active retail merchants and more than 5.2 million active customers on board. The market capitalisation of the company stood at $8.92 billion as on 2 October 2019.

Highlights for FY19:

- In FY19, total global underlying sales increased 140% to $5.2 billion and the run rate was in excess of $7.2 billion;

- Active customers of 4.6 million at end of FY19, up 130% (Moreover, APT was on-boarding over 12,500 new customers per day);

- Over 200,000 UK customers on-boarded in the first 15 weeks, higher than the US at the same time post-launch;

- Strategic partnership with VISA to support future expansion and platform innovation in the US;

- US and UK growth exceeding expectations - major new merchant brands continue to on-board;

- US underlying sales of nearly $1 billion in FY19 and run rate in excess of $1.7 billion.

Capital Management: The company successfully raised $317 million in late FY19 through equity and established US$300 million dedicated US receivables warehouse facility which has solidified Afterpayâs balance sheet to scale and compete globally. The warehouse facilities of the company ($947 million) were fully undrawn and provide capacity to meaningfully scale underlying sales and improve ROE.

Stock Performance: On 2 October 2019 (AEST 12:42 PM), the APT stock was trading at $35.750, up by 1.303% from the prior close. In the last one year, the stock has given a total return of 102.98%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.