Funds under management (FUM) or assets under management (AUM) refers to the complete market value of investments that a financial services company manages on behalf of its clients and themselves. Venture capital firms, mutual funds, hedge funds, money management firms, portfolio managers and other financial service companies operate as the fund managers.

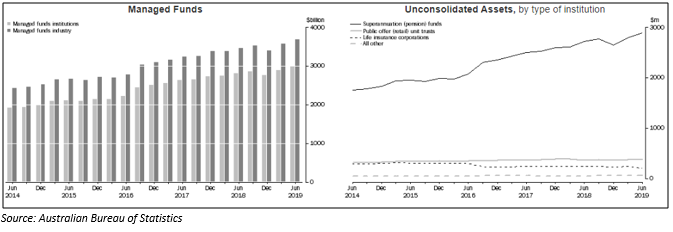

In Australia, FUM by the managed funds industry (including managed funds institutions and investment or fund managers) stood at $ 3,680.6 billion at the end of June 2019, according to data from the Australian Bureau of Statistics. The figure represents a quarter-on-quarter increase of 3.0% from $ 3,573.5 billion in FUM at the end of the March 2019 quarter.

Below discussed are three financial sector players, which are into providing services related to asset management.

Platinum Asset Management Limited

Founded in 1994, Platinum Asset Management Limited (ASX:PTM) is an investment management company, which is focused on one asset class, namely global equities.

On-Market Share Buy-Back

On 17 September 2019, the company updated the market regarding its plans to extend its on-market share buy-back, which would be funded from its existing cash flows. As per the plan, the share buy-back would extend up to 10% of the companyâs issued share capital for a maximum period of one year.

Meanwhile, Platinum Asset Management has appointed Credit Suisse Equities (Australia) Limited to serve as its broker.

FY19 Report

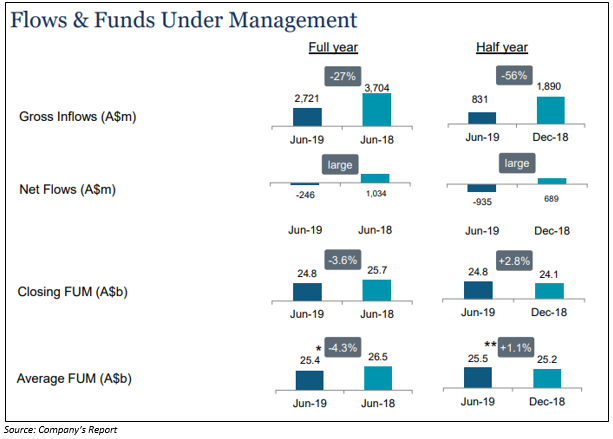

The 12-month period ended 30 June 2019 was a challenging year for the company. Investment returns for most of its managed funds and portfolios lagged the returns in the broader market during the reported year.

Funds under management (FUM) posted a decline of 4% year-on-year to ~$ 24.8 billion in FY19. The company attributed the fall in FUM to $ 0.2 billion in net fund outflows and $ 0.9 billion in year-end net cash distribution and other capital outflows.

Additionally, total revenue and other income of the company stood at $ 299.3 million in FY2019, down 15% year-on-year from $ 353.3 million in the same period a year ago. Platinum Asset Management attributed the fall in revenue to a $ 22 million decline in investment performance fees received during the year. Additionally, a decline of $ 21 million in gains from Platinumâs seed investments contributed to the fall in FY2019 revenue.

During the year, PTM reported a 17% decline in profit after tax to $ 157.7 million, while earnings per share stood at 27 cents per share.

Meanwhile, the board announced a final fully franked ordinary dividend of 14 cents per share, which is scheduled for payment on 20 September 2019. The total dividend for the year stood at 27 cents per share (CPS).

Stock Performance

With a market cap of $ 2.37 billion and approx. 586.68 million outstanding shares, the stock of PTM was trading at a price of $ 4.025 on 18 September 2019 (AEST 01:04 PM), down 0.371% from its previous closing price. The stock has provided negative returns of 11.01% and 26.28% in the past three months and six months, respectively. Platinum Asset Management has an annual dividend yield of 6.68%.

Netwealth Group Limited

With an account holder base of more than 60k, Netwealth Group Limited (ASX: NWL) is a wealth management business, based in Australia. The company, established in 1999, provides financial services including investor directed portfolio and self-managed superannuation administration services. Additionally, the company offers a superannuation master fund, separately managed accounts and managed funds.

Directorsâ Interest Change/Addition in S&P/ASX 200 Index

Recently, Netwealth Group unveiled change in the interest holding of its directors â Mathew Alexander Max Heine, Jane Anne Tongs, Davyd Charles Lewis and Michael Max Heine. Also, in the September 2019 Quarterly Rebalance of the S&P/ASX Indices, S&P Dow Jones Indices added Netwealth Group Limited to S&P/ASX 200 Index, effective at the open on 23 September 2019.

FY19 Report

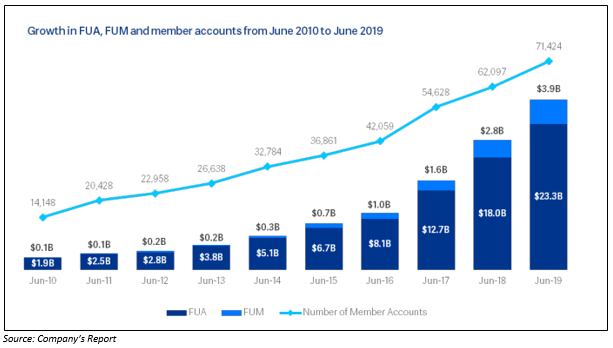

FY2019 was an excellent year for the company, as its funds under administration registered an increase of 29.9% year-on-year to $ 23.3 billion and funds under management went up by 38.7% to $ 3.9 billion. Meanwhile, underlying net profit after tax grew by 23.9% to $ 36.0 million. The company attributed its success during the financial year 2019 to continued investment in market leading technology, including IT infrastructure, IT security, compliance and platform functionality coupled with focus on offering best-in-class service to clients.

During the reported year (FY19), the company posted

- Revenue of $ 98.9 million, reflecting an increase of 18.6% on previous corresponding period

- EBITDA of $ 52 million, up 22.9% from the same period a year ago

- EBITDA margin of 52.6%, compared with 50.8% in FY2018

- Operating net cash flow pre tax of 49.5 million

- Earnings per share of 14.8 cents, up 24.4% year-on-year

Total dividend for the year stood at 12.1 cents per share (CPS), including an interim dividend of 5.5 cents per share and a final dividend of 6.6 cents per share (fully franked, scheduled for payment on 26 September 2019).

Stock Performance

With a market cap of $ 2.05 billion and approx. 237.68 million outstanding shares, the stock of NWL was trading at a price of $ 8.920 on 18 September 2019 (AEST 01:06 PM), up 3.241% from its previous closing price. The stock has provided mixed returns of -3.79% and 6.80% in the past three months and six months, respectively.

Pinnacle Investment Management Group Limited

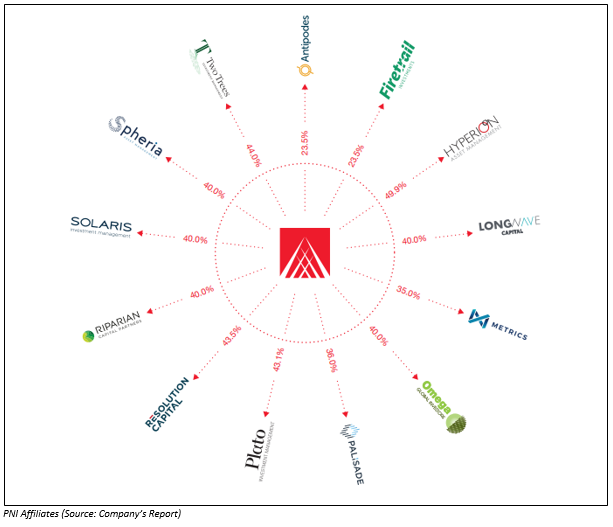

Multi-affiliate investment management firm, Pinnacle Investment Management Group Limited (ASX: PNI) is engaged in the development and operation of investment management businesses. Additionally, the company offers distribution services, business support and responsible entity services to its 13 investment affiliates.

PNI is scheduled to hold its annual general meeting on 31 October 2019.

Investor Presentation

Recently on 17 September 2019, the company released its investor presentation, discussing several business aspects including financial and business highlights for FY19, business focus, distribution update and outlook.

FY19 Financial/Business Highlights

- Revenue for Pinnacle affiliates increased by 40.6% to $ 236.8 million

- Net profit after tax from continuing operations grew by 32% year-on-year to $ 30.5 million

- Funds under management increased by 42.9% to $ 54.3 billion

- Strong and flexible balance sheet with $ 51.2 million in cash and principal investments at the end of the year

- Earnings per share from continuing operations reported at 18.3 cents per share in FY19, up from 14.3 cents per share in the same period a year ago

The board also declared a final dividend of 9.3 cents per share (fully franked), scheduled for payment on 4 October 2019. Total dividend for the year stood at 15.4 cents per share (CPS).

FY20 Outlook

During the next financial year, Pinnacle Investment Management Group plans to continue to deliver growth within existing affiliates and assess high quality new affiliate opportunities. Moreover, the company would maintain current investment levels to achieve medium term growth.

Stock Performance

With a market cap of $ 821.16 million and approx. 182.89 million outstanding shares, the stock of PNI was trading at a price of $ 4.590 on 18 September 2019 (AEST 01:07 PM), up 2.227% from its previous closing price. The stock has provided negative returns of 13.49% and 23.64% in the past three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.