Australia is known to have one of the worldâs best health system, which provides quality, safe and reasonable healthcare to individuals. This is the reason which places Australia among the countries with the longest life expectancies in the world.

The Australian healthcare system is aided by central, state, territory as well as local governments. Medicare services are made available to the citizens of Australia as well as New Zealand. Under Medicare facilities, all the cost of public hospital services is included. It comprises of services catered by general practitioners, essential dental services for children along with services from community nurses.

In this piece of article, we would be discussing three companies belonging to the agriculture technology sector, healthcare sector and consumer discretionary sector; however, directly or indirectly, all these companies are addressing the healthcare sector. Let us have a look at these companiesâ overview, recent updates and stock performances on the Australian Securities Exchange.

CropLogic Limited

Company Overview:

CropLogic Limited (ASX:CLI) is an award-winning global agricultural technology company, which provides solutions related to the management of soil moisture. Its software and hardware package, CropLogic realTime, is designed in such a manner that it can help in optimising the yields through a single click. The solution enables combining on-the-ground expertise and actionable in-field intelligence, thereby optimising the yields.

Awards:

Supply Agreement with Deschutes Labs:

On 6 August 2019, CropLogic Limited updated the market regarding a supply agreement with Deschutes Labs, which is a new industrial hemp processing facility in Central Oregon, United States. With the first phase processing capacity of more than 10,000 lbs in a single day, the facility is scheduled to start its operations in September. Moreover, the facility would be certified for food grade extracts manufacturing. Additionally, it would be designed and operated as per the standards of GMP and ISO 9000.

The supply agreement is a proof of CropLogicâs expertise in agronomy, farm management and agriculture technology, which it can apply to industrial hemp. Further, the agreement, which positions CropLogic as a viable manufacturer, also supports in building credibility amid hemp farmers being targeted by the company.

As per the supply agreement, the wholly owned subsidiary of CLI, Logical Cropping LLC, would deliver biomass in weekly allotments starting from 20 October 2019. For each delivery, payment would be made in USD. The total supply agreement value is A$ 15.4 million or USD 10.5 million. In case of force majeure, insolvency or material breach, the agreement would be terminated.

Apart from the supply agreement, the company also updated about its Hemp Trial farm review. The company planted CBD producing hemp biomass in 500 acres of land. It also initiated a joint venture program to grow further premium trimmed flower hemp in 16.6 acres of land, highlighting the companyâs skill set, which also includes its leading product CropLogic realTime.

Stock Information: In the previous six months, the shares of CropLogic Limited have provided an excellent return of 600%. The opening price of the shares of CLI was A$ 0.084 on 7 August 2019, while at AEST 12:25 PM, the stock was trading at A$ 0.080, down 4.762% from its previous closing price. CropLogic Limited has a market cap of A$ 31.88 million and approximately 379.57 million outstanding shares.

Phylogica Limited

Company Overview: Phylogica Limited (ASX:PYC) is a biotechnology company, which focuses on the commercialisation of its intracellular drug delivery platform. Moreover, the company is focused on the screening of its peptide libraries to recognise drug cargoes for development against multiple disease targets.

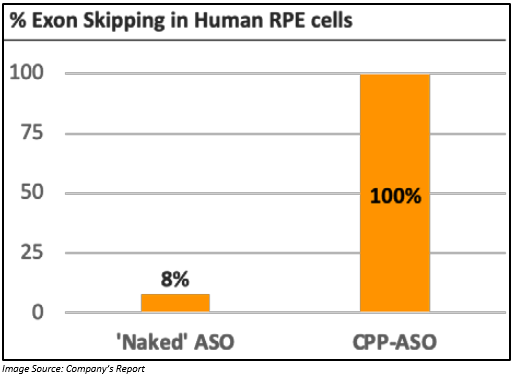

First Assessment of Cell Penetrating Peptide: On 6 August 2019, Phylogica Limited announced that it had completed the first assessment of its Cell Penetrating Peptide delivery technology in human cells. The Cell Penetrating Peptides are now capable of delivering an Anti-Sense Oligonucleotide (ASO) into human cells. The experiments are part of the companyâs flagship development program, under which it is testing its Cell Penetrating Peptides in the cell type of interest for the development of treatments for blinding eye diseases. The cells, known as Retinal Pigment Epithelial or RPE cells, are a high value target cell in drug development.

The result compared exon skipping, which is used to measure efficiency, obtained by an ASO âwithâ and âwithoutâ the application of Cell Penetrating Peptide (CPP). The results showed that ASO alone achieved 8% exon-skipping. On the other hand, CPP-ASO achieved 100% exon-skipping on the cells.

PYC now plans to focus on delivering 3D retinal organoids, which is the final pre-clinical technical milestone, during Q419, prior to beginning Investigational New Drug enabling studies for facilitating its technologyâs clinical assessment.

Stock Information: In the previous six months, PYCâs shares have provided a return of 20%. The opening price of the shares of PYC was A$ 0.040 on 7 August 2019, while at AEST 12:40 PM, the PYC stock was trading at A$ 0.037, up 2.778% from its previous closing price. The company has a market cap of A$ 87.94 million and approximately 2.44 billion outstanding shares.

BOD Australia Limited

Company Overview: Bod Australia Limited (ASX: BDA) is a developer, distributor as well as marketer of health products and supplements. The company focuses on extracts from plants including medicinal cannabis.

Capital Raising: On 6 August 2019, Bod Australia Limited announced that it had raised $ 1.2 million by exercising 4.5 million options, which were held by the board and the management of the company. As a result of the exercising of options, there was a net increase of 2.6 million shares in the number of shares held by these board and management team members. The management of the company had sold 1.9 million Bod Australia shares in the company to new and high-quality institutions in Australia as well as HNI investors.

After exercising the options, there was an increase in the holdings of Chief Executive Officer Jo Patterson and Chief Operating Officer Craig Weller by 750,000 shares each. On the other hand, 550,000 shares were added to the kitty of Non-Executive Director Simon OâLoughlin and Non-Executive Director Simon Taylor. All the new shares, along with the existing shares that were held by the board and management, are subject to an escrow period of 12 months.

Cash at bank of Bod Australia Limited stands at more than $ 11 million, which will be used for the growth opportunities.

UK Market Entry: As per an announcement made by the company on 29 July 2019, Bod Australia Limited entered into a Heads of Agreement with medicine manufacturer PCCA Ltd to import as well as distribute the formerâs MediCabilisâ¢, a pharmaceutical grade medicinal cannabis, across the United Kingdom.

PCCA is an MHRA licensed medicines manufacturer from the United Kingdom. PCCA also holds multiple licenses which would ensure that the products of Bod Australia Limited can be imported and distributed across the area with no regulatory issues.

Source: Companyâs Report

Stock Information: In the previous six months, the shares of BDA have provided investors with a return of 10.75%. The opening price of the BDAâs share was A$ 0.545 on 7 August 2019, while at AEST 12:53 PM, the stock was trading at A$ 0.550, up 6.796% as compared to its previous closing price. BDA has a market cap of A$ 43.39 million and approximately 84.25 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.