2020 began on a terrific note for which is probably the world’s best and highest-selling pure electric vehicles company- Tesla, Inc. Record production, record deliveries, and a China expansion was being celebrated by Tesla clients, employees, suppliers, shareholders and supporters just in time when the Company broke another record- this time at the share market.

Tesla Stock Closes at an All-time High of over $500

Oppenheimer’s Colin Rusch had opined that the Company has reached a critical scale that suffices sustainable positive free cash flow. Consequently, he had confidently raised his stock price target by almost 60% to over $600. What followed next will be a memorable moment in Tesla’s history on the NASDAQ.

On 13 January 2020, the Tesla stock surged up by 2.3 per cent in premarket trading. It continued to rise by approximately 10 per cent before finally settling at an all-time high of just a little over USD 524 per share. Interestingly, the stock has more than doubled over the past three months.

An icing on the cake, Tesla’s current (as on 13 January 2020) market capitalisation of USD 94.60 billion is more than that of General Motors Company (USD 49.98 billion) and Ford Motor Company (USD 36.76 billion) combined (USD 85 billion).

So, what is propelling this upswing? The entrance into China (which perhaps is the largest marketplace for medium-sized premium sedans) and solid year-end delivery numbers. Let’s dig deep into-

Tesla’s Entrance into China

After spending the new year at a car-assembly plant in Fremont, California, Elon Musk celebrated the delivery of the first Model 3 sedans to public customers in China. The sale of Model 3s locally in China help Tesla duck transport costs and import taxes and is a great chance for Tesla to boost its sales in 2020.

Not only is China the largest market for mid-sized premium sedans, it is also the biggest marketplace for the revolutionary electric vehicles. A technological hub and always open for business, China is a very strategic choice for Tesla.

Tesla recently launched the Gigafactory facility in Shanghai. Despite breaking ground less than 12 months ago, it has been successful in producing just under 1,000 customer salable cars and begun deliveries as well. Moreover, production run-rate capability exceeding 3,000 units per week has been demonstrated (excluding local battery pack production).

A recent and incremental positive news for Tesla has been China’s decision to not make any substantial cuts in subsidies for new-energy vehicles in July 2020, the time when it usually cuts renewable energy subsidies which causes a drop in vehicle sales. This is believed to be a huge move to bring stability to the market and ensure the industry's sustained development.

Tesla’s Strong Year-end Delivery Numbers

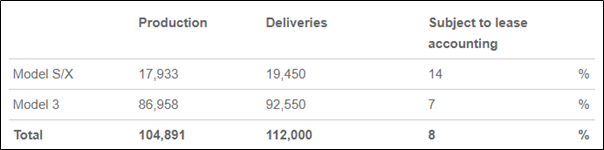

After facing a rough tide in the beginning in 2019 with a loss of over $700 million in the first quarter, the Company has come a long (and positive) way. In the fourth quarter of FY19, Tesla achieved record production and record deliveries. Its results were very much in line with the full year guidance-

- Record production of almost 105,000 vehicles

- Record deliveries of almost 112,000 vehicles

- In 2019, the Company delivered ~367,500 vehicles, 50% more than 2018

Tesla’s Fourth Quarter Production and Deliveries (Source: Tesla’s Report)

The much-anticipated Model 3 helped Tesla hit another record year for deliveries. Consequently, the Company is believed to having sold more cars in 2019 that 2017 and 2018 combined. In 2020, car fanatics are awaiting two more launched scheduled for this year- Model Y compact CUV and Model Y compact SUV.

Recently, The Tesla Model Y received its California Air Resources Board (CARB) certification ahead of the launch, indicating the potential range and imminent deliveries.

What do the Experts Say?

With a turn-around of events for Tesla last year, the market consensus seems rather positive about Tesla’s growth trajectory in 2020. Experts believe that the Company has the capability to be a transformational tech-company and provide enormous returns. Others have been regarding the stock to be a must-own after its record break stance.

However, business is a dynamic world and not everything is under one single company’s or country’s control.

Some experts preach that even though the fourth quarter numbers have been promising, it is still one of the very few profitability periods that the Company has registered in almost over a decade (since it being a publicly traded Company). Consistency will be a factor that the market will keep an eye on for Tesla through the year.

Tesla’s Stock Performance

After the close of the market on 13 January 2020, NASDAQ: TSLA settled the day at USD 524.86, up by 9.77 per cent or USD 46.71 relative to its last close. In the last three months, the stock has delivered returns of 111.73 per cent and in the past month, the returns have been a promising 46.45 per cent.

However, by the end of the trading session on NASDAQ (as on 15 January 2020), TSLA was at a price of USD518.50, slipping by 3.61 percent from its previous close.

The Company is due to announce its financial performance in the Q4 earnings. With Tesla’s proficient risk tolerance, implementation of learnings from past errors, surmountable ambitions, relief from subsidies and a seemingly good year ahead, Elon Musk seems to be a very happy man!

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.