In the last one year, the benchmark index S&P/ASX 200 has given a return of over 8%. Below we have discussed seven stocks that have given excellent returns in the past one year.

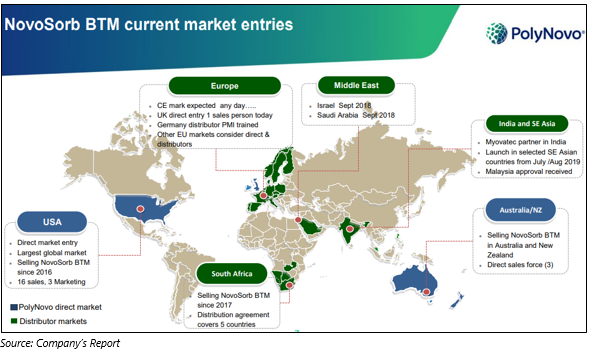

PolyNovo Limited

About the Company: PolyNovo Limited (ASX: PNV) is into the business of developing and commercialising ground-breaking medical devices using its NovoSorb technology for the treatment of burns, surgical wounds and Negative Pressure Wound Therapy. The market capitalisation of the company is $1.43 billion, as on 18 September 2019.

Appointment of Senior Vice President: PolyNovo recently announced the appointment of Mr Ed Graubart as Senior Vice President of PolyNovo North America LLC. Mr Graubart would be monitoring all sales and marketing operations in the US business. He has 29 years of experience in the orthopaedic medical industry. The new appointment is expected to aid PolyNovo to rapidly scale up its American sales and marketing.

Update on Thickness Burn Study: On 5 September 2019, PolyNovo met the US FDA for its full thickness burn study. The agency confirmed that NovoSorb BTM has the potential for this burn population. Also, the FDA gave guidance on what the agency would like to see as the primary goal for the trial. The companyâs clinical team is studying the protocol design to incorporate FDA input and is expecting to make the submission to the FDA in December 2019. These revised timelines mean that patient enrolment is due for Q4 FY20.

Plan for FY20: PNV is planning for a significant expansion of sales of BTM (Biodegradable Temporising Matrix) in the US, Australia and New Zealand. New products are there in the pipeline for breast and hernia. Also, the company is boosting its production capacity commission hernia manufacturing. Moreover, it has bought adjacent building for hernia and breast device manufacturing.

Stock Performance: On 18 September 2019 (AEST 03:09 PM), the PNV stock was trading at $2.260, up 4.147% from the prior close. In the last one year, the stock has given a return of 298.17%. The stock is near its all-time high of $2.360.

Jumbo Interactive Limited

About the Company: Jumbo Interactive Limited (ASX: JIN) is a lottery retailer that offers services via the internet and mobile devices in Australia and eligible overseas jurisdictions.

On 6 September 2019, S&P Dow Jones Indices announced to have added Jumbo Interactive Limited in S&P/ASX 200 Index, effective at the Open on September 23, 2019. In late August 2019, JIN issued additional 250,000 fully paid ordinary shares following exercise of options.

Appointment of Professor Sharon Christensen: JIN has appointed Professor Sharon Christensen to the Board as a non-executive director. Professor has an experience of 29 years in legal and regulatory departments and is also a research leader in regulatory responses to digital innovation and disruption.

Performance in FY19: The companyâs revenue increased by 64% which led to an increase of 125% in NPAT to $26.4 million. The number of new accounts increased by more than double to 444,004 and active customers rose 74% to 761,863. The company has a strong cash position with general funds up by 84% to $74 million. The total net assets of the company stood at $77 million with zero debt.

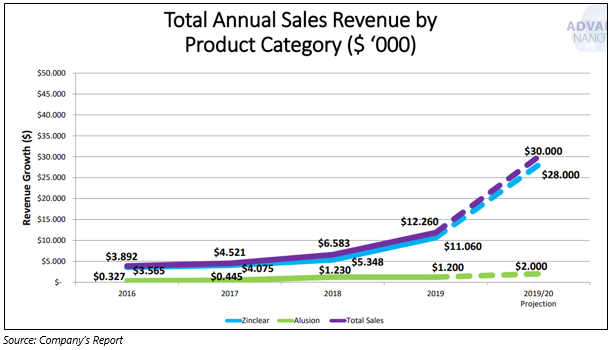

Source: Companyâs Report

Source: Companyâs Report

Stock Performance: On 18 September 2019 (AEST 03:10 PM), the JIN stock was trading at $22.980, down by 0.087% from the prior close. In the last one year, the stock has given a return of 221.89%. The stock is near its all-time high of $27.190. The market capitalisation of the company is $1.43 billion.

PPK Group Limited

About the Company: PPK Group Limited (ASX: PPK) is into the business of designing, manufacturing, servicing, supporting and distributing CoalTram and other underground vehicles of coal mining equipment. The company is scheduled to hold its Annual General Meeting on 26 November 2019 in Sydney. The market capitalisation of the company is $263.96 million, as on 18 September 2019.

PPK Acquires AICIC: PPK Group Limited has acquired AIC Investment Corporation Pty Ltd (AICIC). AICIC has a 50% ownership in BNNT Technology Limited, a joint venture company that holds a 20-year licence (exclusive) related to technology developed by Deakin University for the production of Boron Nitride Nanotubes (BNNT).

Dividend: The company has announced a final dividend of $0.01 per share (fully franked). It is the first-time, the company has declared a final dividend since 2014. The company also introduced DRP in early 2019, which was well received by the investors with 75.9% of the interim dividend being reinvested back into PPK shares.

Stock Performance: On 18 September 2019 (AEST 03:10 PM), the PPK stock was trading at $3.490, moving up by 9.062% from the prior close. In the last one year, the stock has given a return of 932.26%. The stock is near its all-time high of $3.700.

Advance NanoTek Limited

About the Company: Advance NanoTek Limited (ASX: ANO) is a developer and manufacturer of advanced material products. The market capitalisation of the company is $286.82 million, as on 18 September 2019.

TGA Licence for Brisbane Facility: ANO has secured appropriate TGA licence for its new production plant in Brisbane, Australia. The company would use the additional capacity to complete orders from the US and Australian clients in the future. Moreover, the capacity addition would enable to company to add to the reserve stock that it already holds for European markets.

Increase of Distribution Network in Europe: The company appointed 2 new distributors in July 2019 that are not material to ANOâs business at present. ANO is currently negotiating with 2 more distributors in the UK/Ireland and Germany. It is also looking to sign a further 4-6 new European distributors by FY20.

Plans for FY20: ANO is trying to introduce new high-speed mixers to improve quality and boost production capacity. It is also working on evolving additional powders and dispersions using other natural ingredients in FY20.

Stock Performance: On 18 September 2019 (AEST 03:11 PM), the ANO stock was trading at $4.710, down 1.875% from the prior close. In the last one year, the stock has given a return of 411.23%. The stock is near its all-time high of $7.850.

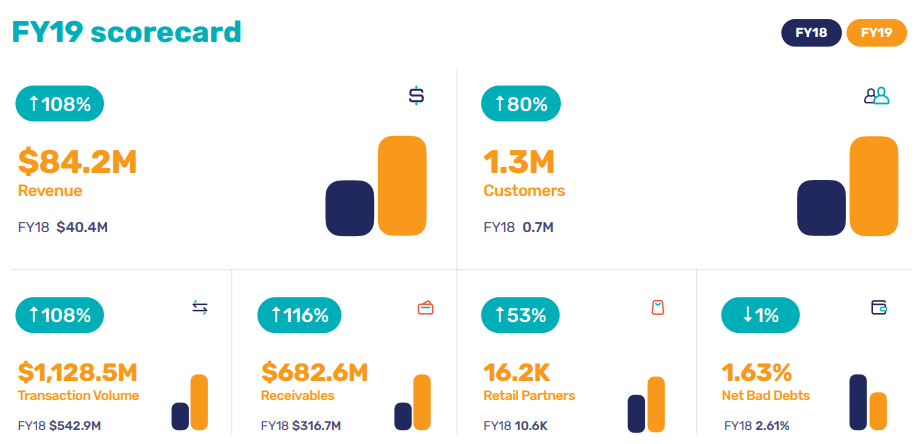

Zip Co Limited

About the Company: Zip Co Limited (ASX: Z1P) is one of the top players in the payment industry and digital retail finance. It offers point-of-sale credit and digital payment services. The market capitalisation of the company is $1.25 billion, as on 18 September 2019.

Acquisition of New Zealand and Australian Businesses: Zip Co Limited, on 6 September 2019, entered into an agreement for the acquisition of the New Zealand and Australian businesses (Spotcap ANZ) of global SME lending provider Spotcap Global. The acquisition would provide significant capability to Z1P in the SME credit space.

By acquiring Spotcap ANZ, Z1P achieves a proven and market leading underwriting capability with 4 years of credit portfolio performance data and deep learnings that would be extracted from commercial bankâs transactional data.

Zip Closes Debt Funding Deal: Zip has priced its first issuance from the Zip Master Trust. The deal, which was arranged by NAB, was oversubscribed and completed at $500 million, whose earlier mandate was $400 million.

FY19 Financial Highlights: The company reported a revenue of $84.2 million for the year ended 30 June 2019, up by 138% from FY18, reflecting growth across all important segments. Transaction volumes increased by 108% to $1,128.5 million. During FY19, the company saw significant growth in all the segments as compared to previous year:

- Customer number surpassed 1.3 million, up by 80%;

- Partner number increased to over 16,000, up by 54%;

- Number of transactions processed reached 4.8 million, up by 154%.

Source: Companyâs Report

Source: Companyâs Report

Stock Performance: On 18 September 2019 (AEST 03:11 PM), the Z1P stock was trading at $3.610, up 1.977% from the prior close. In the last one year, the stock has given a return of 227.78%. The stock is near its all-time high of $4.170.

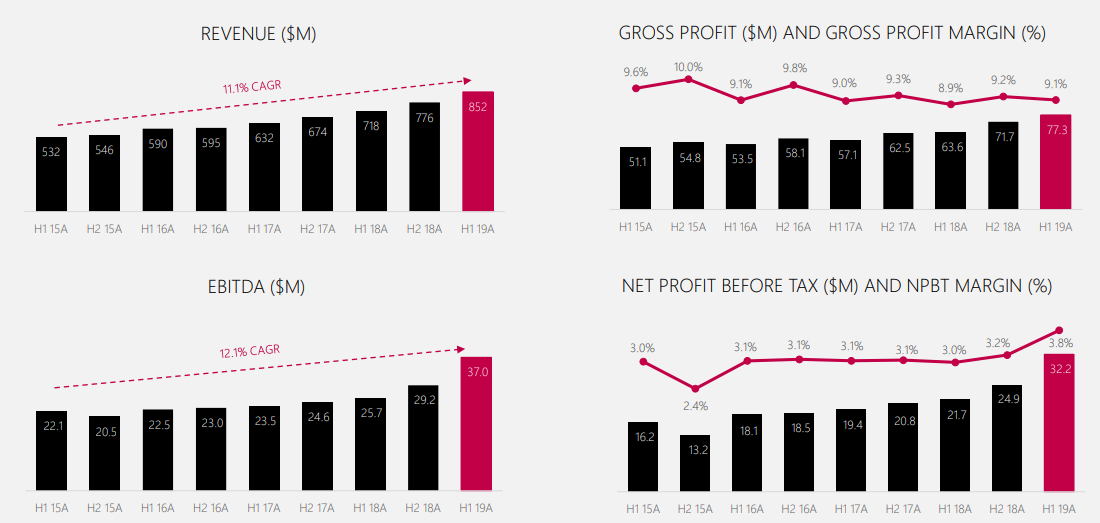

Dicker Data Limited

About the Company: Dicker Data Limited (ASX: DDR) is Australiaâs largest and longest established Australian owned distributor of IT products. The market capitalisation of the company is $1.14 billion, as on 18 September 2019.

Financial Highlights of 1H19: For the period of six months to 30 June 2019, the company reported a revenue growth of 18.7% to $852 million, backed by growth in established vendors and new vendors. The company reported a profit margin of 9.1%, while operating costs as a percentage of sales decreased in the period. Net profit before tax was up by 51.2% to $32.3 million.

Financial Performance Source: Companyâs Presentation

Free Shares to Eligible Employees: Dicker Data, in August 2019, announced that all the eligible employees would be offered $1,000 worth of new fully paid ordinary shares in the company. The offer is made in accordance with the companyâs Bonus Employee Share Plan to approximately 460 eligible employees.

Stock Performance: On 18 September 2019 (AEST 03:11 PM), the DDR stock was trading at $7.235, moving up by 2.77% from the prior close. In the last one year, the stock has given a return of 133.89%. The stock is near its all-time high of $7.850.

Opthea Limited

About the Company: Opthea Limited (ASX: OPT) is a biologics drug developer whose primary focus is on ophthalmic disease therapies. The market capitalisation of the company is $891.75 million, as on 18 September 2019.

OPT Releases Positive Data from OPT-302: The company recently announced positive data from a clinical study with 366 patients for OPT-302 with ranibizumab (Lucentis®) compared to ranibizumab. Data from the Phase 2b multicentre, randomised, double-masked, sham controlled study was presented at the European Society of Retina Specialists EURETINA 2019 Congress in France.

Source: Companyâs Report

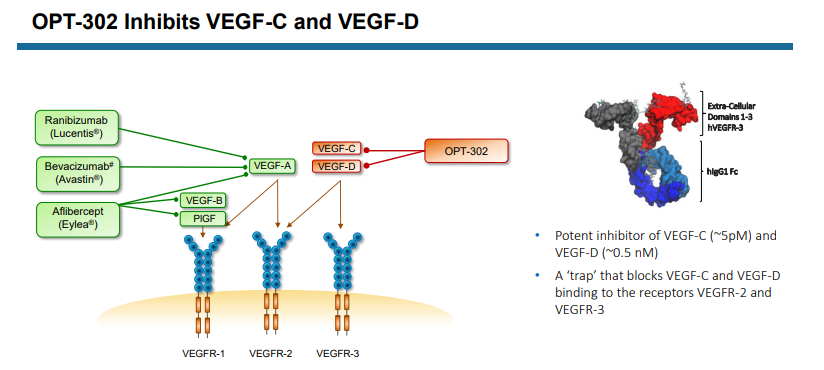

About OPT-302: OPT-302, which is being developed for the treatment of wet age-related macular degeneration, is a soluble form of vascular endothelial growth factor receptor 3 or âTrapâ molecule.

Stock Performance: On 18 September 2019 (AEST 03:12 PM), the OPT stock was trading at $3.840, moving up by 7.563% from the prior close. In the last one year, the stock has given a return of 505.08%. The stock is near its all-time high of $4.150.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.