The two material stocks ANO and DLX have provided lucrative opportunities to the shareholders to earn profits over the past few months. Let us have a closer look at the financial and stock performance of these two companies.

Advance Nanotek Limited (ASX:ANO)

Advance Nanotek Limited (ASX: ANO) is involved in the manufacturing of advanced nanomaterials and nanomaterial products. The company offers metal oxide powders, aluminium oxide pigment and dispersions of zinc oxide for use in the cosmetic and sun-care industry.

The company has recently updated that it has received several new sales orders that showed that the first quarter FY20 volumes will continue to grow at the current rates (compared to 5T of orders received in July / August 2018). These are on top of the backlog of powder sales orders, indicating powder production will be at capacity to August 2019. ANO has placed orders for additional equipment, which will arrive approximately in November 2019, resulting in a further 50% increase in capacity.

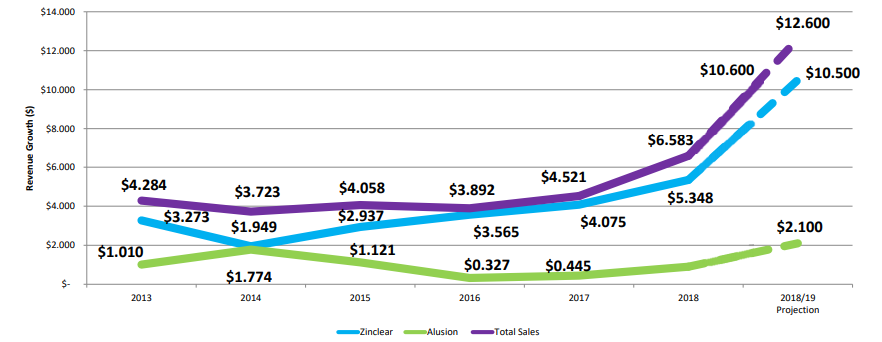

Total Annual Sales Revenue By Product Category (Source: Company Reports)

Total Annual Sales Revenue By Product Category (Source: Company Reports)

The company anticipated a sales increase of over 100% compared to FY18, with an expectation of further sales increase from MERCK in FY20. The increase in the manufacturing capacity of zinc powder is expected to 2,200 tonnes per annum from late 2019, well in excess of current order intake.

On the price-performance front, at market close on May 24, 2019, the stock of Advance Nanotek Limited was trading at $7.020, with a market capitalisation of circa $338.93 million. The stock has yielded a substantial YTD return of 501.03% and exhibited returns of 559.22%, 226.61% and 41.16% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $7.270 and 52-week low price at $0.470, with an average trading volume of ~93,543.

DuluxGroup Limited (ASX:DLX)

DuluxGroup Limited (ASX: DLX) is primarily involved in manufacturing, marketing, selling and distribution of paints, adhesives, coatings and garden care and other building products in Australia, New Zealand, Papua New Guinea and various other countries.

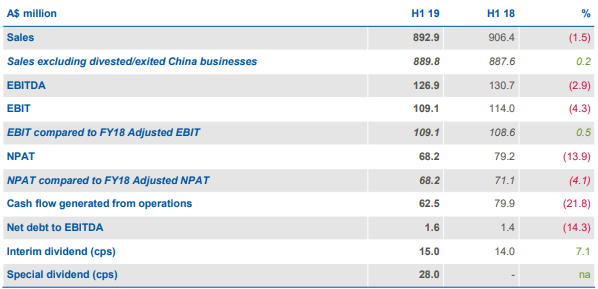

Half Yearly Results Summary (Source: Company Reports)

The H1 FY19 results of the company remained in line with the guidance that revenue and EBIT growth would be biased to H2 sales. The revenue and EBIT remained flat, excluding prior yearâs favourable one-offs. The market volume declined 4% in core decorative paint business, which reflected an unusually strong 5% market growth in the prior period. The volume growth rate for the market over the two years was ~1%. DLX saw good revenue growth in the second quarter, an increase of 4%, which continued into April. The company maintained generally good margin and cost management, despite expected raw material pressures, which are currently moderating. The cash flow was impacted by weaker Q1 revenue, which adversely affected both inventory and creditors.

On the price-performance front, at market close on May 24, 2019, the stock of DuluxGroup Limited was trading at $9.720, with a market capitalisation of $3.79 billion. The stock has yielded a YTD return of 50.62% and exhibited returns of 42.25% and 31.13% over the past six months and three months, respectively. Its 52-week high price stands at $9.870, and 52-week low stands at $6.310, with an average trading volume of ~2,089,845.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.