One of the sectors with high competition as well as the potential for growth is the retail sector. The performance of the retail stocks clearly reflects upon the heat faced by the companies and the competitive edge that the retail companies carry.

With the fusion of technology and increased dependence on logistics, the retail sector has evolved significantly over the past decade.

According to latest ABS stats, Australiaâs turnover in retail sector rose 0.2% in September against 0.4% in August. As per economists, the fiscal reforms and rate cuts paved way to enhanced savings, probably for the discount and festive season of December.

The holiday season is almost here, and investors are looking up to the market in search of retail stocks to consider for investment.

Before you choose to invest in retail stocks, you might consider taking a drone view at performance of two indices concerning consumer retailing, namely, S&P/ASX 200 Consumer Discretionary and S&P/ASX 200 Consumer Staples, along with some of the related stocks on ASX.

To begin with, let us take a look at the

During the last year, the S&P/ASX 200 Consumer Discretionary index has generated a YTD return of ~27.38 %.

Similarly, S&P/ASX 200 Consumer Staples index has recorded a YTD return of ~24 %.

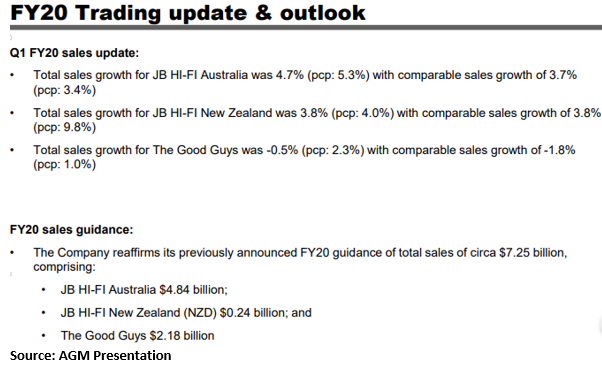

JB Hi-Fi Limited (ASX: JBH)

Established in 1974, JB Hi-Fi Limited offers the leading global brands of Computers, Tablets, TVs, Cameras, Hi-Fi, Speakers, Car Sound and several consumer products, and has a diversified focus into two leading retail brands:

- JB HI-FI, with a focus on Technology and Consumer Electronics; and

- The Good Guys, with a focus on Home Appliances and Consumer Electronics.

The JBH stock closed the dayâs trade at a price of $37.210 on 12 December 2019, close to its 52-weeks high price of $ 38.500. Over a period of last one year, starting from $21.800 on 11 December 2018 to $ 37.310 on 11 December 2019, the JBH stock price has increased by 71.15 %.

During the past five days of trading, the stock was noted trading at the highest price of $38.80 on 6 December 2019. The stock is trading with an Annual Dividend Yield of 3.81%.

Super Retail Group (ASX: SUL)

Founded in 1970s with the development of a number of individual family-owned businesses, Super Retail Group provides solutions and engaging experiences that empower the customers to make the most of their spare time.

The SUL stock closed the dayâs trade at a price of $9.865 on 12 December 2019, down by 0.85%, although closer to its 52-weeks high price of $ 10.430 with a market capitalisation of $ 1.97 billion.

Over a period of last one year, starting from $7.040 on 11 December 2018 to $ 9.950 on 11 December 2019, the SUL stock price has increased by 41.34 %.

During the last month of trading, the stock was noted trading at the highest price of $10.270 on 26 November 2019.

The SUL stock is trading with an Annual Dividend Yield of 5.03%.

Accent Group Limited (ASX: AX1)

Formerly known as RCG Corporation Limited, the Accent Group Limited is an emerging player in the retail and distribution industry of lifestyle and performance footwear, with more than 420 stores.

The AX1 stock closed the dayâs trade at a price of $ 1.650 on 12 December 2019, trading close to its 52-weeks high price of $1.765 with a market capitalisation of $ 900 million.

On a year to date basis, the AX1 stock price has increased by 39.50%.

During the last month of trading, the stock was noted trading at the highest price of $1.705 on 29 November 2019.

The AX1 stock is trading with an Annual Dividend Yield of 4.97%.

Wesfarmers Limited (ASX: WES)

Formed in 1914 as a Western Australian farmers' cooperative, Wesfarmers has evolved into one of the AUâs largest listed companies through its diverse business operations covering chemicals and fertilisers, home improvement and office supplies, gas processing and distribution and general merchandise and specialty departments stores.

The WES stock closed the dayâs trade at a price of $ 40.830 on 12 December 2019, trading close to its 52-weeks high price of $ 42.850 with a market capitalisation of $ 46.4 billion.

Over a period of last one year, the WES stock has generated a return of 35.59%.

The WES stock is trading with an Annual Dividend Yield of 4.35%.

Harvey Norman Holdings Limited (ASX: HVN)

Harvey Norman Holdings Limited is an ASX listed company with activities primarily consisting of integrated retail, franchise, property and digital enterprise and operates under a franchise system in Australia and consistently delivers an unparalleled retail offering to Australian consumers.

The HVN stock closed the dayâs trade at a price of $4.170 on 12 December 2019, with a 52-weeks high price of $ 4.667 and market capitalisation of $5.23 billion.

Over a period of last one year, starting from $3.052 on 11 December 2018 to $4.200 on 11 December 2019, the HVN stock has increased by 37.60%.

The HVN stock is trading with an Annual Dividend Yield of 7.86%.

IDP Education Limited (ASX: IEL)

As a global leader in international educational services, IDP Education has been in the industry for close to 50 years and knows the best practices to help people realise their dream of studying abroad.

The IEL stock closed the dayâs trade at a price of $ 17.540, down 1.41% on 12 December 2019 with a market capitalisation of $4.53 billion.

Over a period of last one year, the IEL stock price has increased by 88.85%.

IEL stock has a PE multiple of 67.750x.

Aristocrat Leisure Limited (ASX: ALL)

Aristocrat Leisure Limited is engaged in developing a diverse range of goods and services including, casino management systems, electronic gaming machines and digital social games, driven by creativity and technology.

The ALL stock closed the dayâs trade at a price of $ 34.400 on 12 December 2019, trading close to its 52-weeks high price of $ 35.890 and market capitalisation of $21.6 billion.

On a year to date basis, the stock has generated a return of 60.73%.

The ALL stock has a PE multiple of 30.890x.

a2 Milk Company (ASX: A2M)

Founded in New Zealand in the year 2000, the premium branded dairy nutritional company- a2 Milk Company Limited has worked in collaboration with globally renowned scientists to lead the technical knowledge of distinctive benefits of the A2 protein type.

The A2M stock closed the dayâs trade at a price of $ 14.690, up by 0.75% on 12 December 2019, with market capitalisation of $ 10.73 billion.

Over a period of last one year, starting from $10.210 on 11 December 2018 to $14.580 on 11 December 2019, the A2M stock has increased by 42.80%.

The A2M stock has a PE multiple of 38.860x.

Coca-Cola Amatil (ASX: CCL)

Coca-Cola Amatil is one of the largest distributors and manufacturers of beverages and coffee in the APAC region. The company is also the authorised producer and wholesaler of The Coca-Cola Companyâs beverage brands across the world.

The CCL stock closed the dayâs trade at a price of $ 11.130 on 12 December 2019. The stock is trading close to its 52-weeks high price of $ 11.570 and market capitalisation of $8.09 billion.

On a year to date basis, the stock has generated a return of by 37.51%.

The CCL stock has a PE multiple of 27.240x.

Woolworths Group Limited (ASX: WOW)

With a mission to deliver the best in convenience, value and quality for the customers, Woolworths Group Limited operates in the consumer staples sector in Australia with multiple brands.

The WOW stock closed the dayâs trade at a price of $ 38.250 on 10 December 2019, with a 52-weeks high price of $40.040 and market capitalisation of $48.28 billion.

Over the period of last one year, starting from $28.740 on 02 January 2019 to $38.280 on 09 December 2019, the WOW stock has increased by 33.19%.

The WOW stock is trading with an annual dividend yield of 2.66%.

Bottom line

The above-discussed ASX listed retail stocks have performed generated decent returns. With technology taking charge of the retail sector through e-commerce and smart selling via mobile devices, can investors expect a sweet candy for their penny in these stocks?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.