Cannabis industry is composed of ancillary products and services, legal cultivators and producers, consumers, researchers, independent industrial standard bodies and regulators. Lately, several companies are getting inclined towards the cannabis industry, as the number of governments legalising the medicinal use of cannabis is growing across the globe.

Let us now take a look at five stocks operating in the cannabis space.

MGC Pharmaceuticals Ltd

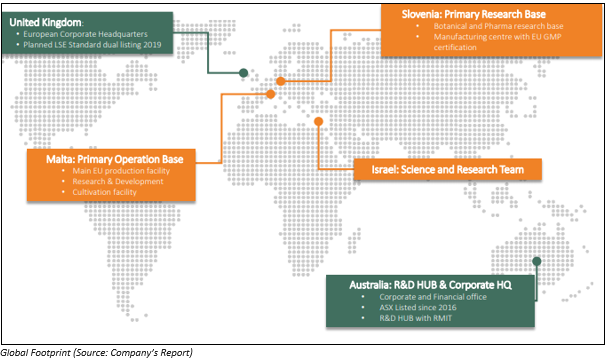

MGC Pharmaceuticals Ltd (ASX: MXC) is a biopharma company with technical, commercial and clinical experience in the medical cannabis industry. The core business strategy of the company is to develop and supply high-quality pharmaceutical products (phytocannabinoid derived), catered towards increasing demand from medical markets in various parts of the world.

MXC Crosses 400 Prescription Milestone in September

- The company announced on 3 October 2019 that the number of patients being prescribed its standardised cannabinoid medicines crossed the mark of 400 in September 2019, which is double the milestone of 200 unveiled by MXC in mid-September 2019.

- The milestone was achieved after the companyâs key distributor agreements activated in Australia and the UK.

- This demonstrates the high demand for the companyâs products. Moreover, this upward trend is anticipated to continue in Australia and the United Kingdom. During the month of September 2019, an average of 14 prescriptions were issued each business day.

- Material increase of prescriptions demonstrates the patient interest and demand for MGC Pharma's EU-GMP grade phytocannabinoid derived medicines, quality and cost competitiveness of the medicines, internally developed portfolioâs market potential and increasing distribution rollout capabilities.

- The company has internally produced CannEpil®, which targets the treatment of drug resistant epilepsy and MXP100, which is recommended for mild neurological disorders, inflammatory and for hepatoma patients. The company is closely working with its designated distributors to onboard further clinics.

Issue of $1m PO Shares and Issue of Options

Recently, MXC raised $1,000,040 (before costs) by issuing 25,001,000 ordinary shares under the Priority Offer to eligible shareholders. The company has also issued the following unlisted options:

- Tranche 1: 14,500,000 options exercisable at $0.05 expiring 31 August 2023

- Tranche 2: 14,500,000 options exercisable at $0.06 expiring 31 August 2023

Stock Performance

The stock of MXC closed the dayâs trading at $0.037 on 4 October 2019, 2.632% lower than its previous closing price. The market cap of the company is $51.94 million, while the stock performance has increased by 8.57% in the past 6 months.

Cann Group Limited

Cann Group Limited (ASX: CAN) is in the business of cultivation of medicinal cannabis for research and medicinal purposes. The company has also entered various partnerships to establish a leading position in plant genetics, breeding, extraction, analysis and production techniques.

Cann Group to Increase Capacity of Mildura Facility by 40%

The company recently announced plans to boost the full production capacity of the large-scale state of the art greenhouse facility in Mildura by 40% to 70,000kg of dry flower per annum and is expecting to generate revenues in the range of $220 million to $280 million, annually, following the increased plant capacity.

Cann Obtains Production Manufacturing

Production licences for the existing northern and southern medicinal cannabis facilities of Cann Group in Melbourne recently secured approval from the Office of Drug Control of the Federal Department of Health. The licences are for the production, in addition to the packaging, storage, transport and disposal of medicinal cannabis.

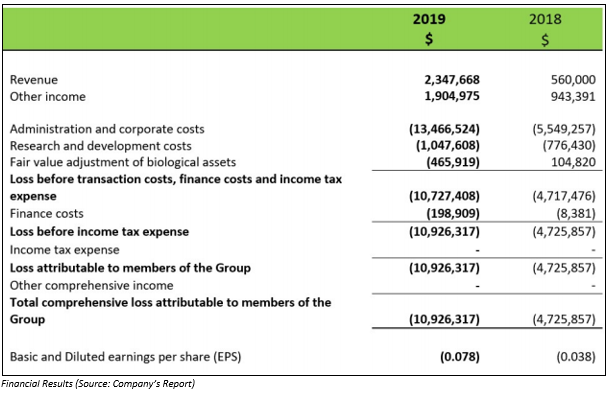

FY19 Financial Performance (as at 30 June 2019)

- Revenue stood at $2.35 million, up from $560,000 in FY2018

- Group reported an operating loss of $10.93 million for the year ended 30 June 2019

- Net assets of the Group went down to $77.30 million from $85.87 million in FY18.

Outlook

- The company expects to commence exports under the supply and offtake agreement with Aurora Cannabis.

- Move forward with the construction and development of the Mildura facility.

- Start IDT manufacturing

Stock Performance

The stock of CAN settled at $1.415 on 4 October 2019, down 5.034%. The market cap of the company is $211.29 million, while the stock performance went down by 29.05% in the past three months.

Auscann Group Holdings Ltd

Auscann Group Holdings Ltd (ASX:AC8) is in the business of development of a reliable dose form cannabinoid pharmaceutical product. Additionally, the company is preparing for its clinical trials. Recently, Gemelli Nominees Pty Ltd. ceased to be a substantial shareholder in Auscann Group Holdings.

Operating results and financial position (as at 30 June 2019)

- During the year, the loss of the consolidated entity for the financial year was $7,649,221 which included $57,943 in non-cash share-based payments.

- During FY19, net assets of the consolidated entity increased to $41,668,347 from $14,112,032 as at 30 June 2018, as a result of continued operational expenditure.

Business Achievements

- Successful completion of pilot production of first product line: The company made a significant research & development breakthrough with the successful conclusion of the product development of its final dose cannabinoid capsules. The new research led to the provision of consistent and stable dosages of the ingredients which solved the stability and dosing problems which existed with current oils and capsules in the market.

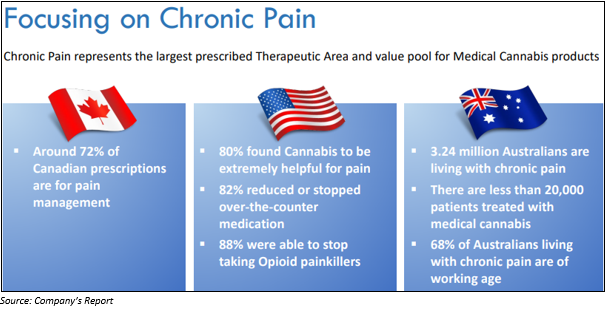

- Established capabilities and partnerships across the whole supply chain: The company developed partnerships across the supply chain and It also appointed PCI Pharma to manufacture and release its capsules for the treatment of chronic pain, leading to successful manufacturing of first engineering batch of capsules from the manufacturer.

- Establishment of in-house Product Development facility: The company purchased a R&D facility in Western Australia for $5.25 million, funded from existing cash reserves, enabling the cultivation, extraction, development and manufacturing operations.

- Chilean operation: DayaCann, which is the companyâs equal JV in Chile, signed a non-binding MoU with Khiron Life Sciences Corp to supply high quality cannabinoid medicines in exchange of funds to support the development of these activities with a payment of USD1,200,000.

Stock Performance

The stock of AC8 closed the dayâs trading at $0.340 on 4 October 2019 with a market cap of $107.8 million. The stock performance decreased by 4.28% in the past 3 months.

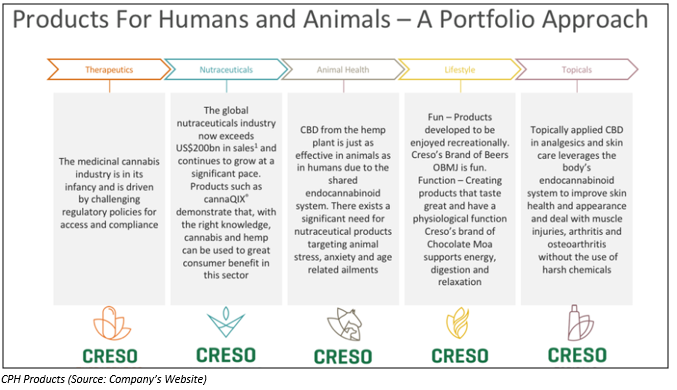

Creso Pharma Limited

Creso Pharma Limited (ASX: CPH) is engaged in the development, registration and commercialisation of pharmaceutical grade cannabis and hemp-based products and treatments. On 4 October 2019, the company announced that the Australian Securities and Investments Commission has registered the Scheme Booklet, concerning the previously announced schemes of arrangement for the proposed acquisition of CPH by PharmaCielo Limited.

Creso Secures Processing Licence

In the month of September 2019, Creso Pharmaâs Mernova cannabis facility was granted with a processing license by Health Canada, allowing the company to extract, produce and wholesale distribute medical cannabis oils. This allows to feed global demand for cannabis extracts and final products for human and animal treatment.

Six Month Financial Performance (as at 30 June 2019)

- During the six-month period, the company reported a net loss after tax of $6,276,707. This includes a non-cash cost of $965,087 for the share-based payment expenses associated with options and performance rights issued during the half-year.

- As at 30 June 2019, the Group had a net cash balance of $3,578,130 and net assets of $17,278,151.

Stock Performance: The stock performance went up by 21.43% in the past 6 months. The stock closed the dayâs trading at $0.345 on 4 October 2019.

The Global Group Limited

Operating under the Farm to Pharma business model, The Global Group Limited (ASX:THC) is engaged in the delivery of medicinal cannabis products. The company recently announced that Une-Innovation Consulting Australia Pty Ltd and M Y Capital Management Corp ceased to be a substantial shareholder in THC.

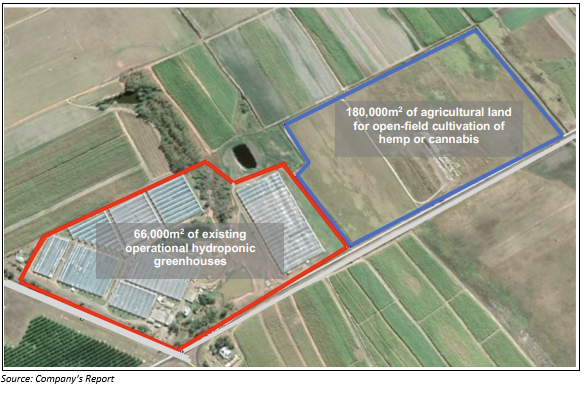

THC Global Secures 6.6 Hectares Cannabis Cultivation Site:

THC Global has secured 6.6 hectares of existing hydroponic greenhouses, which will be repurposed for cannabis cultivation and an additional 18 hectares of agricultural land for a proposed open-field cannabis cultivation operation. The company is expecting to produce 80,000 kg of dried cannabis flower, initially.

Stock Performance: The stock performance went down by 21.82% in the past six months. The stock closed the dayâs trading at $0.432 on 4 October 2019, up 0.485% from its previous closing price.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.