The Financial Sector

An economyâs segment comprising of firms, and financial institutions delivering financial services to retail and commercial customers is known as the financial sector. The big portion of the revenue of it comes from Mortgages and Loans. The sector under discussion for any nationâs economy portrays its health, the better the financial sector becomes, the healthier the economy. According to the Department of the Treasury (Australia), the nationâs financial system is strong, and the governmentâs actions in an answer to the inquiry related to the financial system would make an addition to how well the country is placed to react when faced with both the difficulties and future prospective.

Fintech Sector

The Fintech sector contains a group of entities related to Finance and Technology. Fintech comprises of any company with technological disruption linked with finance. So far, the money offering, and finance related business have been largely held by the banking sector and non-banking financial establishments.

Factors affecting Financial service firms

Rising Platforms

- The increasing choice amid consumers have deep implications on the distributions and designing of products. The platforms involved with various financial establishments from a single channel may turn into a major model to offer the services related to finance. The surge of these platforms is likely to reshape the financial services from clearly defined principles.

Technology in the Financial Sector

- The technology firms are now entering into the financial sector. The combination of finance and technology is termed as fintech sector. This sector is growing quiet swiftly, and more and more investors are interested in this sector. Nowadays, technology is utilised in various financial activities such as check deposits via smartphones, digital payments, money transfer etc. According to the experts, fintech sector, in the future could give a tough competition to the banks and financial institution of the economy.

Bank Policy

- The central bank policy of any country plays a huge role in the financial services space. Capital requirements established by the central banks and interest rate helps to drive arbitrage opportunities between long term and short-term rates. The high and low-interest rate provides benefits in different aspects. The high-interest rate reflects that the sector is performing well, while the low-interest rate helps a consumer to borrow money from the banks and financial institutions.

On 11 October 2019, the Australian benchmark index S&P/ASX 200 Financials (Sector) by the end of the market session was at 6,271.7, moving up by 1.06 percent from its last close.

We will now discuss HUB24 Limited, classified within the financials sector on Australian Securities Exchange:

HUB24 Limited (ASX: HUB)

Australia based HUB24 Limited (ASX: HUB) was set up by a team with a robust backdrop of providing market solutions in the services related to the finance sector. The company commenced its journey in 2007 and came up with an array of investment options..

During the financial year 2019, the company signed eighty-four new agreements with three hundred and ninety-eight new advisors introduced to the platform.

The company has announced the change in the directorâs interest and substantial holding that can be read here.

Solid growth in September quarter

On 11 October 2019, HUB released September quarter, posting a solid increase during the quarter period with Net inflows standing at $1,238 million, with a surge of 94 percent on previous corresponding period. The gross inflows were noted at $1,673 million. FUA was at $14.4 billion, moving up by 57 percent from pcp (as on 30 September 2019).

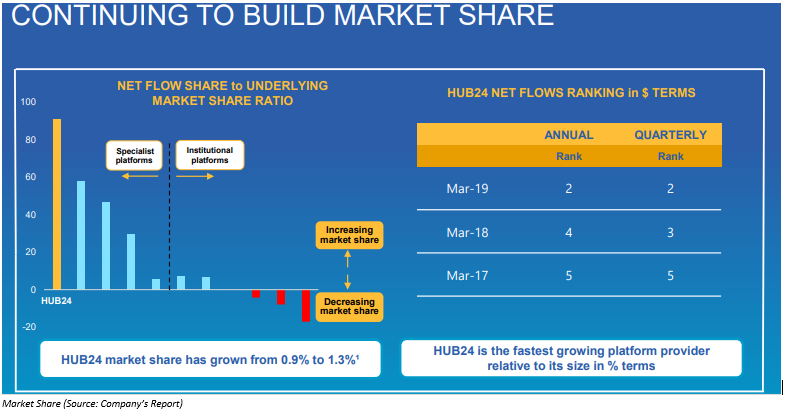

HUB platform persists to progress at the quickest speed, coming at second position in quarterly and yearly net inflows, as per the latest data. Also, Paragem has finalised onboarding eleven fresh practices.

Groupâs revenue surged by 15 % in FY19 results

In late August this year, HUB released the report on FY 2019 for the 12 months ended 30 June 2019. Below are a few pointers from the results:

- HUB attained net inflows rising to 61 per cent standing at $3.9 billion.

- The group revenue moved up by 15 per cent standing at 96.3 per cent.

- Gross profit of HUB rose by 33 per cent, noted at $45.4 million compared to the pcp.

- A fully franked dividend of 2.6 cps was declared by HUB. Also, the full-year dividend came to 4.6 cps, boosted by 31 per cent.

Operational Highlights

FY 2019 has been characterised by consistent product and investment innovation. The add-on of Challenger annuities to the HUB platform aided the ConnectHUB. The new launches by ConnectHUB is planned for FY 2020, and the company continues to invest in its business to aid implementation of HUBâs growth-related strategies.

Key Milestones Achieved

- The company maintained its 1st for position in Managed Accounts functionality for the third year in a row.

- On the industry position front, HUB24 was ranked 2nd in yearly and quarterly net inflows and 1st in decision support tools.

Platform Segment Overview

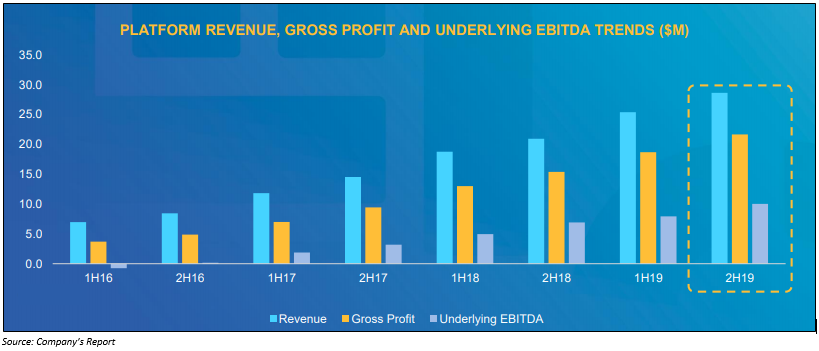

- HUBâs platform revenue rose by 36 per cent standing at $54.1 million from pcp.

- The gross profit of the segment improved by 4 per cent from the previous year to $40.4 million.

- EBITDA (underlying) of HUB was raised by 52 per cent standing at $18.0 million.

- Profit before tax moved up by 38 % noted at $15.0 million.

Outlook

The future of the Australian Wealth Management industry is now taking a form, and the company continues to move forward with encouraging tailwinds and opportunities for growth. The company maintained its leading growth level, while the other participants got influenced by structural change. New clients were acquired to boost the company with a strong pipeline of contracted opportunities, and a growing list of prospective opportunities is leading towards the upliftment of FUA target ($22-$26 billion by June 2021).

Stock Performance

The HUB stock last traded at a price of $12.180 on 11 October 2019, moving up by 3.396 per cent from its prior close. HUB has approx. 62.59 million outstanding shares and a market cap of $737.3 million. The 52-week low and high value of the stock was at $10.130 and $15.550, respectively. The stock has generated a return of -19.97 per cent in the last six months. However, its return on a year-to-date basis is of 1.46 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.