Economists are expecting the falling house prices to get stabilized with the likely interest rate cut in June. It would be a welcoming news for the entire economy if the house prices stabilize, breaking months of steady declines.

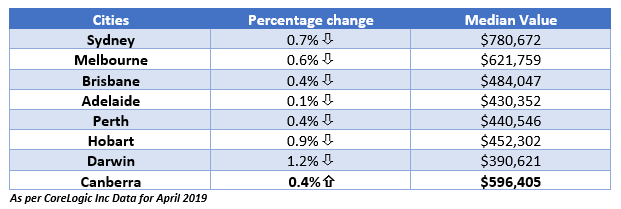

Australiaâs housing market has witnessed a downturn in recent months with a fall in home prices since September 2017. The CoreLogic Inc. hedonic home value index for April 2019 showed that the property prices declined across major capital cities in Australia. The nationâs two biggest property markets - Sydney and Melbourne witnessed saw house prices declining by 0.7% and 0.6%, respectively in April.

Recently, the National Australia Bank Ltd (ASX: NAB) securitisation analysts also anticipated a further fall in house prices in Melbourne and Sydney. In addition, the recent data released by the Australian Bureau of Statistics signified a fall in the number of dwellings approved in March 2019.

Recently, the National Australia Bank Ltd (ASX: NAB) securitisation analysts also anticipated a further fall in house prices in Melbourne and Sydney. In addition, the recent data released by the Australian Bureau of Statistics signified a fall in the number of dwellings approved in March 2019.

The unemployment rate is another factor that poses a risk to the health of the property market through the serviceability of home loans. The Australian economy saw a rise in the jobless rate to 5.2 per cent in April 2019, raising the speculations of a likely rate cut in June.

However, the recent data released by CoreLogic Inc indicated an improvement in the housing prices in Australia. The CoreLogicâs daily hedonic home value series demonstrated an increase in the median home prices in both Sydney and Melbourne. The median home prices in Sydney and Melbourne rose 0.3 per cent and 0.1 per cent, respectively in comparison to the last week. The remarkable improvement in the market conditions in both the cities came after the victory of the Coalition government in the federal election.

The optimistic outlook for the housing prices was given by economists based on several recent moves, including the indication by the Reserve Bank of Australia (RBA) for June rate cut, a removal of 7 per cent home loan buffer proposed by the Australian Prudential Regulation Authority, the miraculous win of the Coalition government in federal elections and the recently announced First Home Loan Deposit Scheme.

A few days back, the Australian Prime Minister, Mr Scott Morrison initiated a scheme for first home buyers under which the Coalition government will underwrite any shortfall in the 20 per cent deposits on home loans for first-home buyers, along with removing the costs of paying lenders mortgage insurance.

These potential moves have made the economists more confident of a recovery in the housing market earlier than expected. Some of them anticipate house prices plunge to stablilize within the second half of this year.

In its most recent Statement on Monetary Policy, RBA mentioned that a fall-off in residential construction could prevent further falls in house prices. Economists expect a further decline in construction, thereby fuelling house price recovery hopes.

A research firm has also upgraded its forecasts of Australian home prices, predicting that prices will not only stabilise but also increase by the second half of next year.

The S&P/ASX 200 Index closed higher today at 6484.8 points, up by 0.5 per cent in comparison to the previous closing price.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.