Stocks that witnessed a rise in the market price

In todayâs trading session, the benchmark index S&P ASX 200 index was up by 0.59% and closed at 6,687.4. Majority of the sector indices also closed in the green today. Let us have a look at six stocks have generated positive movement in the prices. Resolute Mining, St. Barbsara and Regis Resources generated returns of more than 5%. Other stocks, namely Transurban Group, Newcrest Mining and CSL Limited, depicted upward movements below 3%. Below is a snapshot of the performance of each of the companies. Apart from the above, three stock, namely Viva Energy Group, Webjet Limited and Qantas Airways witnessed a fall in prices during the trading session. While Webjet and Qantas witnessed a decline below 4%, Viva Energyâs stock went down at a rate of 8.036%. Below are the relevant details on the performance of the companies.

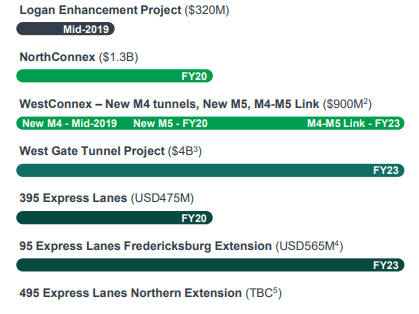

Transurban Group (ASX:TCL)

Transurban Group (ASX:TCL) develops, owns and operates toll roads and intelligent transport systems. On 21st May 2019, the company updated the market about the payment of an ordinary dividend of 30 cents per stapled security for the six months ended 30 June 2019.

During the quarter ended March 2019, the Average Daily Traffic increased by 2.3% with growth achieved across all markets. The company witnessed continued progress with new development projects. Melbourne witnessed the highest increase in ADT by 3.1%, followed by North America at 2.9%, Sydney at 2.1% and Brisbane at 1.1%.

Project pipeline (Source: Company Presentation)

The companyâs stock, at market close, was trading at a market price of $15.340, up 2.609% on 20th June 2019.

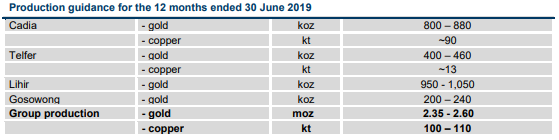

Newcrest Mining Limited (ASX:NCM)

Newcrest Mining Limited (ASX:NCM) engages in the exploration, mine development, sale of gold and gold and copper concentrate. On 23rd May 2019, the company announced the issuance of 17,887 Performance Rights for nil consideration.

In the quarter ended March 2019, the gold production was reported at 623koz, down 5% on the previous quarter. Copper production for the period totalled 25kt, down 6% on the previous quarter. Year-to-date copper and gold production increased by 33% and 7%, respectively, as compared to the prior year. The period saw acquisition of a 70% stake in Red Chris mine from Imperial Metals Corporation with Brownfields and Greenfields exploration activities.

While production guidance for FY19 was estimated to be around the mid-point of the range, AISC expenditure and total capital expenditure are expected to be around the lower end of the range.

Production Guidance for FY19 (Source: Company Presentation)

The companyâs stock, at market close, was trading at a market price of $31.780, up 4.06% on 20th June 2019.

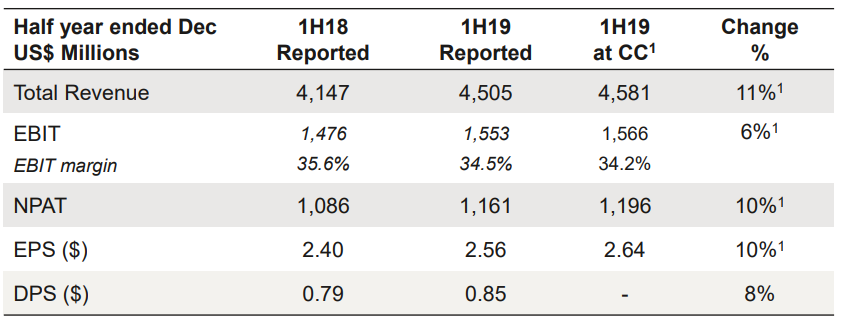

CSL Limited (ASX:CSL)

CSL Limited (ASX:CSL) is engaged in the development and delivery of innovative medicines. The company recently announced the issuance of 28,268 ordinary shares with 9,675 rights at nil price and 18,593 options at $1,374,580.49.

During 1H19, the company witnessed a 11% increase in revenues from US$4,147 million in 1H18 to US$4,505 million in 1H19. EBIT amounted to US$1,553 million, up 6% on pcp and NPAT amounted to US$1,161 million, up 10% on pcp.

1H19 Highlights (Source: Company Presentation)

The stock at the market close was trading at a price of $219.460, up 0.601% on 20th June 2019.

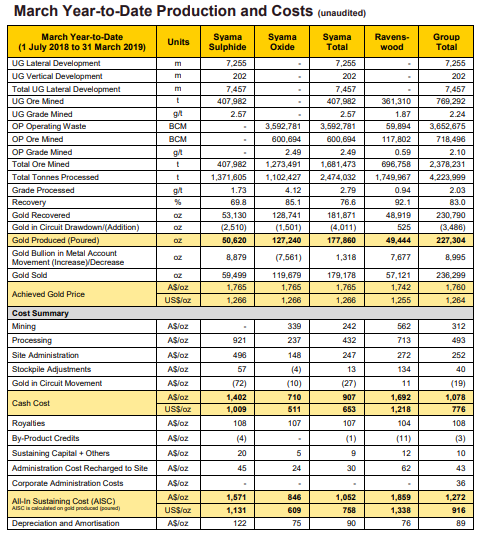

Resolute Mining Limited (ASX:RSG)

Resolute Mining Limited (ASX:RSG) engages in the gold mining and exploration of minerals. On 20th June 2019, the company updated investors that its shares are now listed on the London Stock Exchangeâs (LSE) Main Market.

For the March quarter, the company reported record production of 84,552oz from Syama site, up 50% on the prior quarter, which resulted in a material reduction in All-In-Sustaining Costs. The performance was also marked by strong operating performance and cash flow generation. The company is on track to achieve the production guidance for FY19 of 300,000 ounces of gold at an All-In Sustaining Cost of $1,280/oz.

March Year-to-Date Production (Source: Company Reports)

The stock is currently priced at $1.190, up 10.185% on 20th June 2019.

St Barbara Limited (ASX:SBM)

St Barbara Limited (ASX:SBM) is primarily engaged in the mining and sale of gold. On 17th June 2019, the company updated the market that it intends to acquire Atlantic Gold Corporation for $768 million.

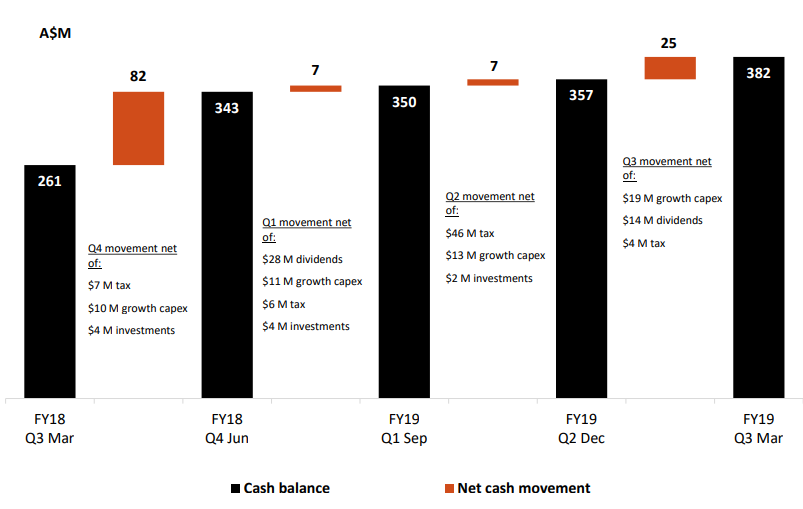

The consolidated gold production for the quarter ending March 2019 was 88,358 ounces as compared to 89,244 ounces in December quarter. For the period, the company reported a cash balance of $382 million as compared to the pcp cash balance of $261 million.

Total gold production guidance for the financial year 2019 is expected to be around 355,000 ounces.

Trends in Cash Balance (Source: Company Presentation)

The companyâs stock is currently priced at $2.940, up 10.112% on 20th June 2019.

Regis Resources Limited (ASX:RRL)

Regis Resources Limited (ASX:RRL) is engaged in the production of gold and exploration and evaluation of gold projects. In May 2019, the company announced the issuance of 42,797 ordinary fully paid shares for a price of $2.70 per share.

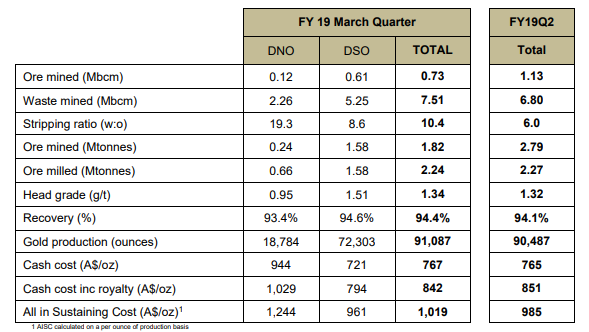

For the March quarter, the gold production was consistent at 91,087 ounces in line with the previous quarter. Year-to-date production was at the top end of the annual guidance totalling 272,453 ounces. Cash flow from operations during the period amounted to $89.3 million. FY19 AISC guidance is expected to be at the bottom end of $985-1055/oz and production guidance is expected to be in the middle to top range of 340,000-370,000 oz.

Operating Results Summary (Source: Company Reports)

The companyâs stock is currently priced at $4.930, up 5.794% on 20th June 2019.

Stocks that witnessed fall in the market price

Viva Energy Group Limited (ASX:VEA)

Viva Energy Group Limited (ASX:VEA) is engaged in the sale of fuel and speciality products and also undertakes manufacturing activities at the Geelong Oil Refinery. On 14th June 2019, the company informed that the voting power of a substantial shareholder, Perpetual Limited reduced from 11.06% to 10.02%.

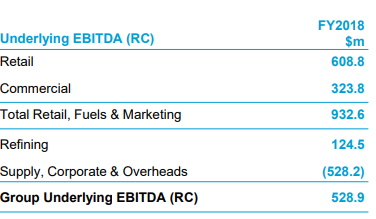

In April 2019, the company updated investors on its refining margin for the month. Geelong Refining Margin was US$7.8 per barrel with the crude intake of 3.6 million barrels. During FY18, the sales totalled 14,045 million litres, broadly in line with the forecast. Underlying EBITDA amounted to $608.8 million from the retail segment, which was also in line with the guidance of $607.6 million. Total Underlying EBITDA amounted to $528.9 million. The company also declared a final dividend of 4.8 cps for the half year ended 31st December 2018.

Key Financial Highlights (Source: Company Presentation)

The stock is currently priced at $2.060, down 8.036% on 20th June 2019.

Webjet Limited (ASX:WEB)

Webjet Limited (ASX:WEB) is engaged in online sales of travel products, including flights and hotel rooms. The company recently announced that the Challenger Limited became a substantial shareholder with 5.04% voting power.

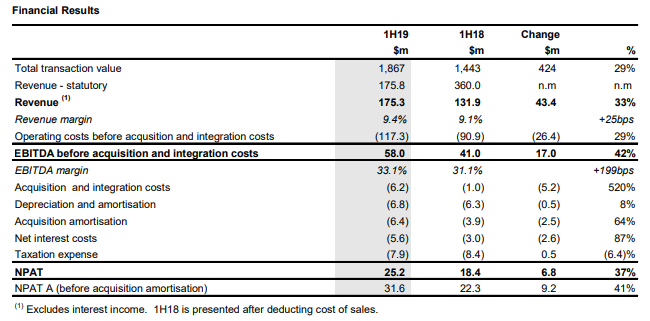

For the half year ended 31st December 2018, the company reported a 33% increase in revenue, excluding interest income, from $131.9 million in 1H18 to $175.3 million in 1H19. NPAT increased by 37% and amounted to $25.2 million in 1H19. EBITDA for the period amounted to $58 million, reporting an increase of 42% on pcp.

Financial Highlights (Source: Company Reports)

The companyâs stock is priced at $14.690, down 2.715% on 20th June 2019.

Qantas Airways Limited (ASX:QAN)

Qantas Airways Limited (ASX:QAN) provides international and domestic air transportation services. The company recently updated that one of the directors named Michael Gerard LâEstrange acquired 3,000 ordinary shares for a value of $5.68 per share.

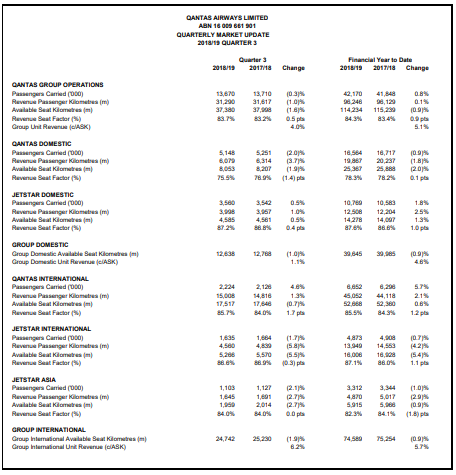

For Q3 FY19, the company reported revenues of $4.4 billion, up 2.3% on pcp. The groupâs Domestic Unit Revenue increased by 1.1% and International Unit Revenue increased by 6.2%. The company also signed an agreement with Melbourne Airport to buy airlineâs domestic terminal. In June 2019, the company and American Airlines received tentative approval for their joint business.

Quarterly Update (Source: Company Reports)

The stock is currently trading at $5.430, down 1.63% on 20th June 2019.

Is AMP to be Penalised?

Meanwhile, the Australian Securities and Investments Commission (ASIC) proposed to impose a fine of between $24 million and $36 million on AMP Limited (ASX:AMP) , a financial services company in Australia and New Zealand, due to the contravention of financial services laws. As per ASIC, there was a breach in 120 cases, but AMP stated that it had violated the law only twice and was therefore liable to pay a fine of $1.2 million to $1.5 million. The case pertains to insurance âre-writingâ or âchurningâ, wherein customers are advised to cancel their life insurance and take out new cover, exposing them to underwriting risks. After referring to internal emails, it was inferred that AMP was aware of the gravity of conduct but failed to deal with the issue. The size of the penalty is now dependent on the number of breaches that AMP has committed.

AMP closed the day flat at A$2.070, with over 20 million shares changing hands. The market capitalisation of the company is A$6.1 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.