The health care sector is one of the tremendously growing sectors, and according to some market research reports, it is expected that global health care spending would soar at a CAGR of 5% in between 2019-2023, hence, it is a sign that there would be many opportunities for the health care sector in the upcoming years.

The health services subdivision in Australia is projected to continue in an increasing robust manner over the next five years due to ageing population in Australia, the growing prevalence of several chronic diseases, as well as increasing coverage of private health insurance.

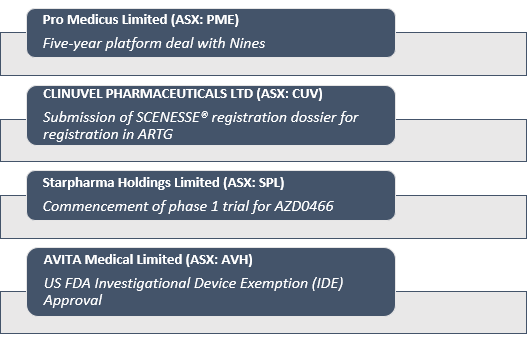

In this article, we are highlighting the recent activities for four ASX listed health care sector players-

Let us zoom the lens on- PME, CUV, SPL, AVH

Pro Medicus Limited (ASX:PME)

An ASX listed health imaging company, Pro Medicus Limited (ASX:PME) was founded in 1983 and is a leader in providing medical imaging services. Pro Medicus offers various radiology IT software and services to health care groups, imaging centres and hospitals across the globe. The company offers multiple e-health solutions, PACS and RIS hence, constituting one of the most comprehensive end-to-end offerings in radiology.

Five-year platform deal with Nines-

On 30 December 2019, Pro Medicus announced that the company’s wholly owned subsidiary, Visage Imaging, has signed a multi-million-dollar deal for five-year with Palo Alto based Nines.

The Visage 7 technology-based offerings would be presented in the Google Cloud Platform and would offer Nines with an enormously scalable and remarkably optimised platform.

This deal is based on committed exam volumes that step-up year-on-year associating with an estimated growth of the Nines offering in the market, and would result in base revenue to Pro Medicus in excess of $6 million over the life of the agreement with the potential for considerable benefit. Implementation would commence in the next few weeks with go live expected in the early second quarter of the CY2020.

Additionally, this contract opens the potential for new Radiology-as-a-Service market for Visage technology and adds to Pro Medicus’ growing footprint in North America.

Stock Performance-

On 31 December 2019, the stock of PME was trading at $23.050, moving down by 6.072% (at AEDT 12:56 PM), with outstanding market shares of approximately 103.95 million. The company had a market capitalisation of nearly $2.55 billion, while the 52 weeks low and high price of the stock was noted at $10.863 and $38.390, respectively. The stock has delivered an excellent return of 115.80% on year to date basis.

CLINUVEL PHARMACEUTICALS LTD (ASX:CUV)

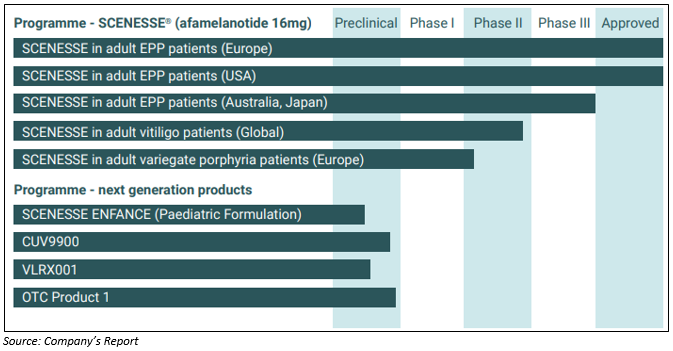

A global biopharmaceutical company CLINUVEL PHARMACEUTICALS LTD (ASX:CUV) is dedicated to developing and producing therapies for patients with various serious inherited and skin conditions. The company is a pioneer in the field of photomedicine, and its R&D has led to novel remedies for patient populations with a medical necessity for photoprotection, repigmentation as well as genetic defects.

CLINUVEL has a strong product pipeline which provides growth opportunities for the company-

Submission of SCENESSE® registration dossier-

On 23 December 2019, CLINUVEL announced that the company has applied to the Australian Therapeutic Goods Administration (TGA) for the registration of its drug SCENESSE® (afamelanotide 16mg) in the Australian Register of Therapeutic Goods (ARTG). SCENESSE® would be prescribed in Australia after its registration in ARTG, for the inhibition of phototoxicity in adult patients with erythropoietic protoporphyria.

Under Section 25 of the Therapeutic Goods Act 1989, a representative of the Secretary of the Department of Health, is responsible for registering therapeutic products on the Australian Register of Therapeutic Goods after scientific review of a technical dossier comprising data on a medicine’s safety, efficacy and quality.

Stock Performance-

On 31 December 2019, the stock of CUV was trading at $28.490, moving downwards by 1.419% (at AEDT 12:58), with outstanding market shares of around 49.41 million. The company had a market capitalisation of nearly $1.43 billion, while the 52 weeks low and high price of the stock was noted at $17.770 and $45.880, respectively. The stock has delivered a positive return of 60.56% on year to date basis.

Starpharma Holdings Limited (ASX:SPL)

An ASX listed health care company Starpharma Holdings Limited (ASX:SPL) is a world leader in the development of dendrimer formulations for therapeutic purpose. The company is focused on women health and its product for women- VivaGel® BV is based on a proprietary dendrimer, SPL7013. VivaGel® BV is accessible for selling under the brand names Fleurstat BVgel in Australia, Betafem® BV Gel in the UK and Betadine BVTM in Europe. Moreover, the company has submitted a new drug application to the US Food & Drug Administration.

AZD0466 phase 1 trial commencement-

On 30 December 2019, Starpharma announced that AstraZeneca initiated AZD0466 (DEP® Bcl2/xL conjugate) phase I clinical study and the first patient has been successfully administered with the medicine. Patients with a range of cancer diseases would be recruited for this trial, and the study would be conducted at 4-5 United States sites.

AZD0466 development is being progressed, and Starpharma is eligible to obtain development, launch and sales milestones of approximately USD 124 million, in addition, the company would also receive tiered royalties on net sales. After the administration of the first dose of AZD0466 in phase I trial, Starpharma has generated a milestone payment of USD 3 million. Under the license development costs of DEP® AstraZeneca products would be funded by AstraZeneca.

Stock Performance-

On 31 December 2019, the stock of SPL was trading at $1.230, slipping by 0.405% (12:59 PM), with outstanding market shares of around 372.48 million. The company had a market capitalisation of nearly $460.02 million, while the 52 weeks low and high price of the stock was noted at $0.940 and $1.445, respectively. The stock has delivered a positive return of 16.51% on year to date basis.

AVITA Medical Limited (ASX:AVH)

An ASX listed biotechnology company AVITA Medical Limited (ASX:AVH) develops and distributes tissue-engineered cellular formulations for replacement of skin, and also offers products such as RECELL and CellSpray, that are used for skin scars and injuries. Avita Medical operates worldwide, and its products are sold under the RECELL® System brand for promoting healing of the skin in a wide variety of therapies including chronic wounds, burns, as week as aesthetics. AVITA’s RECELL® System is Therapeutic Goods Administration (TGA) registered in Australia, and in Europe it had received CE-mark approval.

US FDA Investigational Device Exemption (IDE) Approval-

According to an ASX announcement on 30 December 2019, AVITA medical unveiled that the US Food and Drug Administration has approved the company’s Investigational Device Exemption (IDE) application to conduct a feasibility study evaluating the safety as well as the effectiveness of the RECELL® system for repigmentation of stable vitiligo associated depigmented lesion.

AVITA Medical would collaborate with a prominent medical centre to perform a pilot study involving ten patients who are having stable vitiligo lesions from a minimum one year. Vitiligo lesion areas would be randomly treated with slightly varying cell suspensions prepared using RECELL for confirmation of response rates and optimal suspension parameters.

The RECELL ® System evaluation study for vitiligo is anticipated to initiate the study in the first half of 2020.

On the basis of the outcomes of the study, the company expects progressing with a pivotal clinical trial to pursue FDA or Food & Drug Administration’s approval for RECELL ® System as a cell-based repigmentation therapy option for stable vitiligo.

Stock Performance-

On 31 December 2019, the stock of AVH was trading at $0.640, falling down by 1.538%, with outstanding market shares of approximately 2.12 billion. The company had a market capitalisation of nearly $1.38 billion, while the 52 weeks low and high price of the stock was noted at $0.078 and $0.740, respectively. The stock has delivered an exceptional return of 722.78% on year to date basis and 47.73% in previous six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)

_06_20_2025_00_42_02_637335.jpg)