In this article, we would discuss the companies engaged in the production and exploration of coal. Accordingly, Whitehaven Coal, in the June Quarterly report, has acknowledged the softened thermal coal market due to low seaborne LNG prices and import restrictions from China. Besides, Coronado Global, in its half-year release, has noted the reduction in the price to $165 per tonne from $194 per tonne by Platts Premium Low Vol HCC index. Coronado expects the price of seaborne metallurgical coal to be volatile during the near term backed by the potential port restriction of coal into China, and tariffs on US coal imports.

Letâs look at a few coal stocks for a better understanding.

Coronado Global Resources Inc (ASX: CRN)

Dividend

On 5 August 2019, the coal miner released the results for the half-year ended 30 June 2019. Subsequently, the company announced the total interim distribution of US$0.41 per CDI, which includes a franked dividend of US$0.112 per CDI, and US$0.298 per CDI of return of capital. Besides, the ex-date for the distribution is 23 August 2019, record date for the dividend is 26 August 2019, and it is scheduled to be paid on 20 September 2019.

Accordingly, the dividend is anticipated to be fully franked for the Australian tax purposes, and the remaining part of the distribution would be considered as a return of capital. Meanwhile, for US tax purposes, it would attract US withholding tax. Besides, the total distribution would be funded through available cash and the drawdown from the SFA.

Half-year Report

The company acquired Curragh Mine in March 2018, and the figures are reported on a pro forma basis. Reportedly, the company has recorded adjusted EBITDA of US$405.4 million in HY19, against US$263 million in HY18, up by 54.1%. Also, the revenues were US$1116.2 million in HY18, and the revenues were up by 10.6% to US$1,234.3 million in HY19. Besides, the company reported net income after tax of US$214.3 million in HY19, which was up by 92.7% from US$111.2 million in HY18. Further, the company realised metallurgical coal price of US$137.5 during HY19, up by 2.8% from US$133.7 in HY18. The mining cost per tonne was down by 11.1% to US$51.4 in HY19 from US$57.8 in HY18.

As per the release, the revenues were up due to the greater realised price of US$137.5 per tonne, and the company sold a higher percentage of metallurgical coal. Also, the company recorded sales volume of 10.4Mt for HY19, which depict an increase of 5.3% over the prior corresponding period, driven by escalated production, improved rail availability at Curragh, and improvements in operations.

Early Release of Securities from Voluntary Escrow

Reportedly, the company has approved the early release of common stock, which equates to 106,316,870 CHESS Depository Interests (CDIs) in the company, which was held by Group LLC from voluntary escrow, effective 19 August 2019. Also, the early release represents 11% of the issued capital, and the release would see sell down in the form of CDIs. Besides, it would result in increased free float and liquidity for the company, which would be 31% of the issued capital. Further, this 31% of free float would satisfy the condition for potential inclusion in S&P/ASX indices. Importantly, the company has not made a final decision for the sell down, and the transaction is uncertain.

As per the release, the company has developed a new mining plan for Curragh mine, which would see 15mt production per annum by 2023. Also, it completed the New Coal Supply Agreement with Stanwell Corporation resulting in the acquisition of Stanwell Reserved Area. Besides, the companyâs new 3-year employee Enterprise Agreement was approved by Fair Work Australia. Further, the company has received unconditional credit approved offers to increase the Syndicated Facility Agreement (SFA) to US$500 million from US$350 million along with extended term to February 2023.

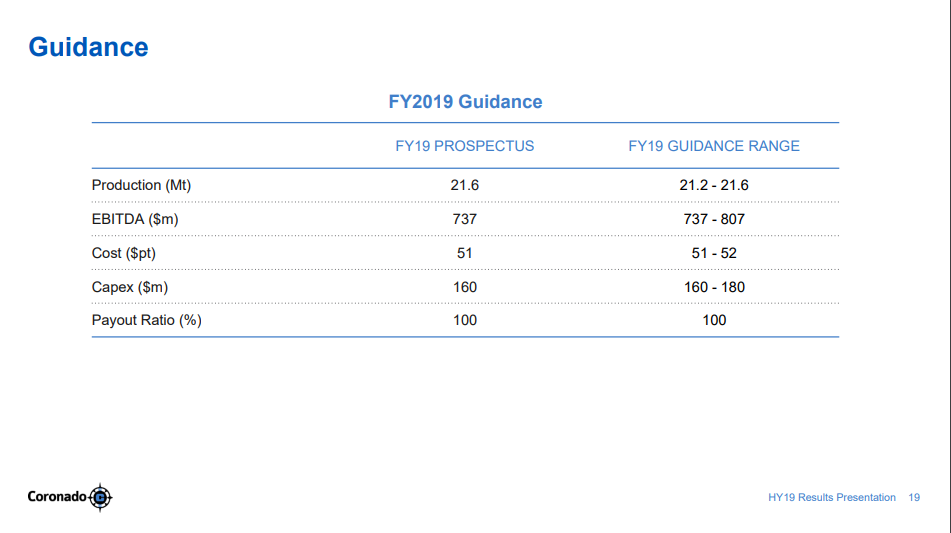

Guidance (Source: Companyâs Half-Year Results Presentation)

On 5 August 2019, CRNâs stock last traded at A$3.2, down by 2.736% from the previous close.

New Hope Corporation Limited (ASX: NHC)

Earlier, in the last month, the company notified an update related to the Colton Project, which followed up on the previously reported court proceedings against Wiggins Island Coal Export Terminal Pty Ltd and others. Accordingly, the Supreme Court of New South Wales had concluded that the company had not guaranteed debts of Northern Energy Corporation Ltd and Colton Pty Ltd under the Deed of Cross Guarantee.

Quarterly Activities Report

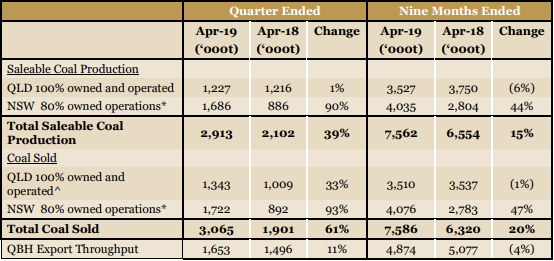

Production & Sales (Source: Quarterly Activities Report, May 2019)

On 28 May 2019, the company had reported the Quarterly Activities report for the period ended 30 April 2019. The company operated in Queensland and New South Wales regions, through the projects.

Queensland Operations

According to release, the operations at New Acland concentrated on the West Pit and Centre Pit during the quarter, and noise constraints impacted the operations. Also, the operations at the Jeebropilly have been focusing on finishing well and safe production, and the company anticipated the completion of the mining operations by the end of calendar year 2019.

New South Wales Operations

Reportedly, the company acquired an additional 10% interest in the Bengalla JV from Mitsui for $215 million. Now, the company has an interest of 80%, and the JV produced 1.7 million tonnes up by 90% over the prior corresponding period.

Reportedly, the company drilled 38 holes for a total of 3,708 metres at New Acland & the North Surat. Also, the PFS for North Surat has been progressing with a focus on capital cost estimates and financial analysis. Besides, the drilling activity continued on the Cherryâs road at New Acland, and the drilling on Woori leased started in April. Further, the resource planning and project planning continued during the quarter for Burton/Lenton project.

Bridgeport Energy

As per the release, the company realised oil price of US$69/bbl or A$98/bbl during the quarter, and the oil production was 93,137 barrels for the quarter. Also, the company acquired the Senex interests in ATPs 736, 737 and 738 (three exploration tenements) in Jundah, QLD.

On 5 August 2019, NHCâs stock last traded at A$2.36, down by 4.453% from the previous close.

Whitehaven Coal Limited (ASX: WHC)

Quarterly Results

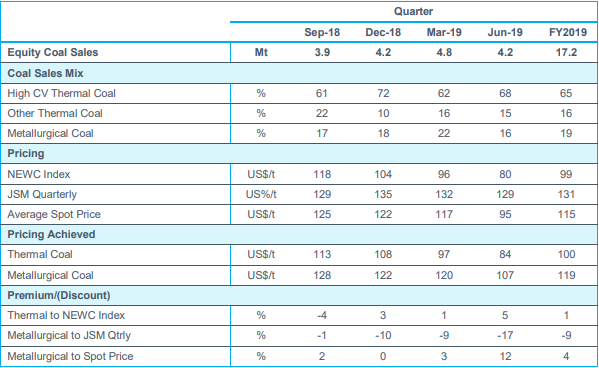

In July 2019, the company released Quarterly Report for the June Quarter. Accordingly, the company recorded 4.364Mt of equity coal sales, including purchased coal, up by 12% over the prior corresponding period. Also, the managed coal sales were 5.338Mt, which includes the sale of purchased coal.

Besides, the globalCoal Newcastle Index (gC Newc) thermal coal price came down to an average of US$79.86/t for the quarter against an average price of US$99.41/t for FY2019. Further, the company recorded thermal coal sales at a price of US$84/t in the quarter, and for the full year the sale price was US$100/t. Moreover, the company achieved a sales price at US$107/t for the metallurgical coal sales in the quarter.

Equity Sales and Prices (Source: Companyâs Quarterly Report, July 2019)

Thermal & Metallurgical Coal Outlook

According to the release, thermal coal prices had come down during the quarter due to low seaborne LNG prices in Asia & Europe. In Europe, the decline in gas prices from US$9/GJ to US$3/GJ has resulted due to the preference of gas over coal for power generation, causing a fall in demand in the region.

Also, the power demand in China grew by 4.9% in the initial five months of 2019, and the increase in power generation was noticed through the hydroelectricity in combination with wind & solar sources. Subsequently, power generation through coal declined in the coastal regions while it increased in central, western parts of China. Besides, the domestic production was ramped up, coal imports declined, and Australian sales to China declined in the First Half CY2019.

It was also asserted that the metallurgical coal outlook remains healthy backed by the steel production in China, India & Japan, which rely on the seaborne market to meet coking coal needs.

On 5 August, WHCâs stock last traded flat at A$3.55, from the previous close.

Bounty Mining Limited (ASX: B2Y)

New funding and Extended Coal Offtake Agreement

On 5 August 2019, the company released a new funding and extended coal offtake agreement which was signed on 3 August 2019. Accordingly, the company has completed the recapitalisation of a new funding packed with Amaroo Blackdown Investments LLC (Amaroo) â its major shareholder. Also, the company has agreed to amend, restate the existing coal offtake agreement with Xcoal Energy & Resources GmbH (Xcoal) â an associate of Amaroo.

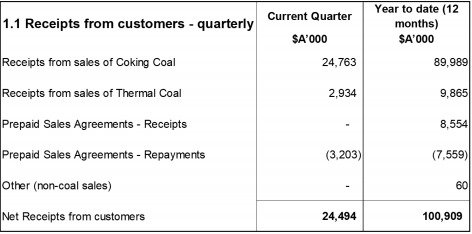

(Source: June Quarterly Cashflow Report, July 2019)

Reportedly, the companyâs independent directors had requested Amaroo to extend the termination date (Currently 31 July 2019) for the Amarooâs existing working capital debt facility and the loan agreement (assigned to Amaroo by VETL Pty Ltd). Now, Amaroo has agreed to extend the repayment date to 30 September 2019 and subsequently to 31 July 2020. Also, under the new financing transaction with Amaroo, the company would issue secured convertible notes with an aggregate principal of A$35,000,000, issued under the subscription agreement.

Besides, the coal offtake agreement with Xcoal was amended, restated as well, subject to approval at the AGM, the term has been extended until 31 December 2025 or until the loading of a total of 6,575,000 metric tonnes of coal +/- 10% in Xcoalâs option.

As per the release, the subscription agreement would be subject to conditions, if the shareholders approve the amendments and relevant proposals, it would see an amendment in the working capital facility termination date and the maturity date of former VETL Pty Ltd loan to 31 July 2020.

On 5 August 2019, B2Yâs stock last traded at A$0.069, down by 12.658% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.