By the end of the dayâs trading on 5 August 2019, the S&P/ASX 200 Information Technology (Sector) declined by 5.46% to 1,371.5, while the benchmark index S&P/ASX 200 also declined on the ASX by 1.93% to 6,768.6. In this piece of article, we would be discussing five technology companies listed on the ASX, whose stock price tumbled on 5 August 2019. Let us have a look at what led to the fall in their stock price.

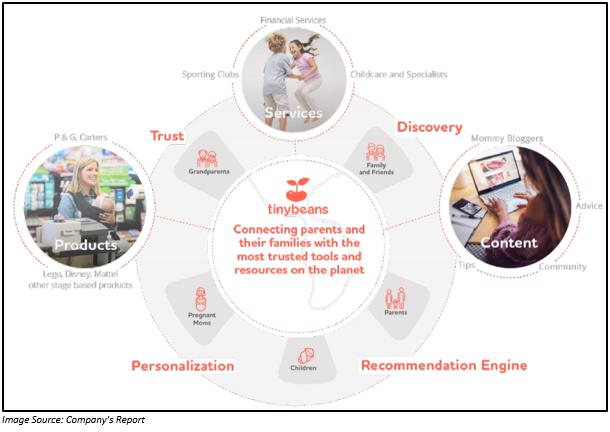

Tinybeans Group Ltd

On 1 August 2019, Tinybeans Group Ltd (ASX: TNY), engaged in providing a mobile and web-based social media platform to the parents to record and share valuable moments securely, announced the completion of a placement of 5 million fully paid ordinary shares to institutional and sophisticated investors. The issue price of each share of TNY was A$ 1 in order to raise nearly $ 5 million before costs.

The placement was supported by various new high quality institutional and sophisticated investors. The funds generated through the placement would be used by the company for accelerating growth in the segments of sales, marketing and product.

Stock Information

By the end of the trading session on 5 August 2019, the shares of TNY closed at A$ 1.080, down by 6.897% as compared to its previous closing price. TNY has a market cap of A$ 38.33 million and approximately 33.05 million outstanding shares.

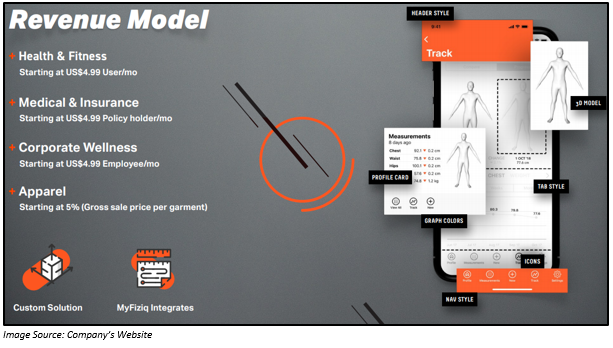

MyFiziq Limited

On 1 August 2019, MyFiziq Limited (ASX:MYQ), engaged in the development as well as marketing of a mobile application for usage in the fitness industry, announced that it received an additional payment of $ 500,000 via the placement with Asia Cornerstone Asset Management Pte Limited or ACAM.

As per the subscription agreement, the company would be receiving A$ 5,200,000. At present, the company has received an initial amount worth $ 3,700,000. The company would be issuing a total of 8,666,667 million fully paid shares in MYQ at an issue price of 0.60 cents per share. The shares would be issued in tranches.

Q4 FY2019 Highlights:

- MyFiziq Limited inked a binding term sheet with Evolt360 IOH Pty Ltd, under which Evolt would be targeting its existing more than 500k active users to obtain an initial 100k subscribers onto the joint offering in the first one year.

- The Toll Logistics app was released by the company to the first 2.4k of 12k Toll employees.

- The company also entered into a binding term sheet with Boditrax Technologies Ltd. The deal would see integration of MYQâs technology within the Boditrax platform, in addition to their new consumer facing mobile app.

- The company received a further $ 2,000,000 under the placement with ACAM.

- The company was granted with the Chinese Patent Protection.

Financial Highlights:

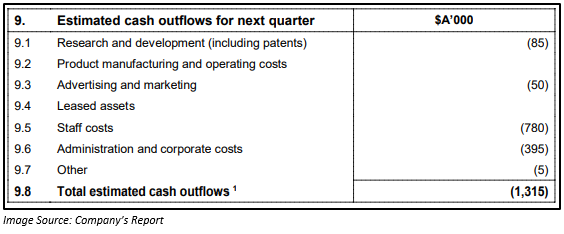

The company used A$ 1.224 million in its operating activities and A$ 0.241 million in its investing activities. There was a net cash inflow of A$ 1.875 million through the financing activities of the company. By the end of Q4 FY2019, MYQ had a net available cash balance of A$ 0.574 million. Expected cash outflow in Q1 FY2020 would be A$ 1.315 million.

Stock Information

By the end of the trading session on 5 August 2019, the shares of MYQ closed at A$ 0.155, down by 8.824% as compared to its previous closing price. MYQ has a market cap of A$ 16.63 million and approximately 97.85 million outstanding shares.

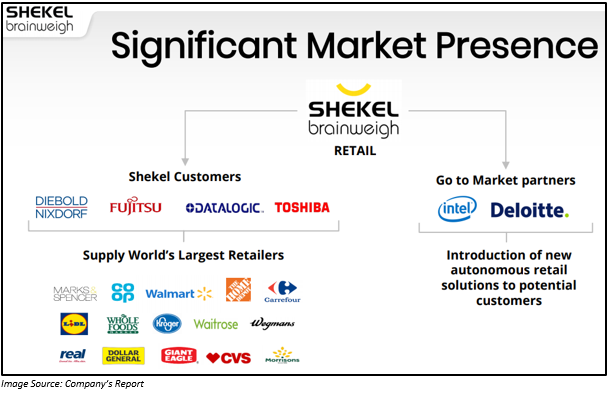

Shekel Brainweigh Limited

Advanced weighing technology company Shekel Brainweigh Limited (ASX: SBW) on 1 August 2019 announced that it entered into a non-binding Memorandum of Understanding (MOU) with Edgify for the implementation of a game changing technology for the self-checkout market. Under the MOU, both the parties would be using their competencies and implement a software solution which would recognize fresh produce during self-checkouts, automatically.

The combination of superior weighing technology of Shekel and machine learning with edge training technology of UK-based software company Edgify will be the first system of this type, enabling self-checkouts to train themselves. Thus, it would help to solve the major issues of the retailers as well as improve the efficiency of the retail supply chain. The solution would also help in accelerating the checkout process of customers.

At present, the parties are working to complete the non-binding MOU into a binding agreement. The marketing efforts as well as discussions are being carrying out with major international retailers.

Stock Information

By the end of the trading session on 5 August 2019, the shares of SBW closed at A$ 0.135, down by 3.571% as compared to its previous closing price. SBW has a market cap of A$ 19.46 million and approximately 139 million outstanding shares.

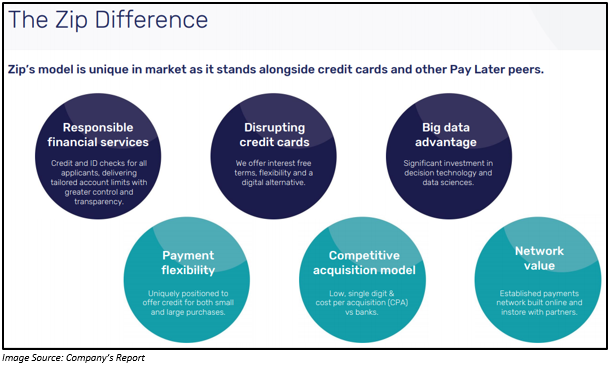

Zip Co Limited

On 1 August 2019, Zip Co Limited (ASX: Z1P), a provider of point-of-sale credit and digital payment services, announced that it had entered into a partnership with another well-known brand Big W, part of Woolworths Group Limited (ASX: WOW) to provide Zip interest free payments to its clients.

Zip s expected to go live Big W during 1H FY2020.

Stock Information

By the end of the trading session on 5 August 2019, the shares of Z1P closed at A$ 3.000, down by 9.91% as compared to its previous closing price. Z1P has a market cap of A$ 1.17 billion and approximately 352.14 million outstanding shares. Around 3,524,633 shares of Z1P traded on ASX on 5 August 2019.

Superloop Limited

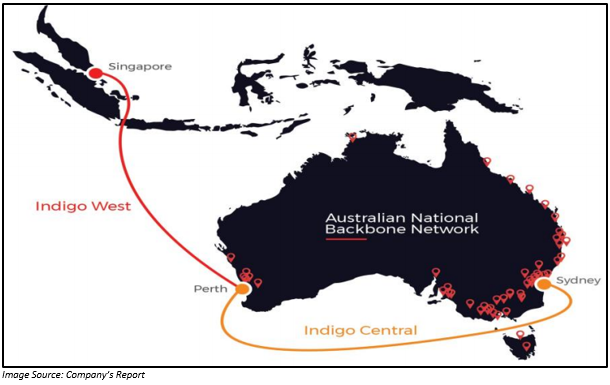

Superloop Limited (ASX: SLC), a provider of connectivity services designing, constructing and operating networks across the APAC region, on 1 August 2019 announced the completion of two major network projects.

The INDIGO subsea cable is now carrying live traffic from Perth to Singapore and throughout the Australia-wide footprint, thereby interconnecting all 121 NBN points of interconnection. The completion of INDIGO subsea cable is a major step in SLCâs vision, to change the way, APAC links, developing continuous city-to-city, building-to-building connectivity via fibre connectivity to bandwidth-intensive locations which include data centres, CBD buildings, hotels, hospitals, education campuses, etc., along with homes and businesses across Australia.

Revenue growth for the Core Fibre Connectivity is increasing across various markets including Australia, Singapore and Hong Kong.

The company also reported a 30% fall in revenue for the services segment, as a result of planned retirement of non-core cloud managed services component. Moreover, due to operational simplification along with synergies, there was a fall in operating cost in the fourth quarter of FY2019 of 15% when compared with the previous corresponding period.

Based on these developments, the company has provided a new guidance of FY2020, according to which it expects underlying operational EBITDA to be in the range of $ 14 million to $ 16 million, supported by robust development in core fibre connectivity business along with the return to growth of complimentary offerings, to be partially offset by a drop in the non-core cloud managed services business.

Stock Information

By the end of the trading session on 5 August 2019, the shares of SLC closed at A$ 0.970, down by 4.433% as compared to its previous closing price. PFP has a market cap of A$ 257.1 million with approximately 253.3 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.