The Australian property market scenario has been a matter of debate in the last few months, with the market going through a long phase of downturn due to a significant fall in housing prices. Analysts have been expressing their own anticipations regarding the much-debated Australian Property Bubble topic. Though, the recent improvement in property market prices has raised fresh hopes of the marketâs recovery in the near future.

Performance of Australiaâs Property Market (2017-19)

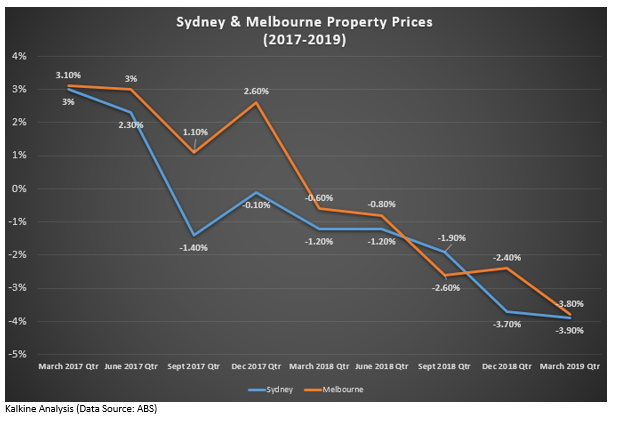

Let us study the trend of housing market prices in the last three years. The below diagram demonstrates the quarter-on-quarter percentage fall or rise in housing prices in Sydney and Melbourne since the beginning of 2017:

It can be seen that during June quarter of 2017, the Australian property market was experiencing a rise in housing prices across its two major capital cities - Sydney and Melbourne. Although at a reduced rate than previous quarter, the residential property prices rose by 2.3 per cent in Sydney and 3 per cent in Melbourne during June 2017 quarter. The quarter saw Sydney and Melbourne recording their largest year-on-year growth amongst all the other capital cities, with a rise of 13.8 per cent each.

The Sydney housing market prices began to decline from September 2017 quarter onwards, when the Residential Property Price Index for Sydney dropped by 1.4 per cent, following a rise over the last five quarters. Although the property prices continued to fall in Sydney since September 2017 quarter, the market experts are expecting a recovery during June 2019 quarter.

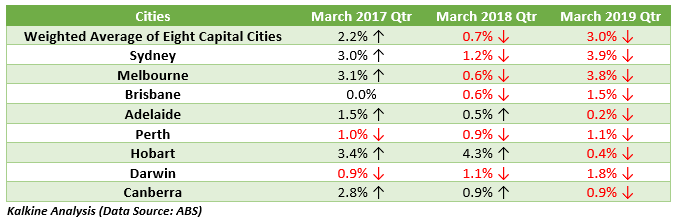

The below table shows the quarter-on-quarter percentage change in housing prices across eight Australian capital cities from 2017-19:

It can be seen from the above table that the Australian property market has witnessed a significant decline in March 2019 quarter relative to March 2017 quarter. Most of the capital cities were observing a rise in property prices except Perth and Darwin (no change in Brisbane) in 2017; while the prices fell considerably across all the capital cities in 2019. The property marketâs situation in March 2018 quarter was no better, with prices declining in all the eight cities, except Canberra, Adelaide and Hobart.

Property Bubble

Before moving on to discuss Australiaâs property bubble, let us first understand the meaning of âhousing bubbleâ. The housing bubble can be defined as the period in the real estate industry when the prices of properties are moving above average. It usually begins when the demand for properties overpower its supply, causing a significant rise in housing prices.

In the United States, the housing bubble bursted in 2007, with the sub-prime mortgage crisis leading to the 2008-09 global financial crisis and great recession. The country, during the low interest rate regime, experienced a rise in housing prices from 2001 to 2006, with prices touching a peak in 2006 and declining substantially afterwards.

Has Australiaâs Property Bubble Bursted?

Few economists believe that Australia is facing a property bubble currently, which is going to burst soon. While, some believe that Australiaâs property bubble has already bursted with a significant fall in the Australian property prices in the last few years.

Besides housing market prices, the country has been facing a plunge in dwelling approvals in the past few months. As per the recently released statistics by the ABS, dwelling approvals fell by 9.7 per cent (seasonally adjusted terms) in July 2019 against 1.2 per cent fall observed in the previous month. The decline in July 2019 was driven by a drop of 24.3 per cent approvals in Victoria and 17.5 per cent fall in New South Wales.

Although the dwelling approvals data of July 2019 provides a gloomy picture of the property market, the market has started showing some signs of recovery.

Is Australian Property Market Reviving?

Though the country has been facing a decline in housing prices in the last few years, the recently released statistics on housing market prices depict a different story. As we discussed in our previous article, the property prices in Sydney and Melbourne improved by 1.6 per cent and 1.4 per cent, respectively, in August 2019. This was the biggest monthly increase witnessed by Melbourne over the last two years and Sydney in the last three years.

Several macro/political developments including interest rate cut, rise in auction clearance rates, ease in lending rules and re-election of Morrison Government , seems to be initiating some form of housing recovery. The market experts believe that the recent moves taken by the Reserve Bank of Australia on reducing interest rates, and the APRA (Australian Prudential Regulation Authority) on removing 7 per cent home loan buffer are the two major reasons of expected housing market revival. Further rate cuts are also anticipated by the market players.

Is Buying a House Overrated?

As we know that the fall or a rise in house prices is driven by the supply and demand for houses in an economy. In the existing Australia property marketâs scenario, some analysts are advising to buy a house now at the lower prices as they expect house prices to rise in the years ahead.

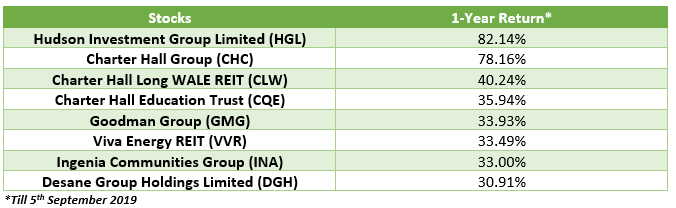

However, some are of the view that buying a house is an overrated decision. They believe that it is not a good idea to put a major share of your hard-earned money into one asset; rather diversified investment is a better option. As per these experts, investing in real estate stocks generate better, greater and faster returns than investing in a real estate. It has been observed that the pace of a rise in the property price is slower than the pace of rise in stock prices in related space.

Analysts suggest that even if one wants to invest in the real estate sector, one can take the route of investing in real estate stocks. There are several stocks listed on the Australian Stock Exchange that have delivered substantial returns in the last few years. Let us take a look at some of these stocks and their last 1-year return in the below table:

It can be inferred that the Australian property market is showcasing a mixed scenario, with a fall in dwelling approvals while a modest rise in housing prices. The uncertainty surrounding the property market continues to create a perplexing situation, with some expecting rebound while others anticipating a fall in property prices further.

Let us keep our eyes hooked at the property market developments!

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.