With the commencement of August 2019, many investors must be looking for stocks to buy this month. By the closure of the market session on 2 August 2019, the Australian benchmark index S&P/ASX200 was at 6768.6 points, down by 0.3 percent compared to its last close.

Letâs now look at a few ASX-listed stocks in which investors might be interested in:

WorleyParsons Limited (ASX:WOR)

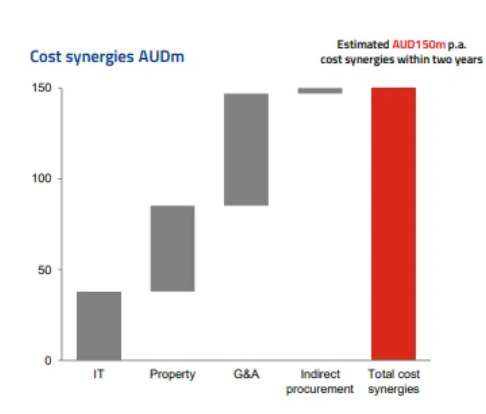

A leading global provider of professional project and asset services, WorleyParsons Limited (ASX: WOR) is currently focused on integrating the operations and deliver cost & revenue synergies, aligned with the existing strategic priorities, as mentioned in the Investor Dayâs presentation, released on 5 June 2019. The company has increased its cost synergy target to A$150 million from A$130 million.

Besides this, the company has also increased its focus on the development of the transformational strategy for the new Worley, which is expected to enhance the companyâs leadership position in chemicals & petrochemicals and capture the opportunities presented by the global energy transition while leveraging automation and the use of digital products.

Cost Synergy Target (Source: Companyâs Report)

On 31 July 2019, WOR notified that a hook-up and commissioning contract was awarded to the company by BP for its Mad Dog 2 project and the Argos deep-water platform. This is an encouraging piece of news for the company and its shareholders with WorleyParsons are looking forward to support BPâs North American strategy.

In the past six months period, WORâs stock has given a return of 13.89% as on 1 August 2019. At the market close, on 2nd August 2019, WOR stock was at a price of A$15.230 with a market capitalisation of circa A$8.34 billion.

Coles Group Limited (ASX:COL)

Australiaâs leading retailer, Coles Group Limited (ASX: COL) recently, on 18 June 2019 unveiled its refresh strategy, which is based on the 3 pointers mentioned below:

- Inspire Customers by offering best value food and drink related solutions to make peopleâs life smoother;

- Smarter Selling via efficacy and speed of change;

- Win Together along with team members and communities.

Through the strategy, the company intends to become the most trusted retailer in the Australian region a to develop long-term shareholder value, while truly differentiating itself in the Australian retail market. Through Smart selling, the company expects to deliver cumulative savings of around $1 billion by the financial year 2023. If that happens, it would be a great achievement for the company. Further, the company is also planning to optimise its store network to raise sales density as well as to enhance its profitability.

Soon on 22nd August 2019, the company is expected to unveil its FY19 results.

In the past six months, COLâs stock has increased by 11.51% as on 1 August 2019. At the market close, on 2nd August 2019, COLâs stock was at a price of A$14.020 with a market capitalization of circa A$18.74 billion.

COLâs Six-month Price movement (Source: ASX)

Audinate Group Limited (ASX:AD8)

A leading provider of professional digital audio networking technologies, Audinate Group Limited (ASX: AD8) recently on 16 July 2019 made its Dante AV Module⢠and the Dante AV Product Design Suite⢠products commercially available for manufacturers, helping them to add robust and integrated audio and video capabilities.

On 10 July 2019, the company completed its Share Purchase Plan (SPP) which was significantly oversubscribed with applications exceeding A$37 million. This announcement follows the successful completion of A$20 million placement, which was also substantially oversubscribed.

The funds raised from SPP and the placement would be used to expand global sales penetration as well as to accelerate recent product initiatives. Besides this, the funds will also be used to develop next generation Dante platform.

Companyâs Geographical Spread (Source: Companyâs Report)

In the past three months, AD8âs stock has increased by 22.15% as on 1 August 2019. At the market close on 2nd August 2019, AD8âs stock was at a price of A$7.410 with a market capitalisation of circa A$486.82 billion.

To know more about Audinate Group Limited click here.

Aristocrat Leisure Limited (ASX:ALL)

Manufacturer of casino gaming systems, Aristocrat Leisure Limited (ASX: ALL) recently commenced proceedings against Ainsworth Game Technology Limited (AGT) in relation to the breach by AGT of the Australian Consumer law.

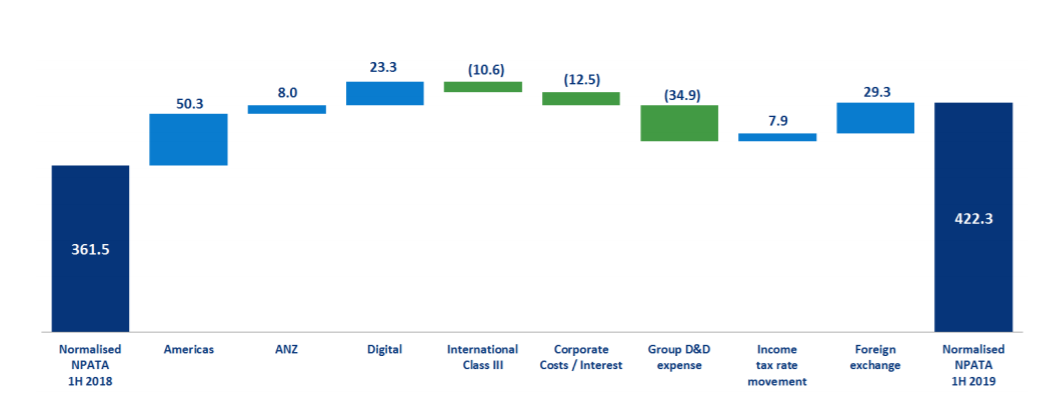

For the six months ended 31 March 2019, the company reported a normalised NPATA growth of 17%, mainly due to the strong growth across North America and Digital. The normalised revenue in the half year period was up significantly by 30% to $2.1 billion as compared to pcp.

For the half year period, the companyâs Board determined an Interim dividend per share of 22.0 cents per share which was 16% higher than pcp.

During the period, the company generated a Normalised operating cash flow of $439 million (HY18: $302 million) which shows the continued strength of the companyâs recurring revenue profile and cash flow generation capability.

NPATA bridge for the H1 FY19 (Source: Companyâs Report)

The company is presently focused on expanding its North American addressable market by moving into a number of market adjacencies.

In the past six months, ALLâs stock has increased by 24.70% as on 1 August 2019. At the market close on 2nd August 2019, ALLâs stock was at a price of A$30.320 with a market capitalisation of circa A$19.44 billion.

BlueScope Steel Limited (ASX:BSL)

Steel manufacturer, BlueScope Steel Limited (ASX: BSL) recently announced that it expects to earn underlying EBIT of around $1,350 million in FY19, representing 6% growth on FY18. This is lower than the companyâs earlier expectation of achieving 10% growth on FY18.

The company recently announced that it would extend the current on-market buy-back program by a further amount of up to $250 million, as part of its 1H FY2020 capital management program.

The company expects its FY2019 financial results to be release on 19th August 2019.

In the past three months, BSLâs stock has decreased by 4.29% as on 1 August 2019. At the market close on 2nd August 2019, BSLâs stock was at a price of A$12.290 with a market capitalisation of circa A$6.53 billion. The stock is trading at a PE multiple of 3.990x and has an annual dividend yield of 1.1%. BSLâs stock has provided a year till date return of around 17.14%.

Corporate Travel Management Limited (ASX:CTD)

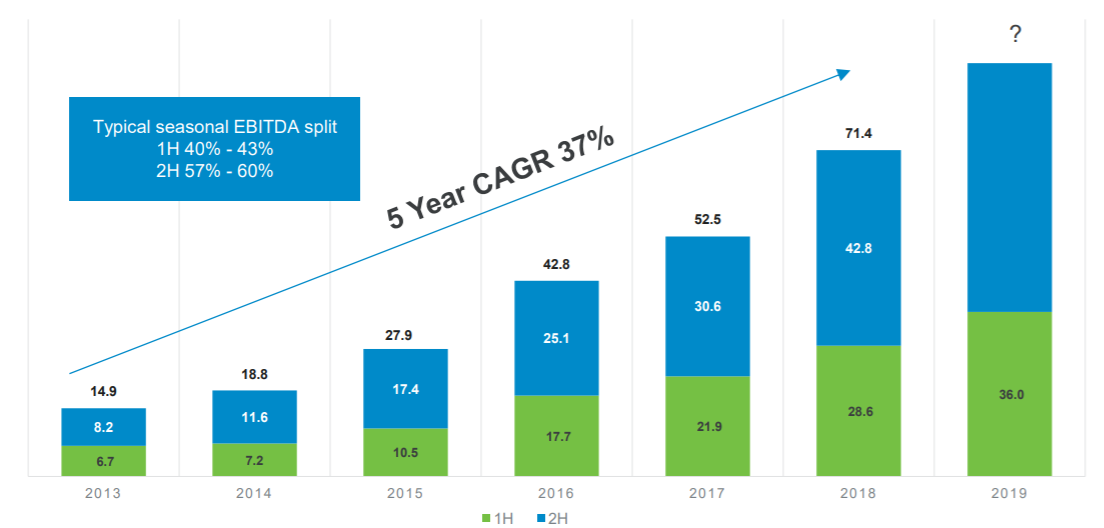

A global provider of innovative and cost-effective travel solutions, Corporate Travel Management Limited (ASX: CTD) reported a TTV (Total Transaction Value) growth of 31% in the first half of FY19. Along with this, the company witnessed a 21% growth in Underlying EBITDA and 25% growth in Statutory EPS.

The companyâs EPS has witnessed a substantial growth in the past few years as depicted in the figure below.

5 Year CAGR growth in EPS (Source: Companyâs Report)

The company recently announced changes in the holdings of its substantial shareholder Mitsubishi UFJ Financial Group, Inc. which now owns 7,507,368 ordinary shares of the company with 6.92% voting power.

The company recently announced the appointment of its new Global CFO by bringing Neale OâConnell on-board who has significant experience of working in various multinational companies.

In the past six months, CTDâs stock has decreased by 4.17% as on 1 August 2019. At the market close on 2nd August 2019, CTDâs stock was at a price of A$22.310 with a market capitalisation of circa A$2.47 billion. The stock is trading at a PE multiple of 28.620x and has an annual dividend yield of 1.71%. CTDâs stock has provided a year till date return of around 6.86%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.