WorleyParsons Limited (ASX:WOR) provides engineering, design and project delivery services to Hydrocarbons, Minerals, Metals, Chemicals and Infrastructure sectors. The company now deems to be a world-class hydrocarbons service provider, a key chemicals service provider and a leader in mining, minerals and metals.

At April end, the Group completed the acquisition of Jacobs Engineering Group Incâs Energy, Chemicals and Resources (Jacobs ECR) Division, for which it had entered into a binding agreement in October 2018. WOR paid a consideration of US$3.2 billion as a closure to the deal.

In the Investor Presentation released on 5th June 2019, the company discussed its perspectives, insights, capabilities and expertise from around the world for a bigger and brighter future of its shareholders.

Post-acquisition of Jacobs ECR, Worleyâs focus is aligned towards integrating its operations and delivering cost and revenue synergies with existing strategies. The company increased the cost synergy target from $130 million to $150 million, which is expected to deliver benefits over the next two years. WOR will enter in a transformational phase, enhancing its leadership position in chemicals and petrochemicals and grabbing opportunities arising from the global energy transition. This transition will see different reactions from different countries as a result of a change in the energy mix, and an increase in the annual sanctioned investments through 2025.

Cost synergies (Source: Company Presentation)

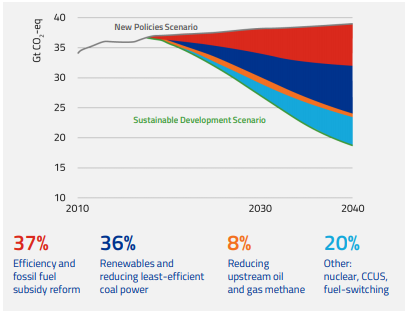

Impact of Global Energy Transition

With the global energy transition in place, a set of tremendous growth opportunities await Worley. There will be a sharp increase in the project sanctions in the midstream market, which is aligned to Worleyâs global footprint. An upstream investment estimated at 11% CAGR for gas and 4% CAGR for oil through 2022 is also expected. Additionally, the company will cater to the growing demand through the pick-up in approvals of new upstream projects.

There will be a major shift in the composition of demand in oil products with a fall in demand for gasoline and diesel, increased demand for chemical feedstock and decreased yield for residues. These changes will see CapEx investment (expecting 5.5% CAGR through 2022) for the purpose of upgrades and brownfield projects. Chemicals and Petrochemicals being a key contributor to the global oil demand will provide Worley with a strong growth platform with its geographic positioning in the investment hotspots.

Under the mining, minerals and metals sector, the companyâs core capabilities are aligned to aluminium, copper and nickel and lithium and cobalt, which are critical to the energy transition. Worleyâs digital and new energy capabilities will support new and existing mines to reduce the environmental impact of the extraction and processing operations.

The power sector has seen an investment trend towards low carbon power generation. In the power domain, the company will focus on growth through emerging technologies in hydrogen, power operations and maintenance, offshore wind power and distributed energy systems.

Energy transition opportunities in various sectors (Source: Company Presentation)

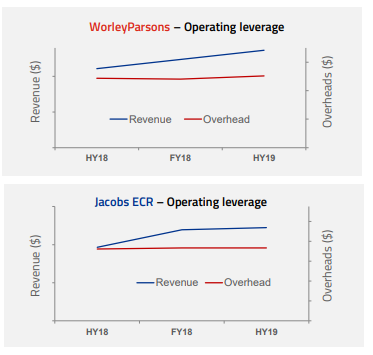

On the financial front, both Worley and Jacobs ECR have a sustainable cost program for revenue growth. The companies will focus on attaining further margin growth with a gross margin or overhead ratio. With continued address to revenue growth, gross margin, cost control and sustaining performance management, the businesses will focus on achieving operating leverage.

Key operating indicators (Source: Company Presentation)

A debt structure comprising of a new Syndicated Facility provided the Group with additional flexibility and liquidity to cater to working capital and strategic growth requirements. The new facility consists of a multi-currency revolving credit facility of US$500 million and term loans of US$800 million maturing in 2024.

To bring the planned transition into action, the company has strong leadership in place to deliver synergies. It has also involved a leading management consulting firm to mitigate the risk of planned synergies. With Regional Management in place, there will be clear and defined expectations for implementation of the synergies. Worley will be focused on four areas of synergy, namely cost, margin, shared services, and revenue.

Worleyâs transformation will help it claim new spaces in the markets where it currently serves. It will engage in creative partnerships with the customers and suppliers and deliver services that will mark a significant change in the industry.

On 30th May 2019, Worley announced another contract issued by Intecsa Industrial S.A. for its 100% owned subsidiary, Chemetics Inc. The company also reported a services contract assigned by Thai Oil Public Company Limited on 29th May 2019. For the half-year ended 31 December 2018, the Group reported revenues of $2,645.7 million, up by 9.8% against $2,409.4 million in the previous corresponding period. The profit before tax grew at a remarkable rate of 46.2% from $79.8 million in the prior period to $116.7 million in the current period.

Customer confidence and spend is growing as a result of improvement in the commodity prices. The consumption and demand of energy and resources have been increasing and global energy transition is assisting in core growth and emerging markets. Considering the above scenario, WorleyParsons is deemed to have an exciting and viable future.

At the time of writing (5 June 2019, AEST 4:00 PM), the stock of WorleyParsons Limited was trading at a market price of $13.140, up 1.546% during intraday. The stock is trading at a PE multiple of 27.77x, with an EPS of 0.466 AUD and annual dividend yield of 2.13%.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.