Investors enter into the securities market in a hope of gaining profitable return on the stocks, whether it is for a short-term or long-term period. Usually, for a long-term profile, an investor should invest in the long-term growth stocks.

Letâs now have a look at the 5 long-term growth stocks.

CSL Limited

CSL Limited (ASX: CSL) is an Australian registered company, which is involved in the manufacturing, developing and marketing of diagnostic and pharmaceutical products. CSL Limited was officially listed on Australian Stock Exchange in 1994.

Recently, the company, via a release dated 6th August 2019, announced that it will be releasing its full year results for FY 2019 on 14th August 2019. As per the release dated 17th July 2019, the company updated the market that it has named Ms Anjana Narain, as Executive Vice President and General Manager of its one among the worldâs leading influenza vaccines providers - Seqirus business, with effect from 1St August 2019.

CSLâs Financial Year 2020 Transition

The company had previously in February 2019 advised the market, that it would transition to its Good Supply Practice License in China in fiscal year 2020. Adding to that, this license allows the company to own and sell products in the domestic Chinese market. In order to support the transition, the company, via a release dated 21st June 2019 provided an estimate of the âone-offâ financial effects for the Group on FY20, which primarily includes expectation of lower sales of albumin, in the range of ~$340 - $370 million and Profit effect in accordance with historical CSL Behring margins.

In 1H FY19 report, declared in February 2019, the company reported net profit after tax amounting to US$1,161 million for the period, reflecting a growth of 10 percent on a constant currency basis.

On 12th August 2019, by the closure of the trading session, the stock of CSL Limited was at a price of A$222.78, with a market capitalisation of A$99.7 billion. The stock provided returns of 0.01%, 11.59% and 15.02% in the time span of one month, three months and six months period, respectively.

Transurban Group

The Australian registered company, Transurban Group (ASX: TCL) operates and finances toll roads along with managing the related consumer and government association. Transurban Group got listed on ASX (Australian Stock Exchange) in 1996.

Recently, the company, via a release dated 8th August 2019 announced successful wrap up of pro-rataâ institutional placement amounting to $500 million on 7th August 2019. The company would also be undertaking a non-underwritten Share Purchase plan, which is to be amounted at $200 million to the holders of the companyâs securities, who have registered address in ANZ region and meet certain eligibility criteria. Adding to that, the company will invite the eligible security holders under the Share Purchase Plan to subscribe for up to $15,000 of new securities per security holder.

The proceeds from the institutional placement and SPP would be utilised to finance the companyâs acquisition of the rest of the 34.62% interest in the M5 West for an amount of $468 million, as well as for general corporate purposes.

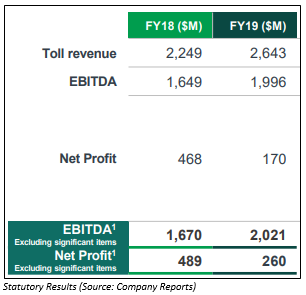

A look at the Full Year results

In the FY19 results, for the period ending 30 June 2019, declared on 7 July 2019, the company reported toll revenue of $2,643 million in FY19 as compared to $2,249 million in FY18, which comprises of the growth of $110 million fueled by traffic and revenue growth, throughout the current Australian and North American networks and growth of $284 has been driven by acquisition of A25 and consolidation of M5 West from September 2018. The company delivered a net profit of $170 million in FY19 against $468 million in FY18.

By the end of the trading session, on 12th Aug 2019, the stock of Transurban Group was at a price of A$15.150, witnessing a fall of 0.918% as compared to its earlier close. The stock provided returns of 0.40%, 12.50% and 21.35% in the time span of one month, three months and six months period, respectively.

LiveTiles Limited

LiveTiles Limited (ASX:LVT) is involved in the development and sale of software in Australia and overseas. LiveTiles Limited was officially listed on Australian Stock Exchange in 1999.

Recently, the company, via a release dated 9th August 2019 announced that LiveTiles AI Cyber-security solution, which was rolled out in June 2019 is now being offered directly, through partners and the LVTâs Microsoft co-sell arrangement in 39 countries. It further added that the AI Cyber-security solution has strong interest from government, educational organisations and corporate. The company works alongside and grow security capabilities of key Microsoft technologies. Its partner channel is driving the solution into new and current customers.

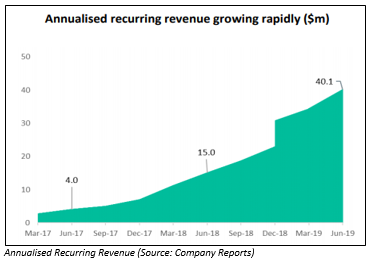

As at 30th July 2019, the company reported Annualised Recurring Revenue amounting to $40.1 million, reflecting a rise of 167% from the last 12 months. It reported 919 paying customers, which represents ongoing substantial enterprise customer base growth. It posted customer cash receipts of $7.9 million in the quarter ended 30th June 2019, reflecting a rise of 52% in comparison to March 2019 quarter and an increase of 130% on pcp.

In the June 2019 quarter, the company had delivered net operating cash outflow of $6.2 million, which comes up as a fourth consecutive quarter of net operating cash flow improvement. It is expecting increasing brand and product awareness, as well as conversion of a strong sales pipeline to deliver continued strong customer and revenue growth in financial year 2020 and beyond.

On 12th August 2019, the stock of LiveTiles Limited, last traded at a price of A$0.500 per share, up 3.093% from its last closing price, with a market capitalisation of A$320.42 million. The stock provided returns of -1.02%, 4.30% and 38.57% in the time span of one month, three months and six months period, respectively.

Nearmap Ltd

Nearmap Ltd (ASX: NEA) is into the provisioning of geospatial map technology for business, enterprises and government customers. Nearmap Ltd got listed on ASX in the year 2000.

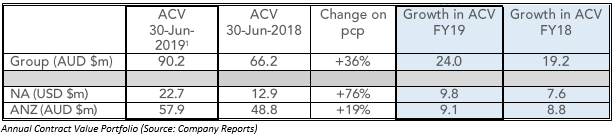

Recently, the company, via a release dated 12th July 2019 announced that it is expecting the results of FY19 to show another year of record growth. At the end of 30th June 2019, the company reported annualised contract value portfolio amounting to $90.2 million, reflecting the growth of 36% on pcp. With respect to North America Segment, the annualised contract value portfolio (ACV) stood at US$22.7 million as at 30th June 2019, reflecting a growth of 76%. In terms of Australia and New Zealand, it reported annual contract portfolio amounting to $57.9 million, which represents a growth of 19%.

Recently, the company, via a release dated 1st July 2019 announced that as a result of the lapse unexercised employee share options, the company has decreased the number of options on issue by total of 12,500 options at the exercise price of $0.40 with an expiry date of 30th November 2020.

After the close of the market, on 12th August 2019, the stock of Nearmap Ltd was at A$3.100, up 0.649%from the last close, with a market capitalisation of A$1.38 billion. The stock has produced returns of -14.44%, -13.48% in the time span of one month and three months, respectively.

Webjet Limited

Webjet Limited (ASX: WEB) is an Australian registered company, which provides full range of online travel bookings, service for flights, hotels, car hire etc.

Recently, the company via a release announced that Mitsubishi UFJ Financial Group, Inc. has become an initial substantial holder in the company, with the voting power of 7.78% on 2nd August 2019. Going forward, it also announced that Carol Australia Holdings Pty Limited and its related bodies corporate has also become initial substantial holder in the company with the voting power of 7.61% on 2nd August 2019.

The company in its Investor session: ORD Minett presentation released on 18 June 2019, primarily communicated about Rezchain and Rezpayments. Rezchain is a part of B2B division, WebBeds of the Webjet Limited. Rezpayment creates a cost effective, flexible solution in order to solve a complex and highly critical component of the paymentâs lifecycle.

It was also mentioned in the release that Rezchain has been a crucial element in shifting towards â8/4/4â structure from an â8/5/3â structure in the WebBeds division by FY22 period. â8/4/4â structure represents 8% revenue/TTV, 4% costs/TTV, 4% EBITDA/TTV.

The following picture provides an overview of B2B market:

The company reported gross margin of 100% in 1H FY19 in comparison to 35.6% in 1H FY18. WEB delivered EBITDA margin and net margin of 29.7% and 15.1% in 1H FY19 against 9.9% and 5.2% in 1H FY18, respectively. It posted return on equity of 4.7% in 1H FY19 as compared to 5.8% in 1H FY18. The current ratio of the company stood at 0.99x in 1H FY19, reflecting YoY growth of 6.4%, this implies that WEB has improved its capability to meet its short-term obligations. It delivered asset to equity ratio of 2.31x in 1H FY19 in comparison to 2.30x in 1H FY18.

On 12th Aug 2019, post the market close, the stock of Webjet Limited was at a price of A$13.450, up 1.28% from the last close, with a market capitalisation of A$1.8 billion. The stock has generated returns of -0.52%, -19.86% and 13.41% in the time span of one month, three months and six months period, respectively

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.