One of the worldâs largest toll-road operator, Transurban Group (ASX: TCL) is acquiring remaining 34.62% minority interests in M5 West for $468 million, taking its ownership to 100%. To fund the transaction, the company has already completed $500 million âpro-rataâ institutional placement. Besides paying for the acquisition of M5 West, the proceeds of the placement will be utilised for general corporate purposes.

M5 West is an existing Transurban asset and its 100% ownership will allow the company to realise operational synergies. Under the placement, the company will issue around 34.01 million new securities with settlement expected on Monday, 12th August 2019 and allotment on 13th August 2019.

Upcoming Share Purchase Plan (SPP): Along with the placement, the company is also planning to undertake a non-underwritten SPP, which is to be capped at $200 million. To be eligible for this SPP, the shareholder must have a registered address in Australia or New Zealand, and he/she should be a holder of Transurban securities as at 7:00 pm (AEST) on Tuesday, 6th August 2019.

Under the SPP, the eligible shareholders will be invited to subscribe for up to $15,000 of new securities per security holder at a lower of placement price of $14.70 per new stapled security and a price that is a 2% discount to the volume weighted average price of Transurban securities traded on ASX between 26th August 2019 and 30th August 2019.

FY19 Financial Performance: The company currently has 17 toll roads in Sydney, Brisbane, Melbourne, Australia, as well as in the Greater Washington Area and Montreal in North America. In Australia, the company served over 5 million customers and more than 3.6 million drivers preferred Transurbanâs roads in North America in FY19

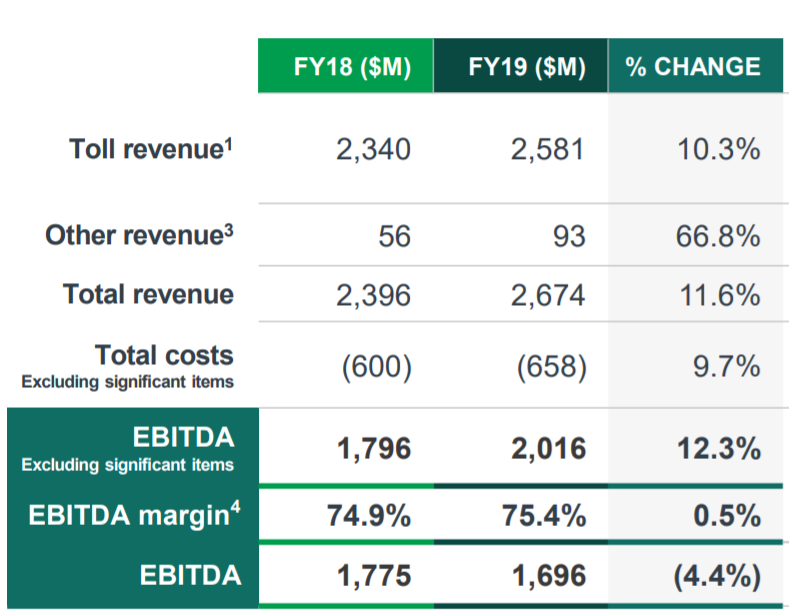

For the period ended 30th June 2019 (FY19), the company reported a 12.3% growth in EBITDA, reaching $2,016 million. The company reported 10.3% growth in its FY19 revenue, driven by traffic and revenue growth across the existing Australian and North American networks as well as $131 million increase from new assets and higher ownership in M5 West. The company also witnessed a traffic growth of 2.0%, driven by a combination of assets impacted by the construction, assets in ramp-up and mature assets across the portfolio.

Proportional Results of FY19 (Source: Company Reports)

The company has declared a final distribution of 30.0 cents per share, including 2.0 cents per share fully franked component. This has taken the FY19 distribution to 59.0 cents per share.

In Sydney, the company saw a toll revenue growth of 10.4% inclusive of New M4 and additional M5 West interests. Besides this, the company also witnessed an underlying EBITDA growth of 12.2% in Sydney. In Melbourne, the company saw a 5.5% growth in large vehicle traffic during FY19. The total revenue growth in Melbourne was 4.2% with underlying EBITDA growth of 4%. In Brisbane, the total revenue growth was 2.3% in FY19. In Brisbane, the company saw a large vehicle growth of 2.3%, outpacing car growth. Notably, in North America, the company witnessed a 45% revenue growth in FY19, with 19.1% toll revenue growth in the Greater Washington Area. In North America, the company witnessed an underlying EBITDA growth of 61.1% and ADT growth of 2.4%.

It has been an exceptional year for Transurban as it continued to build its portfolio for the long term, progressed development projects and expanded initiatives in the customer engagement, sustainability, technology and safety.

Last year in September, along with its partner, the company acquired 51% of Australiaâs biggest road project, WestConnex, and recently opened the first underground section, the New M4 Tunnels. It is believed that WestConnex will be transformative for Sydney and provide significant time savings for the companyâs customers with access to a critical link to the CBD, transport hubs and the cityâs orbital network.

In May 2019, just a few kilometres from Melbourneâs CBD, 500 workers completed construction of a giant launch site for the companyâs West Gate Tunnel Project. It is expected that the 90-metre long tunnel boring machines Vida and Bella will begin digging out the twin tunnels, which will change the face of transport in Melbourne by providing a much-needed alternative to the cityâs busiest river crossing, the West Gate Bridge. Along with this, the tunnels will also remove thousands of trucks from local streets daily.

Once complete, these projects, along with the companyâs nine kilometre NorthConnex tunnels in Sydneyâs northern suburbs and three express lanes projects in the USA, will offer valuable travel-time savings, safety and reliability for motorists, ultimately improving liveability and productivity in these cities.

The companyâs major achievements in FY19 include:

- 7 million trips, saving customers an average of 374,000 hours every workday;

- 2% average daily traffic growth;

- 4 major projects with lanes open: the Logan Enhancement Project, Gateway Upgrade North and Inner City Bypass upgrade in Brisbane and the New M4 Tunnels in Sydney, which was opened in July;

- A revised Sustainability Strategy â aligned with the UNâs Sustainable Development Goals â and continued development of the companyâs climate change management program.

To improve the customer experience, the company has completed the consolidation of all of its Australian retail brands into one national brand, Linkt. The new brand replaced CityLink in Melbourne, go via in Brisbane, and Roam Express in Sydney to provide a simpler and easier experience for customers. During the year, the company also acquired the Roam customer base in Sydney and transitioned these customers to Linkt in February 2019.

In order to understand its customers more properly, the company recently invested in a more advanced research platform, which gives it greater insights into customer behaviors, feedback and their service experience. The company also implemented a process to follow up any feedback through the Voice of the Customer program and resolve customer enquiries.

In FY19, the company refreshed customer-facing tools for its North America Express Lanes brand. The company updated its website, mobile app and customer materials to make it clearer for customers where they need to go to pay a toll, plan a trip or ask a question. The company also developed a new mobile app to make it easier for customers without accounts to pay for tolls.

Outlook: In FY2020, the company will continue to work with its construction partners to advance the eight projects across Australia and North America due for delivery in the next five years. The company believes that the projects will give customers and communities better and more direct connections around cities and will also be generating significant cash flow, allowing the company to grow distributions for its investors.

FY20 Dividend Guidance: For FY 2020, the companyâs Board has issued distribution guidance of 62 cents per security (cps), which is an increase of 5.1% on the FY19 distribution.

Stock Performance: In the past six months, TCLâs stock has provided a return of 24.43%. At market close on 8TH August 2019, TCLâs stock was trading at a price of $15.190, with a market capitalisation of around $40.74 billion. TCL has 52 weeks high price of $16.060 and 52 weeks low price of $10.620, with an average volume of ~5,604,673.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.