Most of the sale and purchase during the trading day involves a relatively small lots of securities. These trades account for the majority of the total volume traded on several major stock exchanges, globally, on a daily basis. However, not all trades are done in the same format. For larger transactions involving a big block of securities, the job is done in a different way, known as block trade.

What is Block Trade?

Block trade is typically defined as a single transaction of a large number of securities like stocks and bonds between two parties at an arranged price. The privately negotiated trading, which involves the sale or purchase of securities, is done apart from the public auction market, either on or off an exchange trading floor.

Single trades of at least 10,000 shares or $ 1,00,000 in value are typically considered for qualifying as block trades, which can also be considered as smart money trades, as only investors with huge money like venture capitalists and other large stockholders as well as institutional investors including mutual funds and pension funds can afford large trades. It directly involves communication with the broker community to find the buyer, with the broker arranging a sale off-market either at a fixed price or a price reached via a bookbuild process.

How Block Trade is Done?

Based on the price and time agreed between the counterparties, a block trade is made. Generally, an intermediary, known as Blockhouse, takes care of the block trades, rather than investment banks or hedge funds. Blockhouse are those entities that have a specialisation in dealing with significant volume trades. They are aware of the procedure, ensuring that the price of the security does not get triggered to a volatile decline or increase.

When a customer decides to transact a block trade, it establishes a relationship with the staff of a blockhouse, who brokers the market and fill the order via a number of sellers.

Several times, block trades are broken up into many orders of smaller size in order to execute them through different brokers.

Globally, several stock exchanges have started offering access to a block trading facility (BTF), owing to the fact that large investors, specifically overseas and OTC, overlook exchanges that are incapable of providing the facility of transacting the business of significant size. Over the years, preference for upstairs markets has grown, as they considerably lower the cost as well as uncertainty concerning the transaction of large orders relative to similar transactions in capital markets.

Though the existing automated trading systems continue to remain the primary method of securities trading on central markets, they have introduced BTF to enable the users to nominally transact large orders. Regulations on a block trading facility vary by exchange. Moreover, the reporting time of the block trade also differs between exchanges.

Block Trading Facility on ASX

In Australia, the Australian Securities Exchange offers a block trading facility to professional market users, enabling participants on ASX 24 to make bilateral arrangements for the transaction of huge volume away from the ASX Trade24 market. BTF was introduced by ASX in 2010, aimed at lowering the market impact as well as information leakage.

Advantages of BTF on ASX

There are several benefits for counterparties engaged in block trades on ASX. Some of them are as follows:

- Maximum Flexibility: ASX offers flexible order arrangement for block trading facility, as participants do not need to meet pre-arrangement, disclosure and withholding stipulations.

- Execution Certainty: The central market gives a thumbs up to block trades, provided they are done in prescribed contracts, as well as do not breach BTFâs business rules.

- Price Certainty: Participants of the block trades can conduct the transaction at any price agreed between them.

How Block Trade Impacts Companies?

Keeping in mind particular purposes, wealthy investors and institutional traders generally execute block trades. Their decision regarding the block trades is dependent on the evaluation of marketplace liquidity in relation to the order size. This type of trading is considered appealing to the participants on the purchase side, as it gives them the chance of obtaining access to huge orders at a fair price, relatively in a quick time period.

Since it is a major transaction, a block trade can have a huge impact on the value of the securities involved. However, it can be difficult to find out the outcome of the block trade for the investors.

Block deals can result in both negative and positive outcome on the price of a security. If transacted at a higher price, a block deal may increase the market price of the security; however, it may result in a decline in the market price as well, if the block deal is done at a price lower than the market price. The momentum remains the same for some sessions.

Let us have a look at a recent block trade in the Australian market, focusing on the seller side.

According to market reports, recently, shares of SEEK Limited (ASX: SEK) worth $ 5.5 million were sold under a block trade. Each share had a selling price of $ 21.57. SEEK Limited is a provider of online employment marketplace services in Australia as well as global markets. Operational for more than 20 years, SEEK is among the top jobs, employment, career and recruitment sites in the country.

The company has a strong portfolio of employment, education and volunteer businesses. Moreover, it serves clients in Australia, Bangladesh, Brazil, Mexico, New Zealand and China. Its operations are also spread across South East Asia and Africa.

Listed on the ASX in April 2005 and headquartered in Victoria, SEEK Limited has a market cap of $ 7.58 billion and 352.01 million shares outstanding. The stock settled the dayâs trading at $ 21.430 on 18 July 2019, down 0.42 per cent from its previous closing price. It generated positive returns of 23.89 per cent in last six months, while five-year returns stand at 26.81 per cent. The stock has an annual dividend yield of 2.14 per cent, while its EPS stands at $ 0.144.

SEEK Snapshot (Source: Companyâs Report)

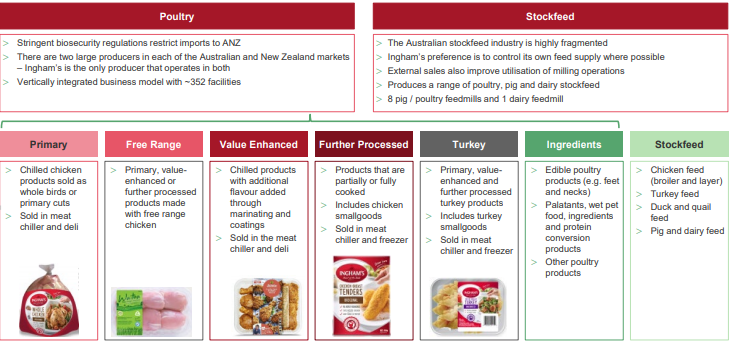

Moreover, in a block trade, a significant volume of shares of Inghams Group Limited (ASX: ING) were sold recently. Priced at $ 4.21 each share, 3 million shares of the companyâs shares garnered $ 12.8 million in the transaction. Inghams Group, founded in 1918, is an integrated poultry producer, catering to poultry, pig, dairy and equine industries. The company serves major retailers and quick service restaurant (QSR) operators, as well as food service distributors and wholesalers across Australia and New Zealand. Moreover, it has a strong foothold in the turkey and stock feed markets in Australia and dairy feed industries in New Zealand. Additionally, its business model includes 345 facilities and farms.

The value-enhanced poultry products provider has an employee base of 8,200 people, enabling it to maintain its product quality as well as best-in-class customer service. With a market cap of $ 1.54 billion and 371.68 million shares outstanding, ING stock is trading at $ 4.075 on 18 July 2019 (AEST 03:43 PM), down 1.807 per cent from its previous closing price. The stock generated positive returns of 16.82 per cent in the last one year, while its year-to-date return stands at 4.53 per cent. Inghams Group Limited has an EPS of $ 0.358.

Inghamâs Overview (Source: Companyâs Report)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.