Holding huge growth potential, small cap stocks are those companies that are often under-recognised and have a small market capitalisation. Strategies like strategic collaborations or capital infusion give these companies business growth. Having presence in new geographical boundaries as well as associations with other companies help small cap stocks in driving higher revenues.

In this article, we would discuss five small cap stocks with recent updates. Some of the recent announcements made by these companies are related to capital raising, new collaborations and quarterly financial performances. Let us have a look at their recent updates, in addition to their performance on the ASX.

iSignthis Ltd

iSignthis Ltd (ASX: ISX) is an IT-based company engaged in electronic payment verification and transactional banking operations, ensuring a smooth end to end user experience. Its solutions are Paydentity⢠and ISXPay®. The company, which is based out of Australia, acts as a Principal Member of Mastercard, ChinaUnionPay, Diners, Discover, among others.

Licensing Agreement with Singaporean unit of Visa Inc: Via a press release dated 8 August 2019, ISX informed regarding a new pact with the Singaporean subsidiary of global payments technology company Visa Inc. Under the Australian Principal Member licensing agreement, ISX would serve as a card acquiring institution for the merchant. Moreover, it would be responsible to process card not present (online/remote) payments and make settlements on behalf of the merchant from cards issued anywhere globally by other Visa Principal or Associate member institutions.

CFO Appointment: In an ASX announcement on 31 July 2019, ISX unveiled the appointment of Elizabeth Warrel for the post of Group Chief Financial Officer, effective from 2 September 2019. Elizabeth, who was associated with banking and financial services industry for more than twenty years, would report directly to iSignthis Ltd CEO John Karantzis.

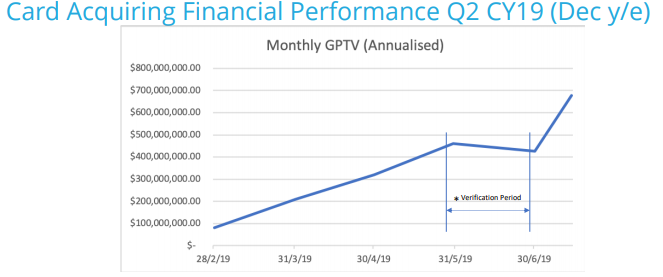

Q2 FY2019 Update: Revenue for the period stood at $ 6.3 million, while cash receipts reached $ 6.01 million. Annualised Gross Processed Transaction Volume (GPTV) of the company stood at $ 690 million (19/7/19).

Source: Companyâs Report

The companyâs EBIT target for FY19 stands at $ 10.7 million. Some of the other revenue streams of the company are BBS, transaction fees, set up fees, transfer fees, spot FX fees, and interest earned from operational banking activities.

Stock Performance: On 12 August 2019, the ISH stock closed the dayâs trading at $ 1.060, up 6% from its previous closing price. It has a market capitalisation of $ 1.09 billion and approximately 1.09 billion outstanding shares. The stock has given a good return of 198.51% and 488.24% in the period of last three months and six months, respectively.

Spectrum Metals Limited

A metal & mining company, Spectrum Metals Limited (ASX: SPX) is headquartered in Inglewood. Its ongoing projects are the Penny West Gold project, in addition to Whaleshark Copper-Gold project and First Hit Gold Project. The company is focusing on brownfield gold asset expansion in Western Australia, which could add value to its operations. Moreover, it plans to continue high-end drilling and exploration during the coming years.

Projects (Source: Company Website)

$ 7.25 Million Fundraising Program: On 1 August 2019, SPX announced to have secured firm commitments regarding a placement to institutional and sophisticated investors. The amount of $ 7.25 million planned to be raised would be utilised for an accelerated exploration program at high-grade Penny West/Penny North gold project in Western Australia, as well as for general working capital purposes. The company would issue 116,000,000 new shares at an issue price of 6.25 cents per fully paid ordinary share. The allotment is as per the companyâs 15% capacity under ASX listing Rule 7.1.

Stock Performance: The stock of SPX has delivered a stellar performance with a positive return of 452.63% and whooping 2000% in the last three and six months, respectively. The SPX stock closed the dayâs trading at $ 0.110 on 12 August 2019, up 4.762% from its previous closing price. The company has a market capitalisation of $ 145.48 million and approximately 1.39 billion outstanding shares.

PPK Group Limited

PPK Group Limited (ASX:PPK) is engaged in the production, support as well as innovation of underground coal mining equipment. The company got listed on the Australian Securities Exchange (ASX) in 1994.

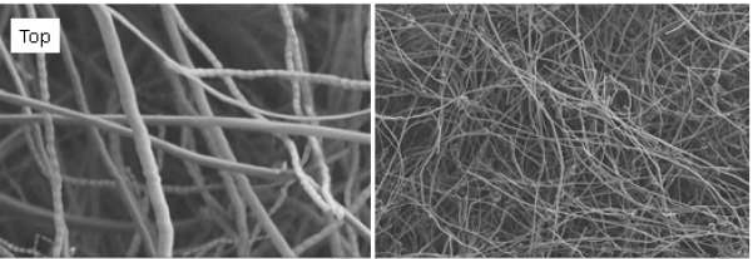

BNNT Technology Ltd Registered with NICNAS: On 1 July 2019, PPK Group Limited informed investors that according to BNNT Technology Limited, the latter has registered with The National Industrial Chemicals Notification and Assessment Scheme (NICNAS). PPK had unveiled the purchase of AICIC in the month of March. AIC Investment Corporation Pty Ltd or AICIC holds a stake of 50% of BNNT Technology Limited. BNNT owns a license contract, enabling the company to produce BNNT or Boron Nitride Nanotubes for 20 years (commercial basis). As BNNT Technology Limited is a registered manufacturer, it can produce BNNT in Australia for commercial purposes.

The figure below depicts BNNT manufactured by BNNT Technology Limited in the lab from the first stage base material.

Source: Companyâs Report

Fundraising Activities: The company, in early June 2019, had announced plans regarding a placement to raise $ 2.75 million for the payment of current loans and to strengthen its balance sheet. Moreover, PPK unveiled that it is holding discussions with a major financial institution for a new funding arrangement to meet increased working capital purposes. For the above placement, PPK is willing to give 1.1 million ordinary shares at an issue price of $ 2.50 per share to sophisticated investors.

Stock Performance: The stock of PPK Group has delivered a stellar performance with a positive return of 95% and 303.45% in the last three months and six months, respectively. The PPK stock closed the dayâs trading at $ 2.250 on 12 August 2019, down 3.846% from its previous closing price. The company has a market capitalisation of $ 193.02 million and approximately 82.49 million outstanding shares.

NetLinkz Limited

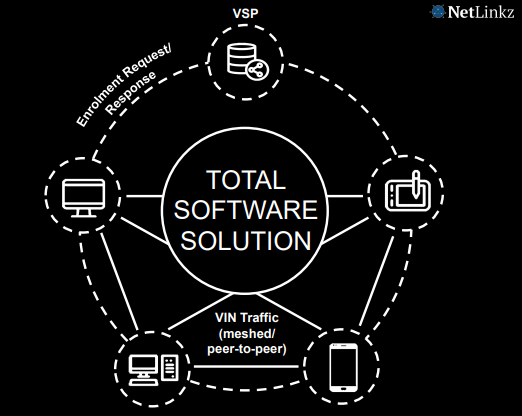

NetLinkz Limited (ASX: NET) is a technology company providing solutions relating to cloud network. The company provides security systems for all types of organisations. It has been awarded the title of a worldwide winner in the âGlobal Security Challengeâ and several other awards for its technology-driven solutions.

Source: Companyâs Report

Strategic Alliance with Beijing Digital Telecom in China: On 12 August 2019, NetLinkz announced that a distributor of NetLinkzâs products in the Asian country, China, namely JAST Limited, reached a deal with Henan D. Phone Trade Corporation Limited, which is the wholly owned subsidiary of Beijing Digital Telecom in the Henan Province.

Under the partnership and agency sales agreement, a cloud services provider model would be developed, using NetLinkzâs VIN and VSP products as the core software for that service. The agreement would enable Henan D. Phone to offer a secure cloud based private network to existing as well as new customer base. The deal would see JAST sell NetLinkzâs products and develop cloud services in the Henan Province, thereby positioning the former as a true value service provider in this sector.

Collaboration with China Communications Services: Via a media release on 7 August 2019, NetLinkz announced that its product distributor in China, JAST Limited, entered a strategic alliance with Sichuan Meixunda Communications Corporation Limited (a 100% owned subsidiary of China Communications Services Corporation Limited). Sichuan Meixunda Communications has access to 20 cities in Sichuan Province. Moreover, it has 381 retail units with more than 18,00 staff. It is a direct reseller of Huawei and Samsung.

Stock Performance: On 12 August 2019, the stock of NET closed the dayâs trading at $ 0.210, down 2.326% from its previous closing price. The company has a market capitalisation of $ 344.48 million and approximately 1.6 billion outstanding shares. The stock has given a return of 147.13% and 667.86% during the last three months and six months, respectively.

Biotron Limited

Biotron Limited (ASX: BIT) is a health care service provider, associated with the R&D and commercialisation of a novel small molecule approach with potential for the treatment of several viral diseases. The companyâs lead compound BIT225 is being developed to treat HIV-1 as well as Hepatitis C virus infections. Its headquarters is in Sydney.

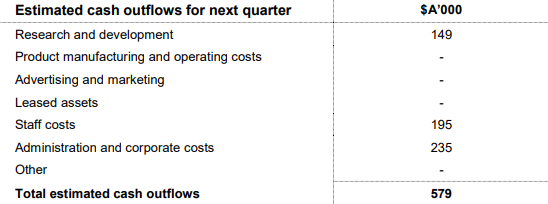

Quarterly Cash Flow Statement: The company, on 30 July 2019, reported details related to its cash flow position through a media release for the quarter ended 30 June 2019. BIT spent $ 320,000 on R&D, with total operating expense at $ 731,000. Net cash used in investing activities during the period stood at $ 13,000. Cash and cash equivalents at the end of the quarter reached $ 5.71 million. The company expects cash outflows of $ 579,000 during the next quarter ending September 2019.

Source: Companyâs Report

Stock Performance: The stock of BIT closed the dayâs trading at $ 0.075 on 12 August 2019, down 3.846% from its previous closing price. The company has a market capitalisation of $ 46.47 million and approximately 595.71 million outstanding shares. The stock has given a negative return of 1.27% and 29.09 % during the past three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.