The benchmark index S&P ASX 200 inched up 0.34% to settle at 6,825.8 on 30 July 2019. Meanwhile, S&P/ASX 200 Energy Sector last traded at 11,050.2, up 0.13% from its previous close, while S&P/ASX 300 Metals and Mining Industry and S&P/ASX 200 Materials Sector closed at 4,659.0 and 14,151.6, respectively, on 30 July 2019.

In this article, we will discuss three stocks, with Indago Energy Limited and Spectrum Metals Limited operating in the energy sector and SciDev Limited serving the mine water and mineral processing industry with its range of coagulants and flocculants.

Indago Energy Limited

Publicly listed energy company, Indago Energy Limited (ASX: INK) is in the business of exploring, developing and evaluating oil & gas prospects and technologies. The company was officially listed on ASX in 2006. It released its June 2019 quarterly activities and cashflow report on 30 July 2019. During the reported period, the company secured a contract to run a trial of its key product, HCD Multi-Flow®, for a major Canada-based oil producer in Alberta. It has started the trial and initial results are likely to be announced in August 2019.

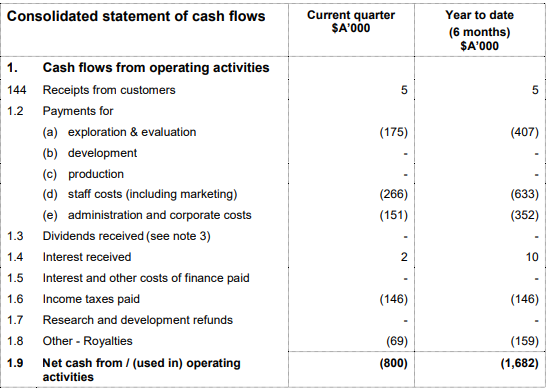

The company also reported to have secured approximately $ 80,000 worth of purchase orders from an independent oil producer in Texas. The orders are for the companyâs key product, HCD Multi-Flow® and related products. The HCD Multi-Flow® product will be placed in a five-well squeeze in highly paraffined wells in Anderson County Texas. During the quarter, the company also undertook a 1 for 3 rights issue, which raised $ 1.4 million in the month of June 2019. Its revenues for the sale of products stood at $ 4,700 during the June 2019 quarter. The company reported $ 800,000 net cash used in operating activities during the quarter.

Cash Flow (Source: Companyâs Report)

During mid July 2019, the company announced a change in the substantial holding of Stirling Mcgregor Super Fund from a 7.86% voting right and 13,698,524 ordinary shares to a 10.47% voting power from 26,485,658 ordinary shares.

Stock Performance: The stock of Indago Energy Limited last traded on 29 July 2019 at a price of $ 0.080 per share. It has a market capitalisation of $ 20.23 million and 252.92 million outstanding shares. The stock has generated returns of 116.22%, 135.29% and 66.67% for the last one month, three months and six months, respectively.

Spectrum Metals Limited

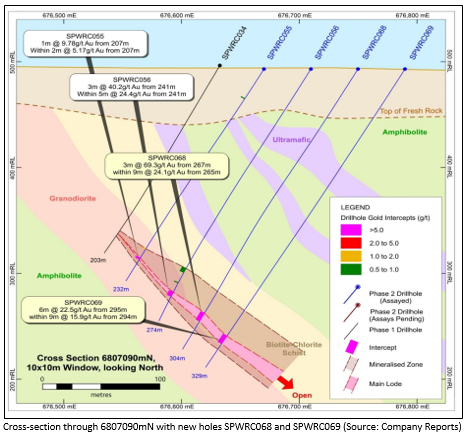

Western Australia-based resource development company, Spectrum Metals Limited (ASX: SPX) is engaged in the exploration and production of mineral resources. On 29 July 2019, the company updated the market with high-grade results from extensional reverse circulation drilling at Penny North. Key highlights from the results are as follows:

- A new hole, identified as SPWRC067, intersected 3m at the rate of 34.4 gram per tonne Au from 264m, which included 1m at the rate of 99.9 gram per tonne Au from 265m.

- Another drill hole was identified as SPWRC068, which intersected 9m at the rate of 24.1 gram per tonne Au from 265m, including 3m at the rate of 69.3 gram per tonne Au from 267m.

- SPWRC069 intersected 9m at the rate of 15.9 gram per tonne Au from 294m, which further included 6m at the rate of 22.5 gram per tonne Au from 295m.

- Drill hole SPWRC070 was identified, which intersected 2m at the rate of 16.6 gram per tonne Au from 274m.

On 24 July 2019, the company announced that Anthony Barton & Associates made a change to its substantial holding in SPX. Earlier, it had 90 million ordinary shares with a 7.1% voting power. According to the new update, the substantial holder now holds 107,500,000 shares, translating into an 8.5% voting power.

Stock Information: The stock of Spectrum Metals last traded on 29 July 2019 at a price of $ 0.075 per share. It has a market capitalisation of $ 94.84 million and 1.26 billion outstanding shares.

SciDev Limited

SciDev Limited (ASX:SDV), established in 2001 and headquartered in New South Wales, is a manufacturer and supplier of chemicals for the treatment of industrial and municipal wastewater. It also serves mining & mineral processing, water, and food and dairy products manufacturing industries. The company was officially listed on ASX in 2002. Recently, the company, via a release updated the market about its very first order from the US oil & gas market. The company reported that its US subsidiary SciDev (US) LLC secured an order for SciDev friction reduction technology, OptiFlox®, for application in the oil & gas market. As per the order, the company will make deliveries in the month of August and September 2019. The order will provide a total revenue amounting to $ 1,080,000.

Results of General Meeting

The company reported results for the general meeting of shareholders, which was conducted on 23 July 2019. The following resolutions were put before the shareholders at the meeting:

- Resolution 1- Re-election of Jon Gourlay as a Director

- Resolution 2- Issue of Options to Lewis Utting, Executive Director

- Resolution 3- Issue of Options to Jon Gourlay, Director

- Resolution 4- Issue of Options to Trevor Jones, Non Executive Director

- Resolution 5- Issue of Options to Simone Watt, Non Executive Director

March Quarter Performance

In the March 2019 quarter, the company entered a deal to secure exclusive distribution, marketing rights and strategic investment from Nuoer Group. SciDev Limited also received a purchase order for an OptiFlox® system from Peabody Energy in the US. During the March 2019 quarter, the company also wrapped up a capital raising of $ 2,500,000 through a rights issue and two-tranche share placement at a consideration of $ 0.06 each share.

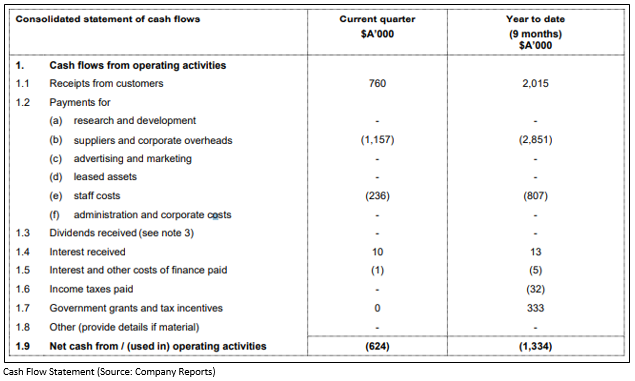

During the reported quarter, receipts from customers stood at $ 760,000, which were marginally higher in comparison to $ 669,000 in the December 2018 quarter. When it comes to the cash position, the company reported net cash utilised in operating activities of $ 0.624 million after making major payments for suppliers and corporate overheads and staff costs of $ 1.157 million and $ 0.236 million, respectively.

Stock Information: On 30 July 2019, the stock of SciDev Limited last traded at a price of $ 0.280 per share, down 3.448% from its previous closing price. It has market capitalisation of $ 31.11 million and 107.26 million outstanding shares. The stock has produced returns of 237.21%, 346.15% and 457.26% for the one month, three months and six months period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.