Indago Energy Limited, Arowana International Limited, Elders Limited, and Aumake International Limited, from the industrials and the Consumer Discretionary sectors trading flat on ASX today (AEST 2 PM, 16 July 2019). Letâs take a quick look at the updates from these four stocks.

Indago Energy Limited

Indago Energy Limited (ASX: INK), formerly known as Pryme Energy Limited and based in Melbourne, Australia, is engaged in the evaluation, exploration and development of upstream oil projects in Kentucky, Utah and Oklahoma. Besides, the company has a proprietary new oil technology that lets for the rapid, clean and cost-effective handling of heavy, asphaltenic and paraffinic oils. With a market capitalisation of ~ AUD 10.62 million and approximately 252.92 million shares outstanding, the INK stock was trading flat at AUD 0.050 (AEST: 2:22 PM, 15 July 2019).

In addition, the INK stock has delivered a positive return of 7.69% in the last one month.

Entry into Indian Oil market- On 15 July 2019, the company announced the receipt of approval to undertake its first field trial in India for one of Indiaâs pre-eminent producers, Oil India, using its key product, HCD Multi-Flow®. Indago has been assigned to treat a well in the Baghewala oil field using HCD Multi-Flow®, in northern India, wherein the field currently has seven wells in production with a further 15 wells planned for development. The existing wells currently produce ~ 40 barrels of oil/day, each having encountered significant declines over several years.

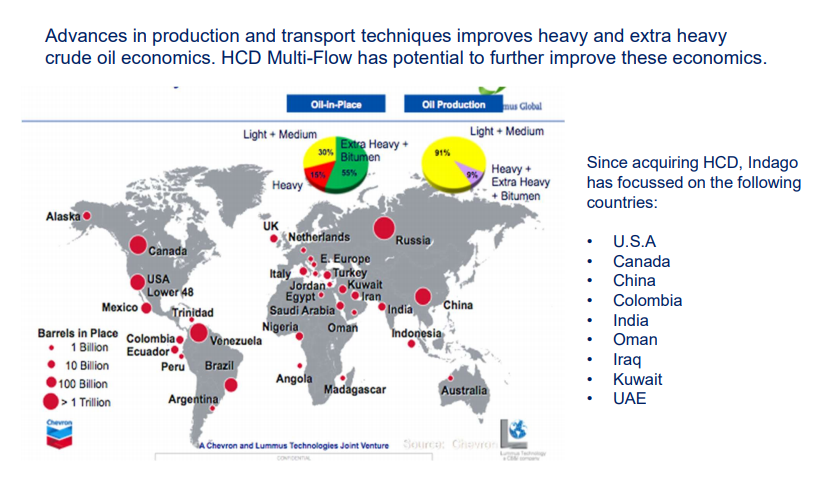

HCD Multi-Flow®, is a small, specially engineered carbon-based molecule that disaggregates & reliquefies the large agglomerations of waxes and asphaltenes naturally occurring in waxy and heavy crude oils. According to INK, 70% of the worldâs crude oil resource is heavy but represents only 9% of world production (see figure below)

Source: Annual rights Issue Presentation

Source: Annual rights Issue Presentation

The objective of the trial would be to reliquefy paraffinic and asphaltenic deposits in the formation and chelate salt scales in order to improve production rates, over a six-month period. The trial is expected to require ~ AUD 50,000 of HCD Multi-Flow® and companion products which will be paid subject to meeting certain production criteria.

Multi-Flow sales in Texas: Recently on 9 July 2019, the company informed to have sold ~ AUD 80,000 of HCD Multi-Flow® and related products to an independent oil producer in Texas.

Arowana International Limited

Arowana International Limited (ASX: AWN), based in North Sydney, Australia, operates as an investment holding company, that offers diagnostic testing, renewable energy, and education related services in Australia. In addition to that, the company is also engaged in the management of funds (both listed and unlisted). With a market capitalisation of around AUD 22.14 million with approximately 158.17 million shares outstanding, the AWN stock was trading flat at AUD 0.150 ( AEST: 3:39 PM, 16 July 2019)

VivoPower FY19 results - The company has announced on 15 July 2019, that its 61%-owned subsidiary, VivoPower, an international solar and critical power services company, released its financial results for the year ended 31 March 2019.

The financial year 2019 witnessed a substantial uptick VivoPowerâs results, with a major turnaround in performance during the 2nd half of the year. As reported, the companyâs revenue increased by 16% year-on-year to $ 39.0 million and the gross profit increased 23% to $ 6.3 million due to operational efficiencies and pricing initiatives.

There was a 54 % ($ 5.8 million) reduction in the corporate and solar overheads while the Net debt also reduced by $ 5.7 million to $ 14.7 million. During the year, VivoPower also sold its North Carolina projects for $ 11.5 million while the Critical Power Services business achieved record forward order book.

The company also added that its Australian solar development is gaining momentum and on track to deliver first 15 MW solar project and the solar portfolio sales management in the US has been reorganized to refocus its strategy in enhancing value and accelerating monetization.

VivoPowerâs new contract wins- On 24 June 2019, Arowana International announced that VivoPower had secured two new order from Kenshaw and J.A.Martin via its Aevitas business units in Australia, taking its forward order book to a new record high of AUD 75 million. This depicts a rise of more than 100% in a year, with expectations that this would be realised over the next 12 months.

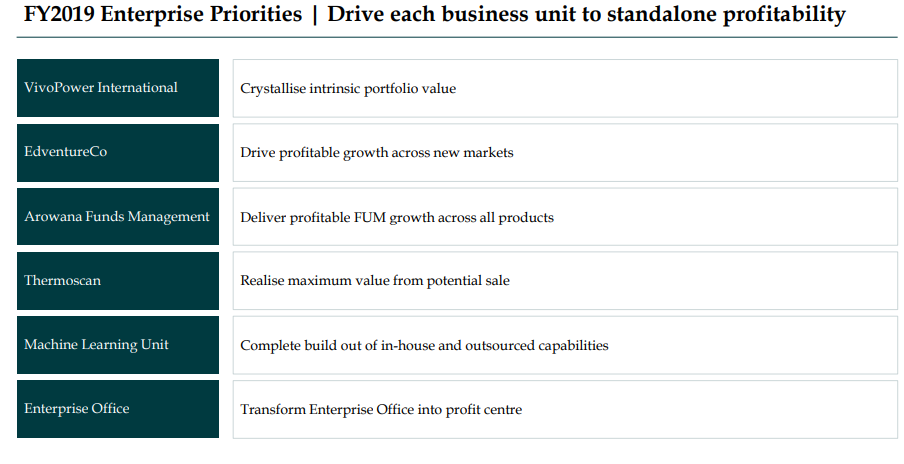

Going forward, the company aims to drive all its business units to standalone profitability (as depicted below).

Source: Annual Investor Presentation

Source: Annual Investor Presentation

Elders Limited

Elders Limited (ASX: ELD), headquartered in Adelaide, Australia, is engaged in the provision of real estate, livestock and wool agency services primarily to the rural and regional customers in Australia. With a market capitalisation of around AUD 717 million and approximately 116.97 million share outstanding, the ELD stock last traded on 12 July 2019 at AUD 6.130 and it has delivered a positive return yield of 5.33% in the last one month. The shares are on trading halt, due to a pending announcement on acquisition and equity raising.

Entitlement Offer - On 15 July 2019, the company had announced a fully underwritten accelerated pro-rata non-renounceable entitlement offer 1 : 6.7 fully paid ordinary shares held in ELD as at 7.00pm (Melbourne time) on 17 July 2019 to eligible shareholders.

AIRR acquisition â On 15 July 2019, Elders also announced that it has reached a scheme implementation deed with AIRR Holdings Limited (AIRR) for acquisition of 100% of AIRRâs equity for $ 10.85 per share. The purchase values AIRR at $ 187 million on an EV basis and $ 157 million on an equity basis.

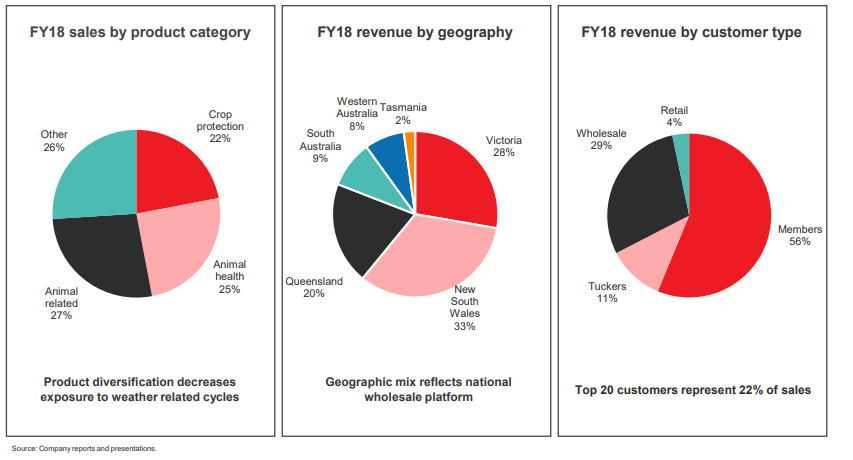

It presents a compelling acquisition rationale with a potential to deliver net synergies of $ 6.6 - $ 9.3 million per annum, to be gradually realised over the next two years. AIRR is highly diversified in terms of product, customers and geography.

Source: Investor Presentation 15 July 2019

Source: Investor Presentation 15 July 2019

Aumake International Limited

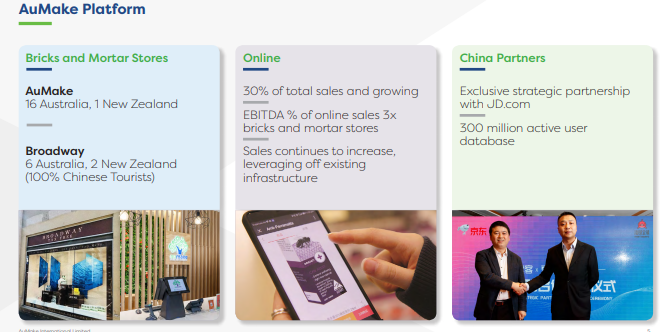

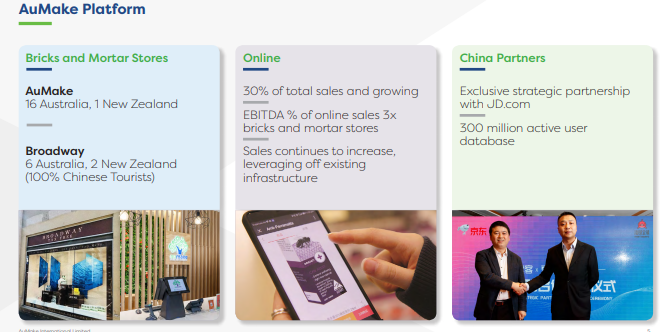

Aumake International Limited (ASX: AU8), based in West Perth, retails health care and cosmetic products as well as operates an online platform that offers dairy and baby food, vitamins and supplements, wool and leather, dairy, and cosmetic products to customers worldwide.

Source: Investor Presentation

Source: Investor Presentation

With a market capitalisation of around AUD 40.98 million and approximately 315.2 million shares outstanding, the AU8 stock was trading at AUD 0.130 (AEST: 3:50 PM, 16 July 2019).

Recently on 15 July 2019, Aumake International declared that its flagship online store had recorded the fastest growth in sales under the global supplementsâ category on JD.comâs Annual 618 Shopping Festival day, as reported by JD Worldwide. AuMakeâs JD store has delivered an impressive average monthly growth rate of over 100% to June 2019 ever since its launch in March 2019; and provides more than 290 SKUs of AuMake owned brands and other less well-known brands online.

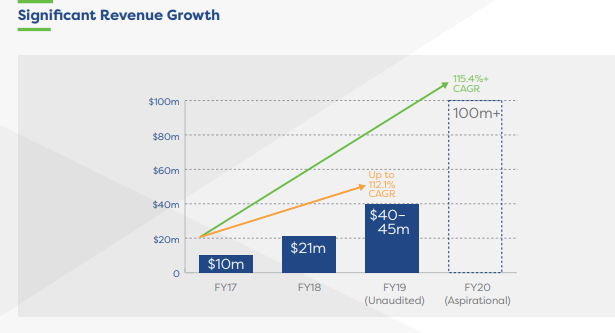

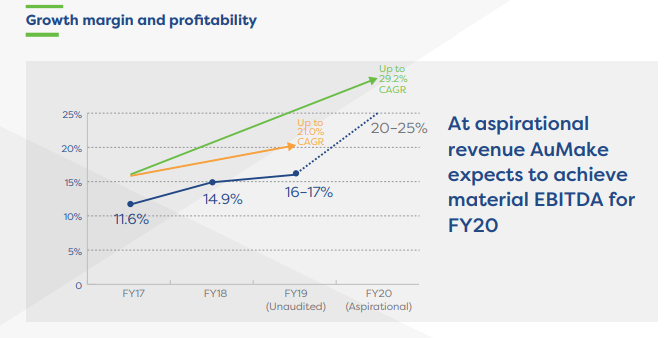

Moreover, AuMake is currently developing and implementing other new initiatives with JD.com. Going forward, the company aims to achieve a significant revenue growth on the following line.

Source: Investor Presentation

Source: Investor Presentation

Source: Investor Presentation

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.