The below-mentioned ASX-listed companies have come with significant updates today (i.e., 9th July 2019). Letâs take a quick look at these updates.

St George Mining Limited (ASX:SGQ)

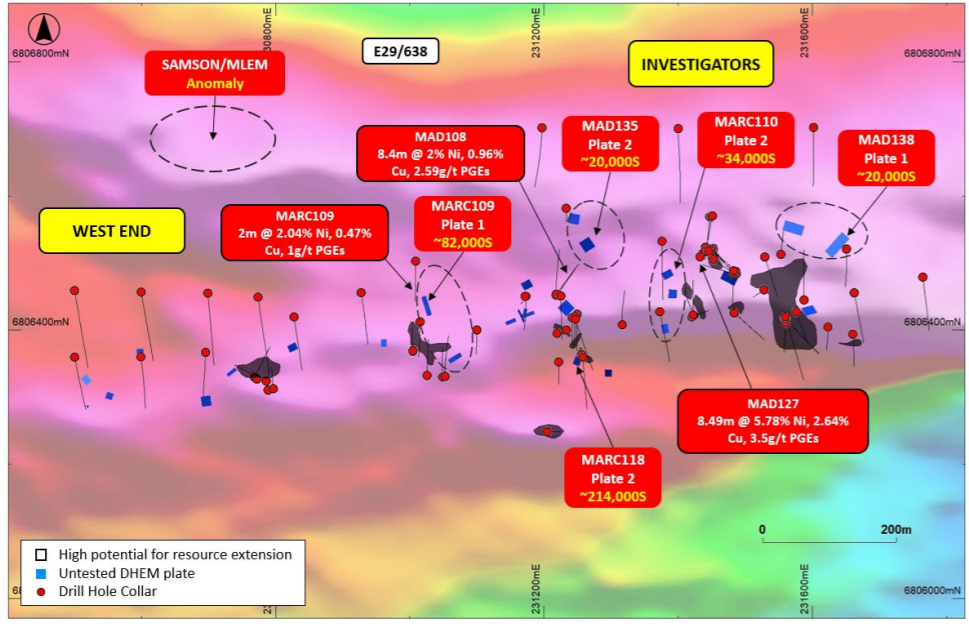

A mining exploration company, St George Mining Limited (ASX: SGQ) is soon going to commence a nickel-copper sulphide drill programme at its flagship Mt Alexander Project, located in the northeastern Goldfields. Through DHEM surveys carried out in drill holes, the company has identified a large number of priority EM targets for the nickel-copper sulphide drill programme.

The surveys identified 73 off-hole EM anomalies in total, which are indicating very strong potential for the presence of much more high-grade mineralisation than what has been recognised by the drilling to-date. Till now, all the EM conductors, which are tested in the Cathedrals Belt have been confirmed as nickel copper sulphides, giving a high level of confidence to the company in the new EM drill targets.

The below image illustrates the location of the new EM plates at Investigators.

Plan view of Investigators Prospect with drill hole collar locations over SAM (MMC) survey data (Source: Company Reports)

On the stock performance front, St George Mining Limitedâs stock has provided a negative return of 15.38% in the past six months. At market close on 9th July 2019, St George Mining Limitedâs stock was trading at a price of $0.117, up 6.364% during the intraday, with a market capitalisation of circa $36.88 million.

Indago Energy Limited (ASX:INK)

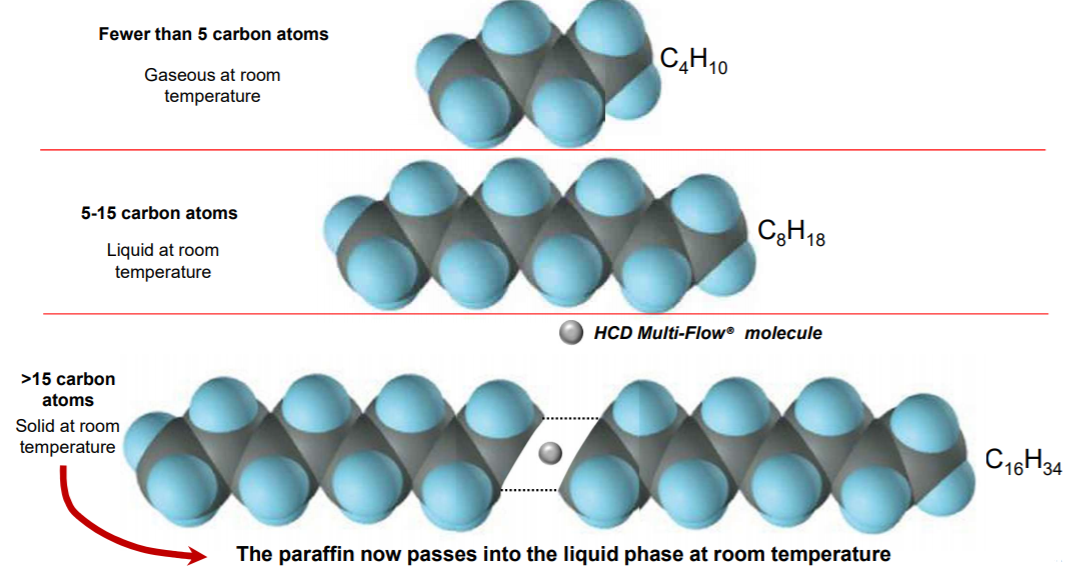

A Publicly listed energy company, Indago Energy Limited (ASX: INK) has sold ~$80,000 of HCD Multi-Flow® and related products to an independent oil producer in Texas. HCD Multi-Flow® will be used in a five well squeeze in highly paraffined wells and if the treatment meets expectations, it is expected that it may result in annual orders servicing over 20 wells.

HCD Multi-Flow® (Source: Company reports)

The company will also be performing two TST well clean ups to remove paraffin from two of the more difficult wells prior to the squeezes. Total sales opportunity would be around 140 drums of HCD Multi-Flow® annually with additional sales of 20 drums of HCD Salt Reducer and smaller amounts of HCD Bio-Nutrient and HCD MicroPhase bacteria.

On the stock performance front, Indago Energy Limitedâs stock has provided a negative return of 17.78% in the past six months. At market close on 9 July 2019, Indago Energyâs stock was trading at a price of $0.042, up 13.514%, with a market capitalisation of circa $9.36 million.

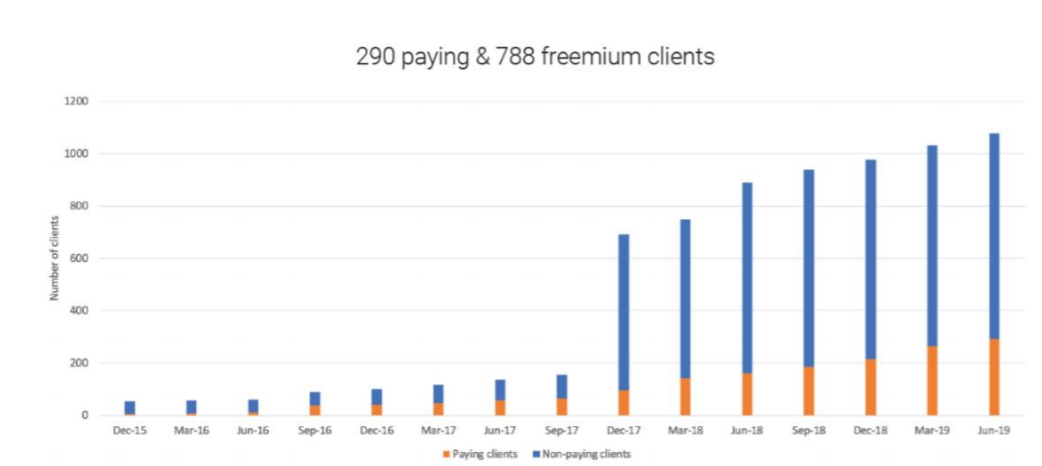

Registry Direct Limited (ASX:RD1)

An emerging Software as a Service company, Registry Direct Limited (ASX: RD1) intends to develop its core systems while gathering fee paying clients from listed, unlisted companies and trusts for its security registry software and services. In 2019 June quarter, the company reported 36 new fee-paying registers. The annual recurring revenue from these clients is around $47,000.

During the June quarter, the company released a new capability for issuers of trusts to make and manage distributions themselves. It is expected that this new capability will accelerate our rate of onboarding trusts.

Recently, on 1st July 2019, the Board announced that the company would raise around $646,400. Each shareholder on the register of the company on 8th July 2019 will be offered the right to purchase one new share at 1.5 cents per share for every three shares they hold.

During the June quarter, the company reported net cash used in operating activities of $251k, net cash used in investing activities of $123k and net cash from financing activities of $37k. At the end of the March quarter, the company had cash and cash equivalents of $132k.

On the stock performance front, Registry Directâs stock has provided a negative return of 28.00% in the past six months. Registry Directâs stock last traded at a price of $0.018, with a market capitalisation of circa $2.33 million as on 4th July 2019.

AirXpanders, Inc. (ASX:AXP)

A medical device company, AirXpanders, Inc. (ASX: AXP) has reported a revenue of $1.87 million in Q2 2019. In the US, the company earned revenues of around $1.79 million, which was 14% higher than the previous quarter.

Currently, the company is exploring opportunities to enhance stockholder value and enable the company to continue serving patients and physicians.

The companyâs shares are currently suspended on ASX and it was last traded at $0.035 as on 28 March 2019.

Vonex Limited (ASX:VN8)

On 9th July 2019, Vonex Limited (ASX: VN8) provided an update on the progress of the launch of the Oper8tor, which is a disruptive aggregated communications platform. The company has been undertaking 3rd party application unit testing and load testing over the past 3 weeks and during that time its technology development team has delivered several valuable improvements, which will optimise the Oper8tor user experience.

Besides this, the company has also identified the potential to secure additional intellectual property (IP) protection for Oper8torâs unique cross-platform SMS messaging functionality and it is expected that in the coming weeks, the company will be in a position to update investors on the new IP protections.

To complete Oper8tor development, testing and fully appraise its IP protection opportunity, the company has now decided to extend the testing window by an additional four to six weeks, ensuring that it delivers the best possible version of the platform and maximises the market impact on the launch, which the company will schedule after completing the testing.

The company recently partnered with Qantas Business Rewards (QBR) as a VoIP and Hosted Phone System telecommunications provider. This partnership is expected to provide valuable marketing support to Vonex over the next 24 months, presenting significant growth opportunities for the company.

On the stock performance front, Vonex Limitedâs stock has provided a return of 12.24% in the past six months. At market close on 9th July 2019, Vonex Limitedâs stock was trading at a price of $0.110, with a market capitalisation of circa $16.43 million. It has a 52-week high of $0.170 and 52 week low of $0.073, with an average volume of ~149,926.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)