Market participants take their position in accordance with the news flow, both fundamental and speculative, reflecting in the price movement, status of the ongoing developments, etc. Accordingly, the Australian Stock Exchange (ASX) comes up with the shorted data for stocks, depicting the sentiments of the investors for particular stock. In this article, we would be discussing five stocks that have been shorted by the market participants.

Syrah Resources Limited

Syrah Resources Limited (ASX: SYR) is engaged with production ramp-up of the Balama Graphite Operation in Mozambique and sales of natural flake graphite.

The company recently released its quarterly updates for the period ended 30 June 2019. SYR sold 53 KT in Q2 2019 against 48 KT in Q1 2019, as a result of higher contract volume and logistics. Weighted average graphite price stood at US$457 per ton which were down from US$469 per ton in Q1 2019, primarily on account of Chinese fines pricing and below the planned coarse flake production.

As far as Balama Graphite Operation is concerned, the company produced natural flake graphite of 44 KT, which was down 8% as compared to 1Q, on account of minor equipment issues. C1 operating cash cost of production for the first half of 2019 stood at US$567 per ton, above the planned owing to lesser production volume. TRIFR (Total Recordable Injury Frequency Rate) at the end of the period came in at 0.3.

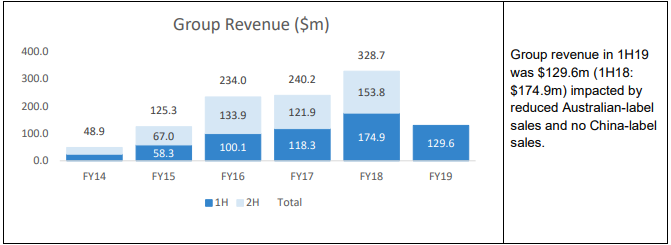

Balama Production Summary (Source: Company Reports)

For the BAM (Battery Anode Material) Project, the company informed that the first dispatch of purified spherical graphite would be made in Q3 2019, owing to the commissioning of purification circuit being in progress. Coming to the guidance, the companyâs production for CY19 has been projected in the range of 205 KT to 245 KT that would be pursuant to the ongoing analysis of sales volume, as well as production and quality performance.

The SYR stock closed the dayâs trading at $ 0.785 on 12 August 2019, down 5.988% from its previous closing price. With a market capitalization of $ 345.17 million, the stock is trading close to the low of its 52-week range of $ 0.755 to $ 2.775. The stock has given a negative return of around 44% on YTD basis. Stock experienced a short interest of ~13.41% (as per the ASIC report of 06 August 2019).

Bellamyâs Australia Limited

Bellamyâs Australia Limited (ASX: BAL) offers organic food as well as formula products. The company recently notified that Fort Canning Investments Pte Ltd and each of the associate entities have become the initial substantial holder with the voting rights of 6.94%.

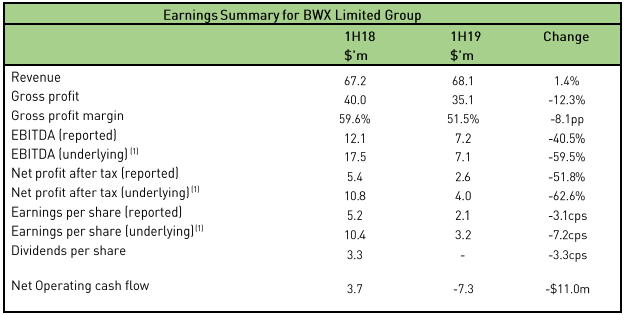

H1 FY19 Performance Highlights: The company posted revenue of $ 129.6 million in H1 FY19 ended 31 December 2018 as compared with $ 174.9 million in H1 FY18. The decline in revenue can be attributed to a drop in Australian-label sales and no China-label sales. Normalised EBITDA at $ 26 million in the period was also lower than the H1 FY18 normalised EBITDA of $ 34.9 million. Gross margin at 42.8% in H1 FY19 was stronger than 37.1% in H1 FY18 and marginally up from 42.5% in H2 FY18.

Group Revenue (Source: Company Reports)

The balance sheet has remained strong with group cash increasing to nearly $ 95 million. At the end of the period, the company had no debt on the balance sheet with continued access of working capital debt facility amount to $ 40 million.

Going forward, the company has provided FY19 guidance with group revenue to be in the range of $ 275 million to $ 300 million. Normalised group EBITDA for FY19 is likely to be in the range of 18% to 22% of revenue.

The BAL stock closed the dayâs trading at $ 9.320 on 12 August 2019, up 0.323% from its previous closing price. The stock is available at the price to earnings multiple of 37.31x. The stock has corrected ~5% in last 1 year. Stock experienced a short interest of ~15.91% (as per the ASIC report of 06 August 2019).

BWX Limited

BWX Limited (ASX: BWX) is engaged with the development, manufacturing, distribution and marketing of branded skin and personal care products with key focus on natural segment of the beauty and personal care market.

The company recently announced that it has executed an amendment and extension to its existing debt facility till July 2022, which was about to expire in the month of June 2020. BWX also updated that Mr Alistair Grant has been appointed as Company Secretary and Chief Legal Officer, with the effective date of 30 September 2019. Along with this, Mr David Fenlon joined the company as Group CEO and Managing Director from 01 July 2019.

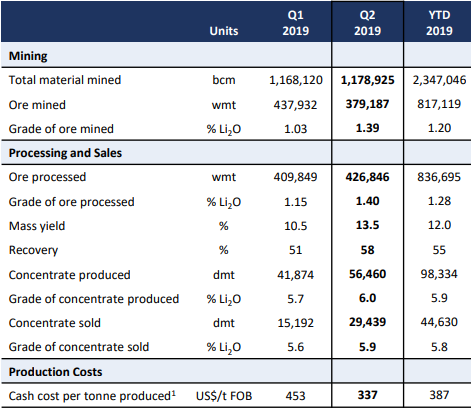

1H19 Performance Highlights: The company posted a yoy growth of 1.4% in topline to $ 68.1 million in 1H19. Reported EBITDA at $ 7.2 million, which was down 40.5% year-on-year, while reported NPAT also posted a steep decline of 51.8% as compared to the prior corresponding period, reaching $ 2.6 million during the first half of 2019. However, the company saw a significant improvement in operating performance of the second quarter which included early stages of realisation of benefits from ERP platform implementation. Net assets of the company at the end of the period stood at $ 277.416 million as compared to $ 270.028 million at the end of 30 June 2018.

1H19 Earnings Summary (Source: Company Reports)

The Management revised its guidance for FY19 with underlying EBITDA to be in the range of $ 27 million to $ 29 million from the earlier guidance of $ 27 million to $ 32 million.

The BWX stock closed the dayâs trading at $ 2.260 on 12 August 2019, down 2.165% from its previous closing price. The stock is available at the price to earnings multiple of 16.620x with dividend yield of 1.82%. Stock has corrected ~53% in last 1 year. Stock experienced a short interest of ~11.96% (as per the ASIC report of 06 August 2019).

Galaxy Resources Limited

Galaxy Resources Limited (ASX: GXY) is engaged in the production of lithium concentrate as well as exploration of minerals. The company focuses on countries including Australia, Canada and Argentina.

The company recently updated that non-cash impairment for 1H19 has been estimated in the range of US$ 150 million - US$ 185 million and the final amount will be updated with the results of 1H19 which are due to be announced in late August 2019.

Highlights of June 2019 Quarterly Activity: The company mentioned that Mt Cattlin produced 56,460DMT (dry metric tonnes) grading 6.0% Li2O, surpassing the production guidance range of 45,000DMT to 50,000DMT. The company shipped lithium concentrate of 29,439DMT in the quarter. The Management provided FY19 production range to be 180,000 - 210,000DMT for the full year.

Production & Sales Statistics (Source: Company Reports)

The GXY stock closed the dayâs trading at $ 1.295 on 12 August 2019, down 2.632% from its previous closing price. The stock is available at the price to earnings multiple of 2.55x. Currently, the stock is trading at the lower end of the 52-week range of $ 1.085 to $ 3.070. Stock experienced a short interest of ~16.21% (as per the ASIC report of 06 August 2019).

NEXTDC Limited

An Australia based data centre operator, NEXTDC Limited (ASX: NXT) recently notified that Macquarie Group Limited and its controlled bodies corporate have become a substantial holder in the company with voting rights of 5.12%. The company also updated the market participants about the raising of $ 200 million in senior unsecured debt through an additional fixed and floating rate tranche of its existing $ 300 million Notes IV.

1H19 Performance Highlights:

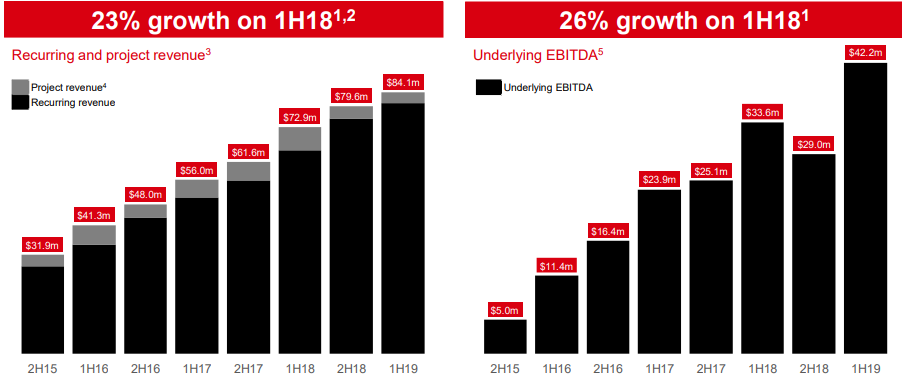

The company posted a yoy growth of 17% in top-line to $ 90.8 million in 1H19 with contract utilisation growth of 28% to 50.4MW whereas interconnections posted a growth of 34% to 9,982, reflecting 7.7% of recurring revenue. Underlying EBITDA at $ 42.2 million posted a yoy growth of 26% during the period. Operating cash flow was down $ 11.8 million or 44% to $ 15 million during 1H19.

Revenue and EBITDA Growth in 1H19 (Source: Company Reports)

The company revised its FY19 revenue guidance to the range of $ 180 million - $184 million from the previous guidance of $ 183 million to $ 188 million. FY19 guidance range for underlying EBITDA is $ 83 million - $ 87 million. The company is likely to incur the capex in the range of $ 430 million to $ 470 million in FY19.

The NXT stock closed the dayâs trading at $ 6.340 on 12 August 2019. The market capitalisation for the stock stands at $ 2.18 billion. Stock experienced a short interest of ~13.689% (as per the ASIC report of 06 August 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.