Short selling is that selling process in which the investor borrows shares, sells them in the market, then makes a repurchase of the same shares and returns it back to the lender, to close the trade. The investor is making a bet that the share price will drop from the levels at which the trade was placed. The investor who enters a short trade usually has a bearish view on the stock price. However, short selling is also carried out by arbitrage traders to make profit out of arbitrage trades. Short selling is a useful tool for hedging purpose as well.

Interestingly, short sellers bear the brunt, in case of market sell off as they are perceived to be praying for the demise of a business. Certain countries do not allow short selling on their exchanges. However, certain market participants believe that short selling is a healthy activity, for it ensures that the bad participants in the market are on their toes. Also, short selling ensures a balanced force in the market.

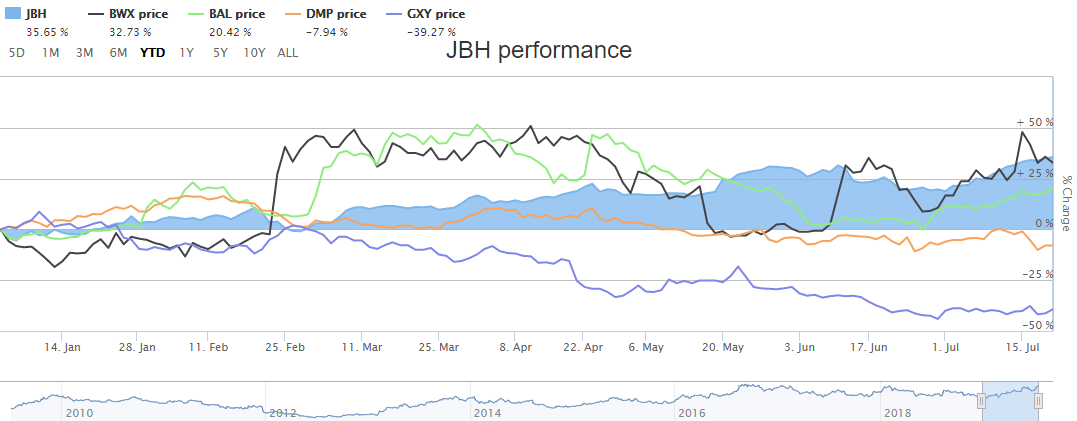

Below is the YTD return of the five shorted stocks on ASX; JBH, BWX, BAL, DMP, GXY.

YTD Performance of the 5 stocks, Source: ASX

Let us now have a look at the five shorted stocks as follows:

BWX Limited

2019 Trading EBITDA Guidance downgraded twice, and the company refinanced the debt which will lower the cost of financing:

BWX Limited (ASX: BWX) reported short position of 15027103 (as on ASIC, dated 16 July 2019). BWX stock has generated a negative return of 7.20% in the last three months as on July 22, 2019. Its YTD return stands at 32.73%. Also, BWX stock last traded at A$2.280, up by 4.11 percent from its prior close.

On 26 May 2019, the company projected that Sukin brand will be affected in the fourth quarter of 2019 on the back of nonpaying promotions and needless building of stock.

As a result, the company had further downgraded the guidance of Trading Earnings Before Interest, Tax, Depreciation and Amortisation for FY 19, which is now anticipated to be in the range of $21 million to $23 million from earlier expectation to be in the range of $27 million and $29 million, as mentioned in 1H19 financial report ended 31 December 2018. The company was initially anticipating FY 19 Trading Earnings Before Interest, Tax, Depreciation and Amortisation to be in the range of $27 million and $32 million.

However, for fiscal 2020, the company expects the margin to improve and the trade investment to reduce. On the other hand, BWX is restructuring its global business and the company now have Mr David Fenlon as the new Global CEO and Managing Director, effective from 1 July 2019.

Further, the company in May 2019 has notified that it was looking for a new President for BWX Brands, USA as the founders of Andalou Naturals, Stacey Kelly Egide and Mark Egide have planned to leave the company.

On 12 July 2019, BWX informed the market that it had refinanced its existing debt at lower margins and the tenure for the expiration has been extended to July 2022 from June 2020. This is expected to lower the financing cost of the company.

Bellamy's Australia Limited

Delay in Getting Approval of SAMR:

Bellamy's Australia Ltd (ASX: BAL) has reported short position of 18959127 (as on ASIC, dated 16 July 2019). On 24 April 2019, the company is taking strategic steps to recommence the sales in the China through offline channel, as well as is working on the execution of its multi-tier product strategy. The company is waiting to get the approval of SAMR to produce organic formula-series that is planned to be made at the Camperdown Powder facility in Melbourne, Victoria.

Meanwhile, ViPlus Dairy has received the approval for its bovine formula-series in which the company is also involved. Overall, until the company receives SAMRâs approval, the company will not able sell their product in China, which will affect the companyâs topline.

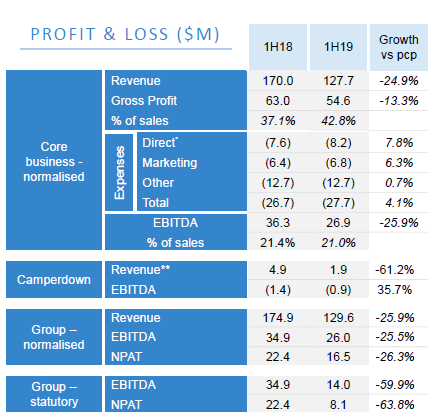

Therefore, considering lower revenue due to delay in SAMRâs approval, for FY 19, in 1H19 results published on 27 February 2019, the company mentioned the Group Revenue to be in the range of $275-300m and Normalised Group EBITDA to range between 18-22% of revenue.

BALâs stock has given a negative return of 4.99% in the last three months as on July 22, 2019. The stock of BAL last traded at a price of level A$9.4, up by 2.845% from its previous close.

1H19 profit impacted by lower revenue and scale (Source: Companyâs Report)

Domino's Pizza Enterprises Limited

Legal Action Against DMP:

Domino's Pizza Enterprises Limited (ASX: DMP) has reported the short position of 9712653 18959127 (as on ASIC, dated 16 July 2019). DMPâs stock has given a negative return of 15.49% in the last three months as on July 22, 2019. The YTD return of the stock was -7.94%. The DMPâs stock, by the closure of the trading session, was at A$37.6, up by 0.347 percent from its prior close.

According to its announcement on 25 June 2019, DMP is facing legal action regarding its pay entitlements. Phi Finney McDonald on behalf of Australian franchisee employees has filed the legal action against DMP. He was working for the company from 24 June 2013 till 23 January last year. The company will now be defending against this case in the Federal Court of Australia.

Meanwhile, for FY 19, the company had projected the Same Store Sales to be at the mid-to-lower end of the range expected to be +3% to 6%. The 2019 EBIT was projected to be at the lower end of guidance of the range expected to be in $227m to $247m.

Galaxy Resources Limited

Subdued Lithium Price in China:

Galaxy Resources Limited (ASX: GXY) has reported short position of 61524088 (as on ASIC, dated 16 July 2019). GXY stock has generated a negative return of 15.29% in the last three months as on July 22, 2019. Meanwhile, GXYâs stock had a P/E of 2.55x. The YTD return of the stock was 39.27%. The stock of GXY last traded at the price of level A$1.355, up by 1.88 percent from its prior closing price.

In the quarterly activities report of June 2019, GXY mentioned that the fall in the domestic lithium price in China in the period was on the back of weak macro environment, that arose due to the trade war between US & China. Further, the prices are expected to remain subdued due to anticipated weakness in New Energy Vehicle (NEV) sales, which will affect the supply chain of the lithium battery, delay in the production and the anticipated steps by the Chinese government to shift to emissions standard China 6 from the China 5.

JB Hi-Fi Limited

JB Hi-Fi Limited (ASX:JBH) has reported Short position of 15165445 (as on ASIC, dated 16 July 2019).

As mentioned in the H1 FY19 outcome, For FY 19 period, the company expects the total sales to be about $7.1 billion and net profit of the group to be in the range of $237 million to $245 million, which means the growth in the range of 1.6% to 5.1%. In the third quarter 2019, the growth in the total sales of JBH Australia had fallen to 2.6% compared to 7.5% in the corresponding period last year and the Q3 comparable sales growth had fallen to 1.5% versus 4.3% in Q3 2018.

There is an anticipation of tax cuts in the future and the improvement in the housing market going forward, which will increase the topline of the company. Meanwhile, JBHâs stock has risen 12.17% in the last three months, as on July 22, 2019 and traded at a P/E ratio of 13.93x. The stock of JBH last traded at a price of A$29.62, up by 1.092 percent from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.