There has been a lot of buzz around the changing market environment for Graphite, propelled by the applications of the material in the steel and battery sector. Also, the EV sales have been rapidly growing, and it appears that the battery production has been underpinning the recent developments in the Graphite market globally.

(Source: Battery Mineralsâ Presentation, July 2019)

In the US, the Government has introduced a legislature to propose the set of minerals as âcriticalâ for the auto & energy industry, which includes lithium, graphite, cobalt and nickel. Besides, global companies like LG Chemicals, Toyota, Volkswagen have committed to uplift the battery production and EV production.

In this piece of writing, we would discuss the stance of the five stocks from ASX on Graphite; also, these companies have recently released updates.

Syrah Resources Limited (ASX: SYR)

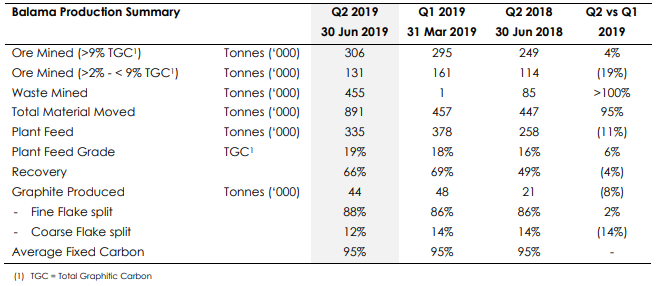

On 17 July 2019, Syrah Resources Limited reported the Quarterly Activities Report for the period ended June 2019 (Q2 2019). Accordingly, the company operates a dedicated Graphite project â Balama Graphite Operation. Besides, it produced 44kt in Q2 2019 down from 48kt in the prior quarter, and the Q2 recovery was 66% versus 69% in the Q1 2019.

Production (Source: Companyâs Quarterly Activities Report)

Besides, the companyâs sales & shipment reached 53kt natural graphite in Q2 2019, and an additional 7kt order was waiting to be shipped; this caused a decrease in inventory over Q2 period. Further, the Q2 2019 had a lesser weighted average price at US$457 per tonne against Q1 2019 of US$469 per tonne; this was due to Chinese fines pricing and lower flake production. Moreover, an agreement was signed with Gredmann Group for 279,000 tonnes (9,000 tonnes/month), starting from June 2019 to December 2021.

Sales (Source: Companyâs Quarterly Activities Report)

Market Update

Reportedly, the company acknowledged that steel production, the major end user of natural graphite, grew by 5% y-o-y for the five months YTD 2019, and it anticipated a flat demand from the steel sector as Chinaâs continues its transformation from an infrastructure driven to a consumption led economy. Also, Syrah anticipates growth in the natural flake market due to the graphiteâs use in anodes, and this would be supported investments to support growth in lithium ion battery demand. Besides, the EV battery manufacturers continue to upscale the capacity.

Importantly, the chair of the US Senate Committee of Energy and Natural Resources, Senator Lisa Murkowski, introduced a bipartisan legislation to secure the supply of minerals such as lithium, graphite, cobalt and nickel, and reduce the dependence on foreign sources.

On 26 July 2019, SYRâs stock was trading at A$0.95, down by 2.062% (at AEST 1:18 PM).

Black Rock Mining Limited (ASX: BKT)

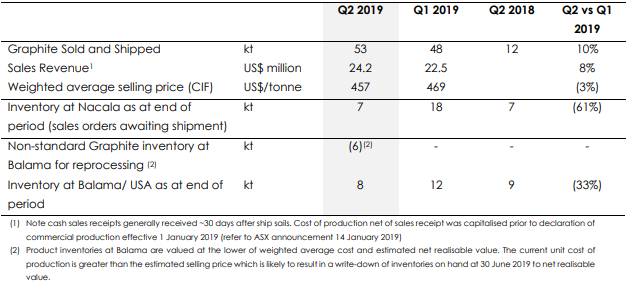

On 25 July 2019, the company reported on the enhanced Definitive Feasibility Study (DFS) for the Mahenge Graphite Project, which included the fourth production module after customerâs intention for an aggressive ramp up.

Enhanced DFS

Revised DFS (Source: Companyâs Announcement)

Reportedly, the DFS was completed in October 2018, and the project is progressing to secure financing to initiate the construction along with the first production target in 2020 to 2021. Also, the fourth production module would produce an additional 85,000 tonnes of graphite concentrate per year, consequential to total production of 340,000 tonnes to 350,000 tonnes per year. Besides, the development is subject to financing and confirmation of the 16% free carried interest of Tanzanian Government, and it would consider four production modules.

As per the release, the fourth production module has no material change to the forecasted capex for initial three phases; however, the revised project NPV10 of US$1.16 billion (A$1.65 billion) â an increment of 30% over the prior DFS would upscale the revenues. Also, the total capex for all four modules would rise from US$269 million to US$337 million, and the US$222 million would be required to fund two, three while fourth would be financed from internal cash flow.

Financing

Admittedly, Ironstone Capital has been appointed to support the financing of the Mahenge Graphite Project. Also, the company is considering a number of financing options while the focus would be on adopting the least dilutive option for the shareholders.

On 26 July 2019, BKTâs shares were trading at A$0.081, down by 3.571% (at AEST 1:31 PM).

Graphex Mining Limited (ASX: GPX)

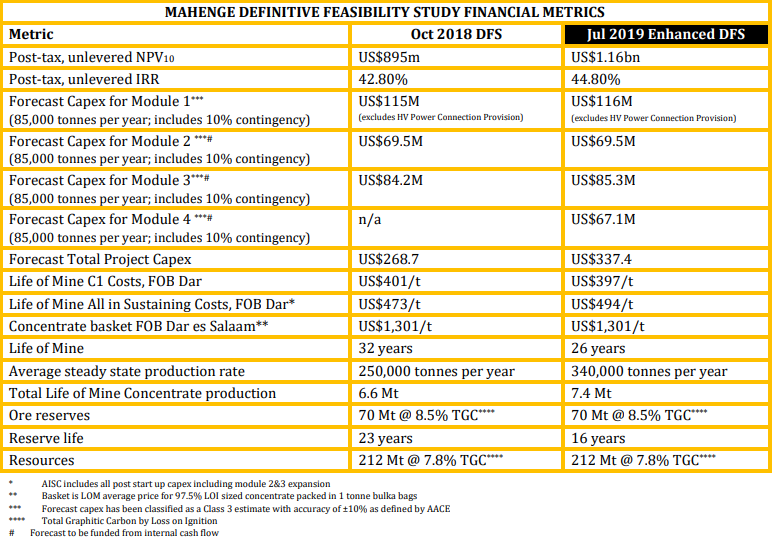

On 23 July 2019, Graphex Mining Limited released the Quarterly Activities Report for the quarter ended 30 June 2019.

Chilalo Development Plan (Source: Corporate Presentation, July 2019)

Definitive Feasibility Study

Reportedly, the company has been moving forward with the DFS for its Chilalo Graphite Project. Also, it is expected that an updated Mineral Resource & Ore Reserve would be made available by August 2019. Besides, the mine planning work would commence following the completion of resource modelling. Further, the metallurgical test work is being overseen and carried out by relevant parties, and the result would allow to update the flow sheet.

As per the release, the company has appointed GR Engineering Services to complete the process plant, infrastructure, design, engineering, cost estimation and final DFS report compilation. Also, the company arranged a design consultant to oversee the required work needed to construct tailings storage facility. Besides, the company conducted passive seismic survey to identify water bores, and necessary works were completed while overall water balance would be prepared to confirm water treatment requirements.

Binding Sales Agreement

Admittedly, the company is actively working to secure the binding sales agreement â a condition accessing the funding package. Also, the company has devoted substantial time in Chinaâs graphite market. Besides, the company has identified 41 potential customers in China as high priority. Further, the company has identified a list of 17 recommended customers from Europe & North America.

Cash & Capital

As per the release, the company had a cash of $1.2 million, and US$2 million were drawn from the interim Loan Note Facility with Castlelake Funds, with US$1 million remaining undrawn at the Quarter end. Also, after the quarter end, the company completed a placement of 12,500,000 shares at $0.2 per share to raise $2,500,000. Besides, the funding package with Castlelake L.P. involves up to US$40 million of equity, and the equity investment would be undertaken at a price equal to lower of a 10% discount to the 15-day VWAP of Graphex shares up to the satisfaction of conditions precedent and A$0.28 per share.

On 25 July 2019, GPX stock was trading at A$0.235, down by 4.082% (at AEST 1:37PM).

Magnis Energy Technologies Limited (ASX: MNS)

On 26 June 2019, MNS reported Nachu Graphite Project Update, and it was asserted that the company has made significant progress at the project.

Processing Efficiency

Reportedly, the companyâs continuous improvement program within the product processing and beneficiation proprietary technology area for the project has improved economic and process flow. Also, the program has been driven by Magnis CEO, Dr Frank Houllis, who has capitalised on excellent crystal structure of graphite in Nachu ore to produce >99% purity product with only four stages of floatation while industry standard is ~95% purity using more stages of floatation.

Construction Commencement

As per the release, the improved processing and mining fundamentals support the full project outcomes. Also, the management has been applying project execution expertise to oversee the improvements being captured by the third parties involved in the full engineering and procurement contract work programs, which are concurrent with the financing efforts.

Nachu Graphite Project

Nachu Project- ongoing work (Source: Companyâs Announcement)

Admittedly, the cleaning of access, community diversion roads is underway, the main road to Special Mining License was cleared, and the diversion road work is near completion. Also, the internal mining lease access roads continue to be surveyed and cleared. Besides, the company had developed a new access road to keep the communities connected.

On 26 July 2019, MNSâ stock was trading at A$0.23, up by 2.222% (at AEST 1:47 PM).

Battery Minerals Limited (ASX: BAT)

On 09 July 2019, Battery Minerals Limited released the Quarterly Activities report for the June quarter.

Market Update

Admittedly, an analysis of the current graphite market by the company had noticed instances of lower prices received by producers against the quoted price of independent forecasters. Also, in spite of booming EV market in China, the company observed that the LiB supply chains are not able to meet the forecast demand for battery raw materials.

Global Developments

Reportedly, BAT also acknowledges the move of the American Minerals Security Act concerns, which intends to list lithium, graphite, cobalt and nickel as âcritical mineralsâ. Also, during the period, Northvolt secured project financing for the greenfield gigafactory in Europe, and a 29% increase, for battery production by LG Chemical. Besides, Toyota has notified that it has a goal of having half of its international sales, to come from EV by 2025, and Volkswagen has plans to make investment in battery production.

Montepuez Graphite Project

Reportedly, the company secured the mining license for the Montepuez Graphite Project in March 2018, and fund raising was completed to progress with the developmental activities during the second half of 2018. During the June quarter, the company was engaged in pursuing the Mining Agreement, and the Ministry of Natural Resources and Energy had completed the review of draft agreement. Also, the review indicated that the Ministry has completely evaluated the terms, and BAT does not expect any material change to project economics due to the Mining Agreement.

Graphite Downstream Processing

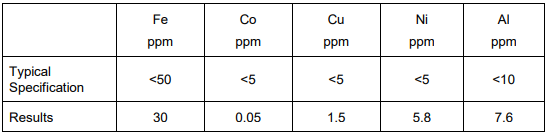

As per the release, the company achieved encouraging results despite the delays caused by equipment issued at Urbix operations in Arizona. Also, the results depict the commitment of the company in evaluating downstream opportunities along with âvalue in useâ in the graphite anode production. The Urbix purification process has led to encouraging results using eco-friendly methods, and the battery grade size fraction of -43micron, which achieved results exceeding 99.9% TGC. Besides, the spheronising industry achieved recoveries in the range of 40% to 45% while the preliminary spheroidising results had depicted an overall market leading recovery of >75%.

Key Results For -43micron (Source: Company Quarterly Report, July 2019)

Further, it was reported that the company has submitted the Balama Central mining concession application to the Government for Balama Central Graphite Project. Also, the company had completed the Balama Central Mining Licence application, and the license application is progressing.

On 26 July 2019, BATâs stock was trading flat at A$0.014 (as at AEST 1:47 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.