Graphite is emerging as a commodity of interest in the global market amid its wide application, both in the steel sector and the battery sector. Both the industries had provided a growth impetus to the graphite electrode industry, which in turn, is aiding the graphite electrode to gain investorsâ attention.

Graphite electrodes are used in the electric arc furnace in steel manufacturing, and the growth of graphite is dependable on the share of electric arc furnace captured in steel manufacturing.

Apart from that, the graphite-based anodes are used in lithium-ion batteries. Many industry experts predict that the battery sector would flourish over time amid encouraging electric vehicles projection and electric storage emergence over the coming years.

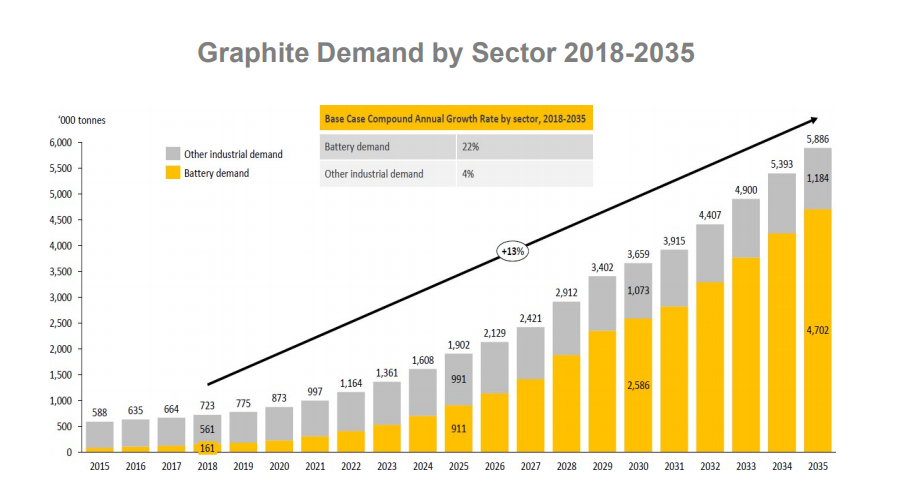

Source: Benchmark Mineral Intelligence

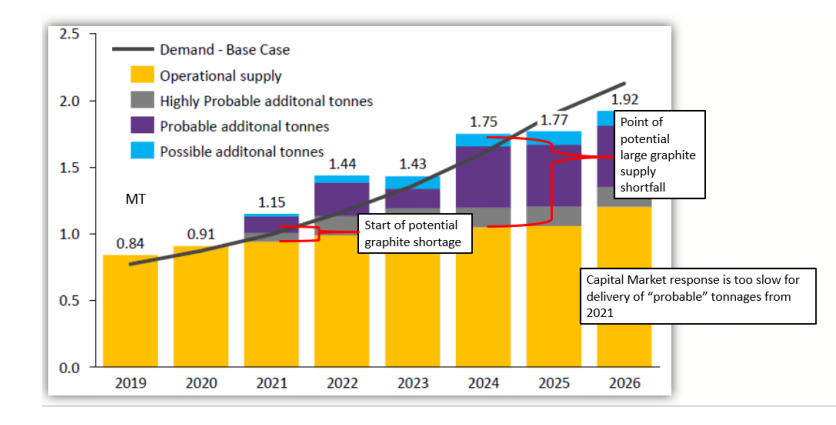

Source: Benchmark Mineral Intelligence

The above image depicts growing graphite demand from the battery sector over the years. With the forecasted demand surge, the supply of graphite is expected to witness a shortfall in 2024.

Source: Benchmark Mineral Intelligence

Source: Benchmark Mineral Intelligence

Out of two types of graphite, i.e., natural and synthetic, the demand and research & development in the synthetic graphite are quite high as compared to natural graphite amid synthetic graphiteâs agility to tolerate extensive heat.

However, one particular problem with synthetic graphite is that it is a carbon compound, and the increased stance of global economies to curb environmental pollution is a particular hindrance in the growth story of graphite.

Could the Emergence of Graphene address the issue?

Graphene, a carbon allotrope, is currently being addressed as a miracle material (single atomic layer of graphite) among the research scholars. The graphene-based anodes are anticipated by researchers to hold energy better than the graphite-based counterpart, and the researchers further expect that the better energy holding capacity of graphene gives it a better charge time.

As per the graphene researchers, graphene-based anodes could charge ten times faster than the conventional graphite-based anode. However, graphene-based anodes show less improvement in load capabilities and longevity.

The research across the field is progressing to improve the load capabilities and the longevity of the graphene-based anodes and to address further high electrical conductivity problem. Once there is some development on these fronts, such anode holds the potential to change the shape of graphite-based electrodes.

ASX-Listed Graphite Players:

Bass Metals Limited (ASX: BSM)

BSM hosts Graphmada large-Flake Graphite Mine in Madagascar which is a democratic island country with supportive laws for mining investment. The country charges low mining royalty of 2 per cent.

The Graphmada mine is wholly owned by the company, and it contains the Mineral Resources of 9.2 million tonnes with an average grade of 4.2 per cent total graphitic carbon (TGC). BSM is currently supplying the graphite from the mine in the United States, Europe and India.

Out of total 9.2 million tonnes of the Mineral Resources, the Mahefedok deposit at the prospect hosts 3.5 million tonnes with an average grade of 4.2 per cent total graphitic carbon, and the Loharano deposit hosts 5.7 million tonnes of the Mineral Resources with an average grade of 4.1 per cent total graphitic carbon.

The overall Mineral Resources of the prospect provides it with a contained graphite estimate of 382 kilotonnes (JORC Code).

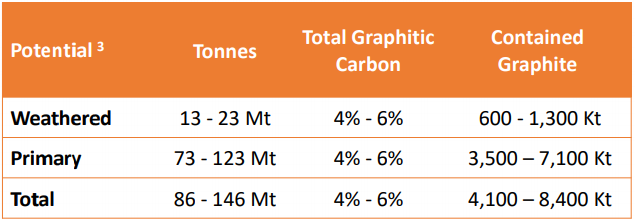

The Exploration Front: Estimation for the exploration target remains in the range of 86-146 million tonnes with an average grade of 4 to 6 per cent total graphitic carbon, which would account for 4,100-8,400 kilotonnes of contained graphite.

The potential of deposition for the estimated exploration target given below:

Source: Companyâs Report

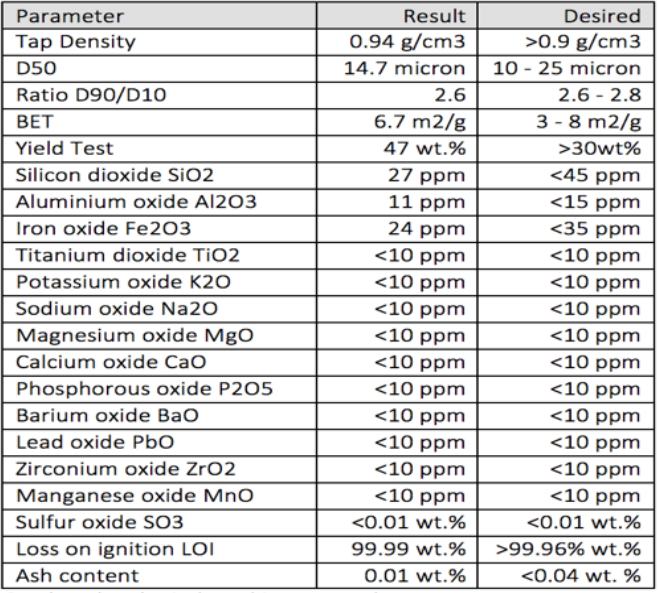

As per the company, the graphite produced by the prospect is highly suitable for lithium-ion batteries as it meets or surpasses the tested parameters of spherical graphite products in the market.

Source: Companyâs Report

Source: Companyâs Report

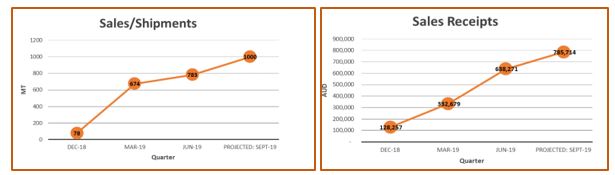

June 2019 Quarter Highlights: BSM processed 32,000 tonnes in the June 2019 quarter out of which 1,005 wet tonnes was produced above the premium benchmark of 94 per cent Fixed Carbon, which in turn, underpinned an increase of 80 per cent against the previous quarter wet tonne production.

The company produced 1,096 dry tonnes, which marked an increase of 85 per cent as compared to the previous quarter and managed to sell 783 tonnes during the June 2019 quarter, up by 94 per cent as compared to the sales volume in the last quarter.

BSM realised a price of A$638,000 for the June 2019 quarter, which was up as compared to the last two quarters. The company projects growth in terms of both sales and realised price in the September 2019 quarter.

Source: Companyâs Report

BSM is currently trading at A$0.009 as on 19 July 2019 (12:42 PM AEST).

Battery Minerals and Limited (ASX: BAT)

BAT hosts two flagship graphite projects, namely Montepuez and Balama Central Project, and feasibility of both the projects suggest low risk high expansion capacity of 100 kilotonnes per annum and 200 kilotonnes per annum.

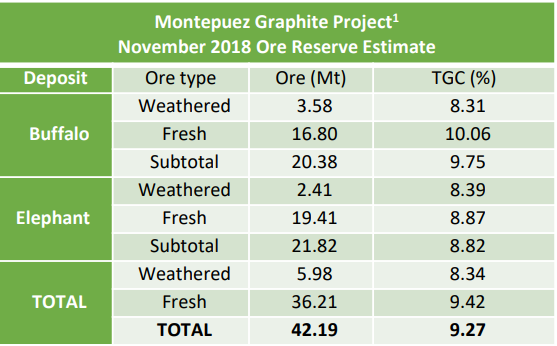

The Montepuez graphite project contains total Ore Reserves of 42.19 million tonnes with an average grade of 8.31 total graphitic carbon (TGC), and a total Mineral Resource of 119.6 million tonnes with an average grade of 8.1 TGC, which in turn, would account for 9,660k tonnes of contained graphite.

The deposit wise ore profile of the prospect is:

Source: Companyâs Report

Port Accessibility: The company has secured a port allocation of 100,000 tonnes per annum at the Pemba Port in Mozambique. The Pemba Port capacity is at 3-4 million tonnes per annum with transportation vessel size of 30,000 to 40,000 tonnes. The port authorities intend to inch up the loading capacity and facilities for 2020. The mine life of the prospect is over 50 years.

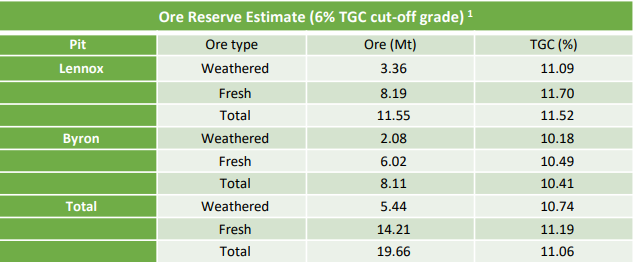

Balama Central Graphite Project: The prospect of the company holds an estimated Ore Reserves of 19.66 million tonnes with an average grade of 11.06 TGC, and an estimated Mineral Resources of 32.9 million tonnes with an average grade of 10.2 TGC.

The Mineral Resources of 32.9 million tonnes of the prospect are estimated to contain 3,357 kilotonnes of contained graphite.

The deposit wise Ore Reserves of the prospect are as:

Source: Companyâs Report

Vanadium Advantage of the Montepuez Graphite Project: The Montepuez prospect of the company hosts mineral and ore reserves of vanadium as well. The new rebar steel standards in China is expected to double the vanadium content in the steel, which would provide the company with an additional advantage.

The total Inferred Mineral Resources for vanadium of the prospect stands at 34.6 million tonnes with an average grade of 0.25 per cent vanadium oxide.

Slight doping of steel rebar with vanadium (0.1 per cent) increases the strength of steel over 100 per cent, while reducing its weight by 30 per cent, and demand of efficient and lighter steel could further inch up the demand for vanadium.

Future Ahead: BAT further plans to finance the Montepuez project and ramp up its sales, and also intends to keep progressing on the Mining License at the Balama Central Project.

BAT is currently trading at A$0.014 as on 19 July 2019 (12:42 PM AEST).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.