There are more than 1,40,000 retail businesses in Australia, that forms 4.1 per cent of GDP and gives employment to about 10.7 per cent of the population as they not only buy or sell goods but provide multiple ancillary services such as arranging financial services or offering after sales services.

Further, the online retailing is growing at the significant pace. There has been always tough competition among the retailers, as they compete for technology, innovation, marketing, strategies etc.

The Australian retail sector has posted a positive growth, despite significantly low rise in wages and rise in household debt as this growth has come up on back of low interest rates and rise in household credit, that affects the consumer spending pattern.

Moreover, there has been an increase in the incoming of foreign countries, which has changed the shape of competitive landscape. The following supermarket stocks like Woolworths and Wesfarmers are among the largest companies of Australia in terms of revenue.

Woolworths Group Ltd (ASX:WOW)

Planned Separation of Endeavour Group after the Restructure and ALH Merger:

Woolworths Group Ltd (ASX:WOW) is an Australian company that also operates in New Zealand is a retail major that has in its portfolio the general merchandise consumer stores, more than 1027 supermarkets, hotels and gaming operations. The company is into the procurement of food, liquor, etc. and also operates pubs, food & accommodation. The company’s stock has recently touched its 52-week high.

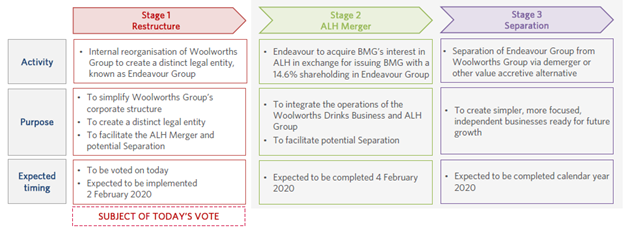

WOW intends to go ahead with the separation of Endeavour Group later in CY2020 after the company completed the internal restructuring and ALH Merger. With this restructuring, the company has created Endeavour Group by all combining its retail drinks business and ALH Group in a single legal entity.

WOW has 85.4% stake of the combined Endeavour Group and BMG, owns a 14.6% stake in this newly formed Endeavour Group. On the other hand, the company in the first quarter of 2020 has reported 7.1% rise in the total sales from continuing operations to $15.9 billion with 7.8% rise in the Australian Food sales, 4.6% rise in the New Zealand Food sales, 4.9% growth in Endeavour Drinks sales, 2.6% increase in BIG W sales, 5.5% rise in Hotels sales and 37.4% growth in Group Online sales.

Endeavour transformation is expected to take place over three stages (Source: Company’s Report)

On 10 February 2020, WOW last traded at $43.165, moving up by 1.042 percent from its prior close. Also, WOW stock has risen 15.65% in the last one-month period as on February 6th, 2020 and it last traded at a P/E multiple of 20.72x.

Wesfarmers Ltd (ASX: WES)

Deferred the final investment decision on Mt Holland lithium project:

Wesfarmers Ltd (ASX: WES) is an Australian giant that is into supermarkets, hotels and convenience stores, home improvement, office supplies, operations of mines, writing of insurance, manufacturing and distribution of industrial products, manufacturing the fertilisers and chemicals, and distributes liquefied petroleum gas and medical and industrial gases.

WES on the Mt Holland lithium project has deferred its final investment decision by a year to the first quarter of 2021, as the company is focusing to cut the capital & operating cost, intends to improve the utility and infrastructure solutions for the project, explore WesCEF’s existing capabilities and having talks with key customers so that the product specifications are matched with changes in battery chemistry.

This step has been taken after the DFS or definitive feasibility study on the project which had confirmed that the Mt Holland lithium (project) has the potential to develop a unified big scale, long-life and high-grade operation in Western Australian region.

On the other hand, for FY 19, the company has reported 4.3% rise in the revenue to $27.9 billion from continuing operations and 13.9% increase in the net profit after tax to $1.9 billion from continuing operations and excluding significant items. The rise in net profit is because of the greater contributions from Bunnings, Officeworks and Industrials and other activities, that comprises of the 15% share in Coles Group, which has offset the decline in the profits of the Kmart Group.

On 10 February 2020, WES last traded at $45.74, rising up by 0.417 percent compared to its last close. Meanwhile, WES stock has risen 11.59% in the last three months as on February 7th, 2020 and traded at a P/E multiple of 9.35x.

Metcash Limited (ASX: MTS)

Underlying Profit to Loss in 1H 2020:

Metcash Limited (ASX: MTS) is a leading company of Australia that is into the wholesale distribution and marketing of a diversified business products across food, grocery, hardware and liquor sectors.

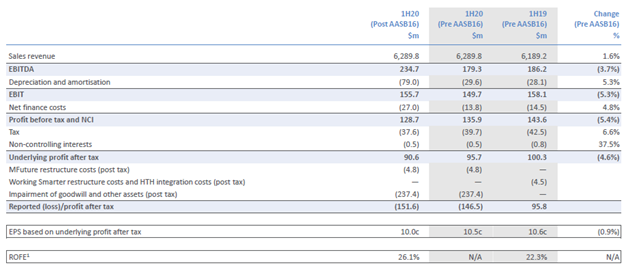

The company for the first half of 2020 has reported 0.5% rise in the group sales (including charge-through sales) to $7.2bn. MTS has delivered the loss after tax of $151.6m, including the post-tax impairment of $237.4m after the loss in the 7-Eleven contract compared to reported profit after tax of $95.8m in 1H19 Pre AASB16. The company’s underlying profit after tax (pre AASB16) has fallen to $95.7m in 1H 2020 from $100.3m in 1H 2019. This decline is on back of the contribution from resolution of onerous lease obligations, which was approximately $10m higher in 1H19, ending of supply of Drakes in South Australia from 30 September 2019.

Further, in the 1H 2020, the group’s underlying EBIT (pre AASB16) has fallen by $8.4m to $149.7m with decline of $7.8m o Food EBIT to $85.2m due to increase in contribution from resolution of onerous leases in 1H19, $0.5m rise in Liquor EBIT to $29.6m due to higher sales, fall in Hardware EBIT by $0.5m to $37.3m driven by resilience in cycle downturn that has negatively affected trade sales.

1H FY 20 Financial Performance (Source: Company’s Report)

On 10 February 2020, MTS closed the trading session at $2.66, rising up by 1.527 percent compared to its previous closing price. Also, MTS stock has fallen 11.19% in three months as on February 7th, 2020 and has an annual dividend yield of 4.96%.