The companies under discussion in this article are from the industrial and material sectors. These sectors comprise of companies from a range of industries, including building products, construction and engineering, machinery, air freight and logistics, airlines, marine, road and rail, transportation infrastructure, chemicals, construction materials, containers and packaging, and paper and forest products.

Letâs discuss eleven stocks from these sectors:

Downer EDI Limited (ASX: DOW)

On 25 November 2019, the company announced that it was selected as a preferred contractor for delivering the Yanchep Rail Extension and the Thornlie â Cockburn Link, which is part of Perthâs METRONET Program. The project would be delivered through a joint venture with CPB Contractors, part of CIMIC Group (ASX: CIM), under an alliance-style project.

The project would be funded through the Western Australia State Government and the Australian Federal Government. The companyâs part of work includes railway construction, relocation of freight lines, station platform extensions, station construction and other station modifications, construction of new road-rail bridges and other associated work.

It was reported that the work on design would be commenced immediately, with construction likely to start in May 2020 and due for completion in 2023. In addition, the company is delivering Stage 1 of the Parramatta Light Rail project in a fifty-fifty joint venture with CPB Contractors for the New South Wales Government.

On 25 November 2019, DOW last traded at $8.090, down by 0.123% relative to the previous close.

CIMIC Group Limited (ASX: CIM)

On 25 November 2019, the group reported regarding securing a contract in partnership with Downer EDI Limited (ASX: DOW) to deliver the Yanchep Rail Extension and the Thornlie â Cockburn Link, as part of Perthâs METRONET Program.

Recently, the group subsidiary CPB Contractors was elected to work on an upgrade project. It was reported that the construct and design contract concerning the northern section of the M80 Ring Road in Melbourne would deliver a revenue of ~$331 million to the group.

The program is funded by the Government of Australia and Victoria, and the program is designed to improve safety of drivers, increase capacity and reduce congestion.

On 25 November 2019, CIM last traded at $32.800, up by 0.03% relative to the previous close.

Qube Holdings Limited (ASX: QUB)

Recently, the group convened its 2019 Annual General Meeting and provided a business update for the first quarter of 2020.

Operating Division

QUB reported that the division is trading slightly behind the expectations, while there is no change to the full-year outlook. Chalmers transaction was completed during the period, and the synergies are expected to be delivered in FY20.

Infrastructure & Property

QUB mentioned that the division is trading slightly ahead of expectations, and the first quarter results had higher bulk volumes, which was partially offset by a decline in the vehicle and RoRo cargo volumes. In addition, the capex at Moorebank Logistics Park is estimated to be around $150 - $200 million higher than previously indicated.

Patrick

QUB reported that the division is trading behind the expectations due to weaker market volumes, and the continued decline in the volumes might impact the full-year outlook. In Q1, the group received $5 million in distribution from Patrick.

On 25 November 2019, QUB closed the dayâs trade at $3.280, up by 0.613% relative to the previous close.

Atlas Arteria (ASX: ALX)

On 25 November 2019, the group reported to have successfully completed the placement and the institutional component of the 4 for 21 entitlement offer of new ordinary stapled securities to global and domestic institutional investors.

ALX raised approximately $1.2 billion, and the placement received strong demand from new existing institutional investors, resulting in an oversubscription. The group is undertaking the capital raising to fund an acquisition, among other reasons.

On 25 November 2019, the ALX stock settled at $7.850, up by 2.749% relative to the previous close.

ALS Limited (ASX: ALQ)

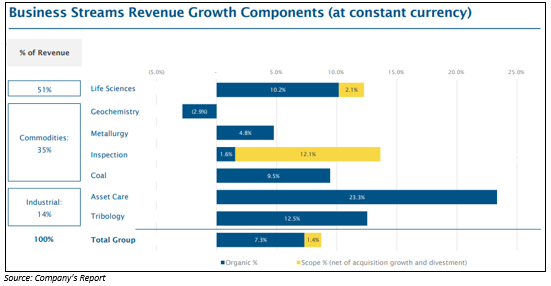

Recently, ALQ announced 6-month results for the period ended 30 September 2019. Revenue from continuing operations increased by 11.3% to $919.1 million compared to $826.1 million in the previous period.

The underlying NPAT (continuing operations) was $98.2 million for the period. The company declared an interim dividend of 11.5 cents per share to the shareholders in records on 28 November 2019, partially franked at 30 per cent.

Outlook

Despite macroeconomic uncertainty, the business fundamentals continue to remain strong. The life sciences division is expected to deliver overall margin expansion of 50 bps in FY20. The groupâs underlying NPAT is likely to reported at $185-$195 million. In addition, the guidance is dependent on no material changes with respect to the operating and economic environment.

On 25 November 2019, ALQ closed the dayâs trading at $8.580, down by 1.606% relative to the previous close.

Cleanaway Waste Management Limited (ASX: CWY)

Recently, the company announced the completion of acquisition of the assets of the SKM Recycling Group, following the successful bidding for the recycling assets of SKM Recycling Group.

In October, the company convened its Annual General Meeting, and Mark Chellew, Chairman of CWY, highlighted the performance of Cleanaway Waste Management during the past financial year (FY19). The company had delivered an increase in profit along with a 42 per cent increase in dividends at 3.55 cents per share compared to 2.5 cents per share in the previous year.

He said that the company has a strong financial position with net debt of $658.5 million, meaning a net debt to EBITDA ratio of 1.4 times. Also, CWY is considering using longer tenor debt to strengthen the debt portfolio further.

On 25 November 2019, CWY closed the dayâs trading at $1.970, up by 1.026% relative to the previous close.

Boral Limited (ASX: BLD)

On 25 November 2019, the company notified that the trial scheduled to commence at the Supreme Court of Queensland in November had been adjourned to 6 February 2020. The matter is related to the Statement of Claim filed by Wagners Holding Company Limited (ASX:WGN) at the Supreme Court of Queensland. WGN is seeking resolution of the dispute with the company through the court.

Earlier this month, the company convened its 2019 Annual General Meeting. In the Q1 FY 2020 trading update, it was reported that volume pressures in several businesses reflected a softer activity.

In addition to improvement initiatives already underway, the company has considerably increased efforts to reduce costs and improve earnings. Moreover, additional extensive business improvement initiatives would benefit the results in 2H.

On 25 November 2019, the BLD stock closed at $4.890, down by 0.204% relative to the previous close.

James Hardie Industries plc (ASX: JHX)

Recently, the company announced 6-month results for the period ended 30 September 2019. Net sales for the half year increased by 2% to USD 1,316.9 million, driven by higher net sales in the North America Fiber Cement and Europe Building Products segments, partially offset by lower USD net sales in the Asia Pacific Fiber Cement segment.

EBIT for the half-year period was USD 285.1 million compared to USD 231.4 million, representing an increase of 23% over HY FY2019. Net operating profit for the period was USD 189.6 million compared to USD 160.1 million in the previous corresponding period.

In addition, the company declared an unfranked dividend of US 10 cents per share to the shareholders in records on 18 November 2019 with a pay date of 20 December 2019.

On 25 November 2019, JHX last traded at $28.790, down by 0.758% relative to the previous close.

Orica Limited (ASX: ORI)

Recently, the company released full-year results for the period ended 30 September 2019. Accordingly, the company recorded sales revenue of $5,878 million compared to $5,373.8 million, delivering an increase of 9%.

The statutory net profit after tax for the period was $245.1 million compared to a loss of $48.1 million in the previous year. EBIT increased 8% over the year to $664.7 million compared to $618.1 million, backed by strong performances across all regions and improvement in manufacturing operations.

Net operating and investing cash inflows for the period were $378 million. ORI incurred capital expenditure of $424 million, including $37 million on rectification works at Burrup.

In addition, ORI declared a final dividend of 33 cents per share with 5 cents franked to the shareholders in records on 13 November 2019 with a pay date on 13 December 2019.

On 25 November 2019, ORI closed the dayâs trading at $23.410, down by 1.182% relative to the previous close.

Incitec Pivot Limited (ASX: IPL)

Recently, the company has released FY19 results for the period ended 30 September 2019. IPL recoded a revenue from ordinary activities of $3,918.2 million, an increase of 1.6% or $61.9 million.

The company reported a net profit after tax of $152.4 million compared to $207.9 million in the previous year. IPL has incurred $140 million in a non-recurring item for the period, lowering the profits.

In addition, IPL has declared a final dividend of 3.4 cents per share with a franked amount of 1.02 cents to the shareholders in records on 2 December 2019 payable on 8 January 2020.

On 25 November 2019, IPL closed the dayâs trade at $3.220, down by 1.829% relative to the previous close.

Fletcher Building Limited (ASX: FBU)

Recently, the company provided an update on the New Zealand International Convention Centre (NZICC) project, which was a subject of fire in late October. It was reported that the companyâs employees were working closely with fire service teams and local authorities to manage the fire impact.

FBU noted that the site had been returned to the company, and access remains restricted due to the ongoing assessment and investigation into the cause of the fire. In addition, the company was working to determine the fire impact on the project, and additional information would be provided during the interim results announcement in February 2020.

On 25 November 2019, FBU last traded at $4.950, down by 0.802% relative to the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.