Industrials (Sector)

Investors are always on a hunt for the sectors which provides positive return. One such profit-generating sector, from the investment point of view is Industrials. Besides, S&P/ASX 200 Industrials (Sector) has generated a decent return of 9.72% during last one-year period. The requirement of industrial products is growing, which is aided by growing population and urbanisation across the globe.

We would be discussing a few industrial companies in terms of their profitability; business prospects and dividend distribution as follows:

IPH Limited

IPH Limited (ASX: IPH) offers a wide range of IP services associated with trademarks, prosecution, provision of filing and so forth across the countries like Australia, New Zealand, Papua New Guinea, the Pacific Islands and Asia.

On 11 September 2019, the company notified the issue price for securities to be allotted to the participants during the Dividend Reinvestment Plan was at $9.36 per share. The Management clarified that the price was calculated on the basis of daily volume weighted average price of IPH shares traded on the ASX for the 10 trading days. Earlier, on 20 August 2019, the company had announced 60% franked dividend of AUD 0.13 with a payment day of 18 September this year.

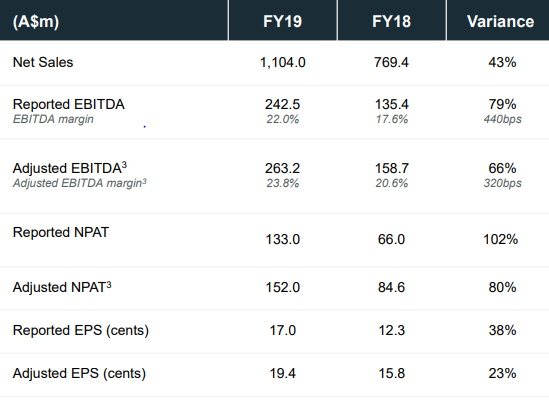

FY19 Financial Highlights: Concurrently, on 20 August 2019, IPH Limited announced its FY19 financial results for the year ended 30 June 2019 wherein, it posted revenue of $259.5 million, up by 15% on y-o-y, followed by NPAT of $53.1 million that grew by 31% on FY18. EBITDA came at 23% higher at $85.9 million on y-o-y basis. The company reported total assets at $414.9 million and net assets at $284.7 million as on 30 June 2019.

Further, the company reported a double-digit organic growth consistently for the third successive half period driven through take up of offering from Asia region. During the year, the company acquired 100% stake of Xenith IP with a cash consideration of $46 million, which was funded by the companyâs debt facilities. Also, Xenith IP has a debt of circa $21 million. Meanwhile, the company sold Filing Analytics, Citation Eagle and DMS products during the year. The companyâs EBIT margin improved on account of strong performance from AJ Park and synergies realised from Spruson & Ferguson merger.

FY19 Balance Sheet (Source: Companyâs Report)

FY19 Balance Sheet (Source: Companyâs Report)

Stock update: The stock of IPH was trading at A$8.8, up 1.149% (as on 16 September 2019, AEST 2:05 PM). The stock is available at a price to earnings multiples of 32.330x along with an annual dividend yield of 2.87%.

Reliance Worldwide Corporation Limited

Reliance Worldwide Corporation Limited (ASX:RWC) is engaged in designing, manufacturing and supply of high quality, reliable and premium branded water flow and control goods. RWC has a wide range of products and solutions across the plumbing and heating and specialist industries worldwide.

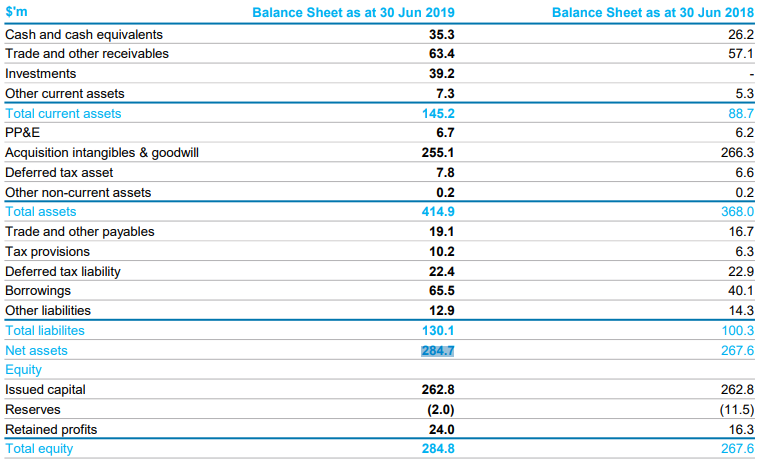

FY19 Result Highlights: On 27 August 2019, RWC announced FY19 financial results closed 30 June this year wherein, the company posted net sales at $1,104 million, higher by 43% over FY18 and net profit of $133 million, which grew 102% at y-o-y. The company posted its EBITDA, on reported basis at $242.5 million, with EBITDA margin of 22% against FY18âs reported EBITDA of $135.4, with EBITDA margin at 17.6 percent. The company posted exuberant growth across top-line and bottom due to $14.2 million of synergies received from John Guest acquisition in FY19.

FY19 Financial Highlights (Source: Companyâs Report)

Operating performance: During FY19, RWC witnessed higher working capital as compared to FY18 year due to a requirement of extending funding support for the growing segment of the company. Revenue from Americas increased by ~17% at y-o-y and ~7% increment from APAC region.

Outlook: For FY20, RWC expects NPAT at around $150 million to $165 million while EBITDA was estimated amid $280 million to $305 million. The management expects that input costs during FY20 are likely to remain stable, while average copper costs are expected to be higher than $6,200 /tonne during FY20.

Stock update: The stock of RWC was trading at A$4.025, edging up by 1.131% (as on 16 September 2019, AEST 2:31 PM). The stock is available at a P/E multiple of 23.410x with a dividend yield ratio of 2.26%. The market capitalisation of the stock stood at A$3.14 billion.

Cleanaway Waste Management Limited

Cleanaway Waste Management Limited (ASX: CWY) is a total waste management, industrial and environmental services entity. It has been helping businesses in the Australian region for more than 5 decades, by providing them solutions with unique advantages to consumers and communities both.

On 16 September 2019, CWY notified the market on the 15th Annual General Meeting to be held on 25 October this year, starting at 10:00 am (Brisbane time).

Further, CWY released an annual report presentation containing overview of the company, business review, sustainability, corporate information, financial report and other information. Further, CWYâs Chairman, Mr Mark Chellew, FY2019 period had been another successful year for the company, with a rise in the earnings and additional rise in dividends to stakeholders.

CWY is testing Diesel-Electric hybrid technology and getting ready to launch its first hybrid automobile in the City of Sydney during FY2020.

Source: Companyâs Report

Recently, the company announced a change in one of its directorâs, Vikas Bansalâs interest in the company, wherein, he acquired 2,060,153 Ordinary shares on 4 September 2019 under the FY2017 Long-Term Incentive Plan rules, upon exercise of vested performance rights, new shares would be issued at no consideration.

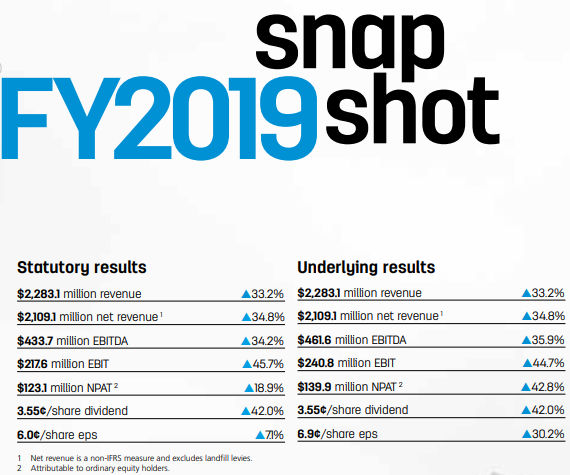

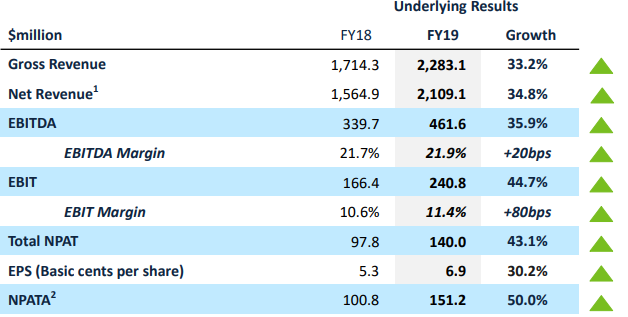

FY19 Financial Highlights: On 15 August 2019, CWY released full-year results closed 30 June this year, wherein it mentioned a revenue of $2,283.1 million, up 32.2% on y-o-y basis and NPAT came at $151.2, 50% higher than FY18. EBIT stood at $240.8 million while EBITDA margin came at 11.4% during the financial year 2019.

FY19 Financial Highlights (Source: Companyâs Report)

Dividend Announcement: The company announced a fully franked dividend of AUD 0.019, payable on 3 October 2019.

Operating performance: In the solid waste services, business growth had driven higher volumes and improvement in product pricing, while prices across metropolitan remained competitive during the year. The company witnessed increased costs of sorting, due to the China National Sword Policy, which is being passed on to Municipal and Commercial consumers gradually. Besides, the company reported an increase in scale of operation in Industrial & Waste Services contributed by Toxfree acquisition during the year. In the Liquid Waste & Health Services segment, the company reported growth across Hydrocarbons and Packaged waste services.

Stock update: The stock of CWY was trading at A$2, down 0.99% (as on 16 September 2019, AEST 3:49 PM). The stock is available at a price to earnings ratio of 33.670x and have an annual dividend yield of 1.76%. The stock has a market capitalisation of A$4.14 billion.

Atlas Arteria Limited

Atlas Arteria Limited (ASX: ALX) is engaged in the development of toll roads across the globe.

On 16 September 2019, ALX announced the appointment of Ms Fiona Beck, as an independent non-executive director w.e.f. 13 September 2019.

Recently, the company announced a change in directorâs interest, where one of its directors named Mr Derek Stapley has acquired 17,400 number of shares at a consideration of $147,900 ($8.50/ stapled security).

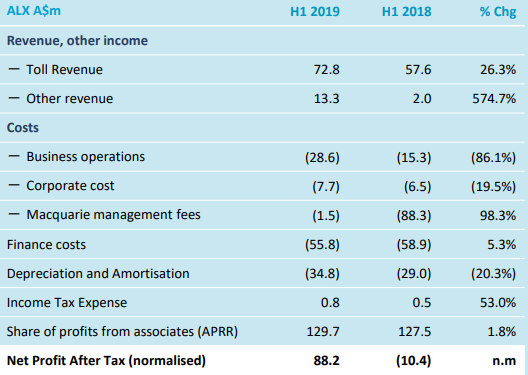

H1FY19 Performance Highlights: In the H1FY19 report ended 30 June this year, ALX reported revenue at $72.8 million, higher by 26.3% from H1FY18 and Net Profit After Tax on normalised basis at $88.2 million against a loss of $10.4 million during H1FY18.

During the first half, the company paid fees paid to Macquarie under the Transition Services Agreement of $750k per month from 16 May 2019, would also be part of the notable items for 2019. The result was strong considering the unusually strong traffic performance in H1 2018 resulting from the nationwide French National Railways strikes.

H1FY19 Financial Highlights (Source: Companyâs Report)

Outlook: As per the guidance of the company, H2FY19 distribution guidance would be around 16.0 cents per share. Also, the distribution guidance for H1 was confirmed at 15 cents per share.

Stock update: The stock of ALX was at A$7.67, by the closure of the trading session, down 1.414% (as on 16 September 2019). The company has a market capitalisation of A$5.32 billion and have an annual dividend yield of 3.47%. The 52-week trading range of the stock was noted at A$5.940 to $8.580.

Seven Group Holdings Limited

Seven Group Holdings Limited (ASX: SVW) operates in leading businesses and investments in industrial services, media and energy sector. The company has dealers across Western Australia, New South Wales and the Australian Capital Territory

Recently, SGH notified that one of the companyâs director named Mr. Bruce McWilliam will retire from the Board at this yearâs Annual General Meeting. Mr. Bruce has completed three-year term since his last election.

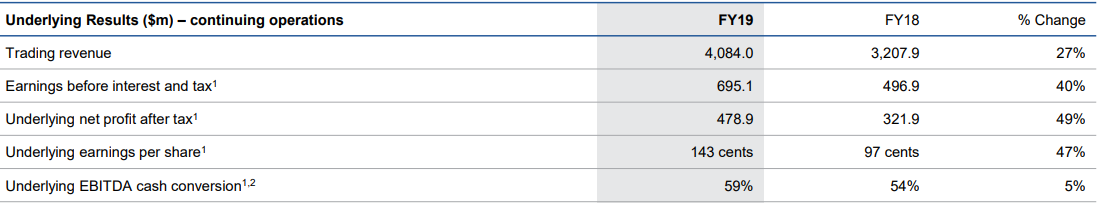

FY19 Financial Highlights: In the full-year report, closed 30 June 2019, the company reported trading revenue standing at $4.1 billion, up 27% with growth across all businesses. EBIT during the year stood at $695 million as compared to $497 million in FY18. The company showed improved operating cash flow despite investment in future growth through working capital. EBIT of Industrial services grew 40% y-o-y, reflecting strength of end markets in mining and infrastructure. Operating cash flow stood at $411 million during FY19.

F19 Financial Highlights (Source: Companyâs Report)

F19 Financial Highlights (Source: Companyâs Report)

Stock update: The stock of SVW last traded at A$17.88, up 0.846% (as on 16 September 2019). The stock has a market capitalisation of A$6.02 billion. The 52-week trading range of the stock was noted at A$13.170 to A$23.080. The stock is available at a P/E multiple of 27.280x and the annual dividend yield of the stock stood at 2.37%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.