On 22 August 2019, Industrials Sector declined 0.63% to close its day trading session at

6,699.9 points. Letâs discuss four industrial sector companies that have come up with some important updates.

Auckland International Airport Limited (ASX: AIA)

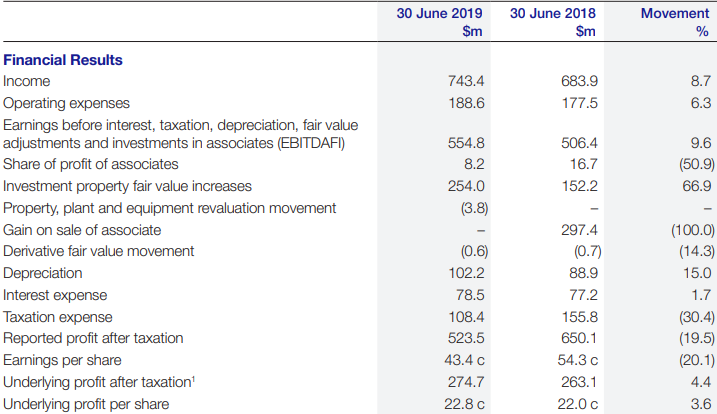

Auckland International Airport (AIA) shares slipped on stock exchange after the company reported a 19.5% declined in its profit after tax for the year ended 30 June 2019. The release came on Thursday, 22 August 2019, in which the company declared its FY2019 profit after tax to $523.5 million, a decline from a prior yearâs reported profit of $650.1 million.

Auckland International Airport Limited is an ASX-listed company, which operates through three core segments that include Aeronautical, Retail and Property. The company stays committed to deliver a number of key aeronautical infrastructure projects that would provide additional aeronautical capacity within the complex and challenging environment of an operating airport.

In FY2019, the top-line of the company has demonstrated a solid performance with revenue up 8.7% to $743.4 million during the year. It reflects the strong revenue growth across the companyâs all business segments- Retail revenue was up 18.5%, Car parking revenue up 5.2% and Aeronautical and Property rental income up 14.9% and 9.5%, respectively.

In the financial year 2019, the company had another record year for traveller numbers at both the International and Domestic Terminals, although growth was slower than in recent years. Overall, passenger numbers increased to 21.1 million, up 2.8% on the previous year, with international passenger numbers including transits reaching 11.5 million, up 2.2% on the previous year while Domestic passengers growing 3.6% to reach 9.6 million.

Auckland Airportâs Financial Results of FY2019 (Source: Company Announcement)

Auckland Airportâs Chair, Patrick Strange stated that Fiscal 2019 has been another year of growth and the company has made significant progress toward its 30-year vision for the airport of the future.

AIA Board declared a final dividend of 11.25 cents per share compared to the final dividend of 11.00 cents per share in the previous financial year, an increase of 2.3% on the prior year. The 2019 final dividend will reportedly be paid on 18 October 2019 to shareholders on the register at the close of business on 4 October 2019.

Outlook: Looking into FY2020, the company expects its underlying profit after tax, excluding any fair value changes and other one-off items, to range between $265 million and $275 million. This is in comparison to FY19âs underlying profit after tax of $274.7 million as reported in annual results.

Stock Performance: Aucklandâs stock price declined 1.733% in a day trading session to close at $9.070 on 22 August 2019. The stock last traded at a price to earnings multiple of 18.910x with a market capitalisation of $11.18 billion.

Over the past 12 months, the stock has surged up by 47.68% including a positive price change of 13.11% as recorded in the past three months.

Sydney Airport (ASX: SYD)

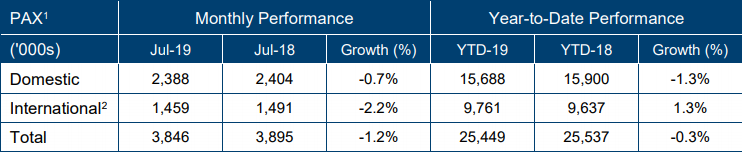

Sydney Airport recently released its traffic performance for the month of July 2019. The company revealed a decline of 1.2% in the monthly traffic, reflecting a reduction of 0.7% and 2.2% in domestic passengers and international passengers, respectively.

Overall, 3.85 million passengers passed through Sydney Airport in July 2019, told CEO Geoff Culbert.

The number of International passengers travelling through the airport last month declined to 1.46 million passengers compared to 1.49 million passengers reported in July 2018. Domestic passengers reduced by 0.7% on the previous corresponding period to 2.39 million passengers.

Sydney Airport Traffic Performance July 2019 (Source: Company Announcement)

Despite the subdued market conditions, there have been some exciting development in the airline industry. Sydney Airport highlighted that the increase of direct services to Santiago as announced by both Qantas and LATAM Airlines has widened door in the emerging South American market. In addition, the launch of Malindo Air to Sydney Airport is expected to boost the companyâs network in Asian market through Malindoâs service from Kuala Lumpur to Sydney via Bali.

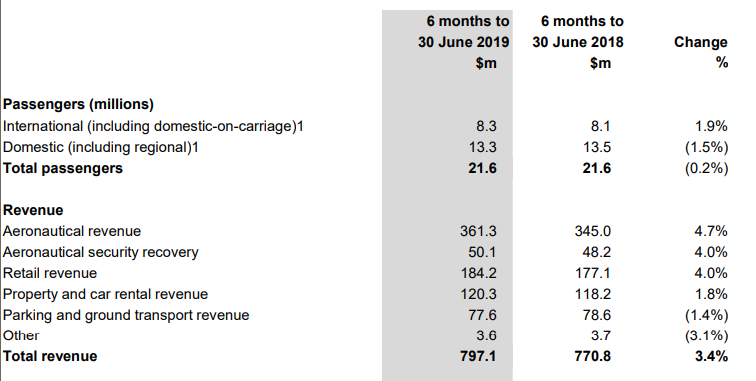

1H FY19 Results: This reporting season, Sydney Airport released its half yearly results for the six months ended 30 June 2019. In the release dated 15 August 2019, SYD reported an increase of 3.4% in total revenue to $797.1 million for 1H19. Its net operating receipts grew 4.8% to $431.2 million, compared to the previous corresponding period.

Sydney Airportâs Passengers and Revenue highlights for 1HFY19 (Source: Company Announcement)

International passengers grew 1.9%, but still overall passengers declined 0.2% due to a 1.5% decrease in domestic passengers on the prior corresponding period. SYDâs 1HFY19 EBITDA grew 4.1% to $649.2 million, underpinned by a solid contribution from its non-aero businesses combined with the growth in international passengers.

For six months to 30 June 2019, Sydney Airport declared a distribution of 19.5 cents per stapled security, an increase of 5.4% on 18.5 cps as distributed in the previous corresponding period.

Outlook: Sydney Airport reaffirmed its full-year FY19 distribution guidance to 39.0 cents on the track record of solid performance and growth across all economic cycles. This reflects a growth of 4.0% on the distribution figure of last fiscal year.

Stock Performance: SYD stock price declined 1.333% to last trade at $8.140 on 22 August 2019. The stock closed at a price to earnings multiple of 46.720x with a market capitalisation of $18.63 billion.

Over the past 12 months, the stock price increased 14.27% including a positive price change of 9.56% in the past three months.

Take a look at Sydney Airportâs Annual General Meeting update held in May 2019.

NRW Holdings Limited (ASX: NWH)

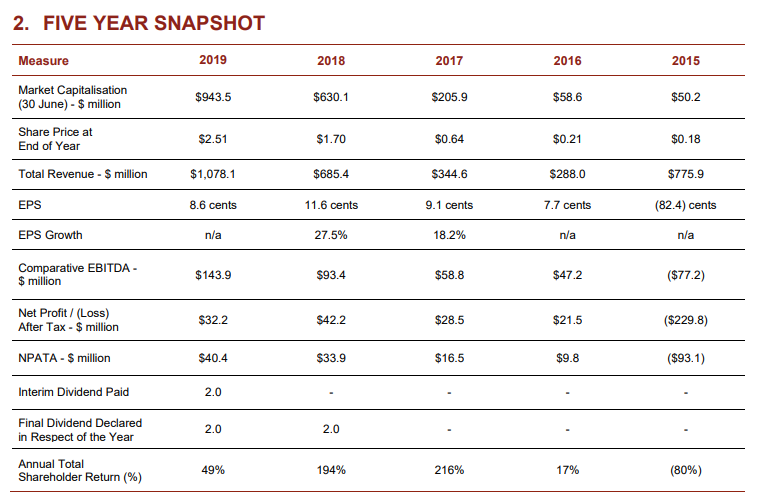

NRW Holdings Limited reported an outstanding result for the financial year 2019, with revenue up 49% to $1.126 billion compared to the previous corresponding period.

Diversified Australian civil and mining contractor NRW Holdings completed highly successful acquisition of the RCR Mining Technologies business in FY19, which has added to the companyâs diversified capability offering and the services.

In addition to extension of contract with Stanmore Coal to ~$950 million contract value, NRW Holdings has also secured three new Civil contracts for major Western Australia iron ore producers â Eliwana, South Flank and Koodaideri.

More on the financial front, NRWâs Comparative FY19 EBITDA increased to $144.0 million up 54% on previous corresponding period; NPATA increased 19% to $40.4 million in year ended 30 June 2019; cash holdings increased to $65.0 million, with strong cash conversion at 95%.

A snapshot of NRWâs five-year performance (Source: Company Announcement)

The Board declared a final dividend of 2 cents per share for the period ended 30 June 2019. The dividend, which will be fully franked, will reportedly be paid on the 10 December 2019.

Outlook: For Fiscal Year 2020, NRW Holdings is forecasting revenue at ~$1.5 billion. As at 30 June 2019, the companyâs order book stood at ~$2.2 billion of which around $1.1 billion is scheduled for delivery in FY20 excluding any orders secured by Urban and RCRMT, as per the companyâs report.

Stock Performance: NWH stock price surged up 5.479% to last trade at $2.310 on 22 August 2019. The stock closed at a price to earnings multiple of 14.70x with a market capitalisation of $823.2 million.

CIMIC Group Limited (ASX: CIM)

CIMIC Group Limited recently announced that it has been selected for the NSW Government funded project at Nepean Hospital. The company told that the award will generate a revenue of ~$379 million to CPB Contractors.

It comes after the recently secured Stage 2 Project for the Redevelopment of Campbelltown Hospital. Under this new contract, CPB Contractors has to deliver the construction of a new 14-storey clinical building at the Redevelopment Stage 1 of the Nepean Hospital.

The report read that work at Nepean Hospital has already been commenced and is expected to be completed in 2021. The new facility at Nepean Hospital site would reportedly include a new emergency department, more than 12 new operating theatres and over 200 overnight beds.

Stock Performance: CIM stock price last traded at $31.750, up 1.405%, on 22 August 2019. The stock last traded at a price to earnings multiple of 12.940x with a market capitalisation of $10.15 billion.

Also Read: CIMIC Group Announced two Significant Contracts for its Construction Business- CPB Contractors

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.