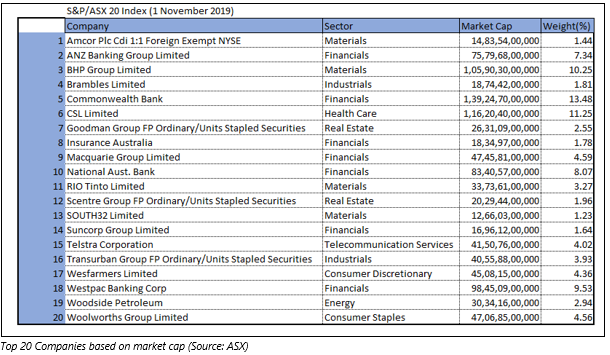

The term âBlue Chipâ coined from a famous game poker, in which a blue chip holds the highest value. These stocks are considered supreme long term, high valued investment vehicles. Blue chip stocks are of famous and well-established companies with many qualities that value investors in the long run.

These stocks are considered safe havens because of their secure nature during an economic downturn. As these stocks do not move much, they provide regular dividends to their shareholders. They provide increased and uninterrupted dividends over time and in the long run, shareholders can gain from dividend income and create portfolio income.

BHP Group Limited (ASX: BHP)

BHP Group Limited is a leading minerals exploration, production and processing company, which had a market capitalisation of $112.97 billion on 28th November 2019. As per ASX, the stock closed the dayâs trading on 28th November 2019 at $38.500, trading above the average of 52-weeks high and low of $42.330 and $29.062, respectively, and delivering total returns of 9.73% in the time period of three months. The companyâs price to earnings multiple stood at 16.780x on a TTM basis with an annual dividend yield of 5%.

Recently, the company announced appointment of Mike Henry as the new CEO, after a thorough succession process.

Rio Tinto Limited (ASX: RIO)

Rio Tinto Limited is engaged in the business of copper, gold, iron ore and other mineral and metal production, with a market capitalisation of $36.01 billion on 28th November 2019. As per ASX, the stock settled at $97.390 on 28th November 2019 and has given total returns of 15.81% in the time period of three months. The companyâs price to earnings multiple stood at 8.480x on a TTM basis and its annual dividend yield was reported at 4.85%.

Recently, the company sanctioned an investment of one billion dollar in its wholly owned Greater Tom Price operations, aided towards sustaining the production capacity of its world-class iron ore business in Pilbara, Western Australia.

Macquarie Group Limited (ASX: MQG)

MQG serves as a Non-Operating Holding Company (NOHC) for the consolidated entity, which is engaged in offering services including banking, financial, advisory, investments and funds management. The company had a market capitalisation of $48.68 billion on 28th November 2019. As per ASX, the stock closed the dayâs trade at $138.050 on 28th November 2019, with total returns of 11.21% in the time period of three months. The companyâs price to earnings multiple stood at 14.850x on a TTM basis with an annual dividend yield of 4.44%.

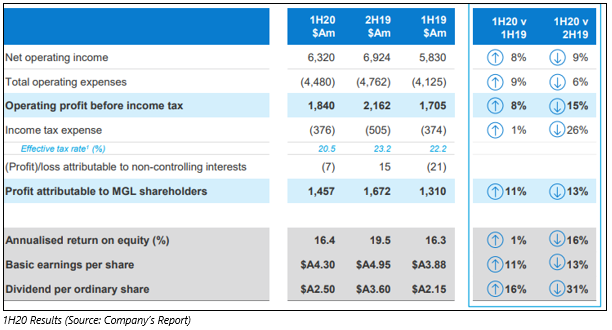

Macquarie provided an update for its 1H20 performance (period ended 30 September 2019). The company reported net profit of $1,457 million, down 13% on 2H19 and up by 11% on 1H19. Moreover, the company declared an interim ordinary dividend of $2.50 per share (40% franked).

CSL Limited (ASX: CSL)

During mid-October 2019, the company provided an outlook for its FY20 operations, according to which CSL is anticipating strong demand for plasma and recombinant therapies to continue in the financial year 2020. Moreover, the company also anticipates witnessing a slight boost in margin arising from product mix shift.

- CSL Limited is engaged in the development, manufacturing and marketing of pharmaceutical and diagnostic products, cell culture media and human plasma fractions;

- The company had a market capitalisation of $127.08 billion on 28th November 2019;

- As per ASX, the stock has given total returns of 19.63% in the time period of three months and closed at $282.990 on 28th November 2019;

- The companyâs price to earnings multiple stood at 46.350x on a TTM basis and its annual dividend yield was reported at 0.95%.

Commonwealth Bank of Australia (ASX: CBA)

Commonwealth Bank of Australia is one of Australiaâs leading providers of financial services that serve the need of more than 17.4 million customers with a focus on retail and commercial banking. The bank had a market capitalisation of $144.61 billion on 28th November 2019. As per ASX, the stock was trading above the average of 52-weeks high and low and has given total returns of 5.88% in the time period of three months. The companyâs price to earnings multiple stood at 16.820x on a TTM basis with an annual dividend yield of 5.28%.

A CBA subsidiary, the Colonial Mutual Life Assurance Society, recently pleaded guilty to eighty seven alleged contraventions of the anti-hawking provisions of the Corporation Act 2001.

Woolworths Group Limited (ASX: WOW)

Woolworths Group Limited, which mainly operates in Australia and New Zealand, has about 3,292 stores. The company operates through its segments - Australian Food, Endeavour Drinks, New Zealand Food, Big W and Hotels. WOW had a market capitalisation of $50.04 billion on 28th November 2019. As per ASX, the stock is trading above the average of 52-weeks high low at $39.650 on 28th November 2019 and has given total returns of 10.31% in the time period of three months. The companyâs price to earnings multiple stood at 19.240x on a TTM basis and its annual dividend yield was reported at 2.57%.

According to a company announcement on 27 November 2019, Group CEO, Brad Banducci, decided to forgo his FY20 short term bonus of $2.6 million. While Group Chairman Gordon Cairns also decided to take a 20% reduction in fees for FY20.

Wesfarmers Limited (ASX: WES)

Wesfarmers Limited is a consumer discretionary sector player with interests including retail operations covering home improvement and office supplies. The company had a market capitalisation of $48.07 billion on 28th November 2019 and closed the dayâs trade at $42.410. The stock has given total returns of 8.44% in the time period of three months. The companyâs price to earnings multiple stood at 8.700x on a TTM basis and its annual dividend yield was noted at 4.2%.

The company is optimistic about the outlook for WES, with investments being made in new growth platforms as well as customer offer to deliver value to shareholders.

Telstra Corporation Limited (ASX: TLS)

Telstra Corporation Limited is a telecommunications carrier, engaged in the provision of telecommunications and information services, including mobiles, internet, and pay television. With a market capitalisation of $44.12 billion on 28th November 2019, the companyâs price to earnings multiple stood at 20.500x on a TTM basis and annual dividend yield noted at 2.7%. The stock closed the dayâs trade at $3.860, which is above the average of 52-weeks high and low. The stock delivered a return of 5.95% in the time period of six months.

The company on 27 November 2019 informed that it expects total operating expenses (excluding restructuring costs and impairments) to decline.

Woodside Petroleum Ltd. (ASX: WPL)

Woodside Petroleum Ltd. is engaged in the management and operation of hydrocarbon exploration, development, production, transportation and marketing; implementation and operation of the North West Shelf Gas Project. The company had a market capitalisation of $32.27 billion on 28th November 2019. Its price to earnings multiple stood at 17.740x on a TTM basis with an annual dividend yield of 5.26%. The stock has given total returns of 10.63% in the time period of three months.

On its Investor Briefings Day 2019, the company provided a narrowed production guidance of 89 to 91 MMBoe for 2019. The company is targeting production growth of more than 6% CAGR in the time period of 2019 to 2028.

National Australia Bank Limited (ASX: NAB)

National Australia Bank Limited provides banking services, credit and access card facilities, leasing, housing and general finance services. The company had a market capitalisation of $75.48 billion on 28th November 2019. As per ASX, the stock has corrected 4.10% in the time period of three months. The companyâs price to earnings multiple stood at 15.260x on a TTM basis while annual dividend yield was reported at 6.34%.

Class Action Settlement

- The bank announced to have reached a settlement regarding a class action brought against NAB by Slater & Gordon in relation to Consumer Credit Insurance (CCI);

- As part of the settlement, the bank would pay $49.5 million; however, it is subject to approval of the Federal Court of Australia.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.